"Executive Summary Middle East and Africa Digital Lending Platform Market :

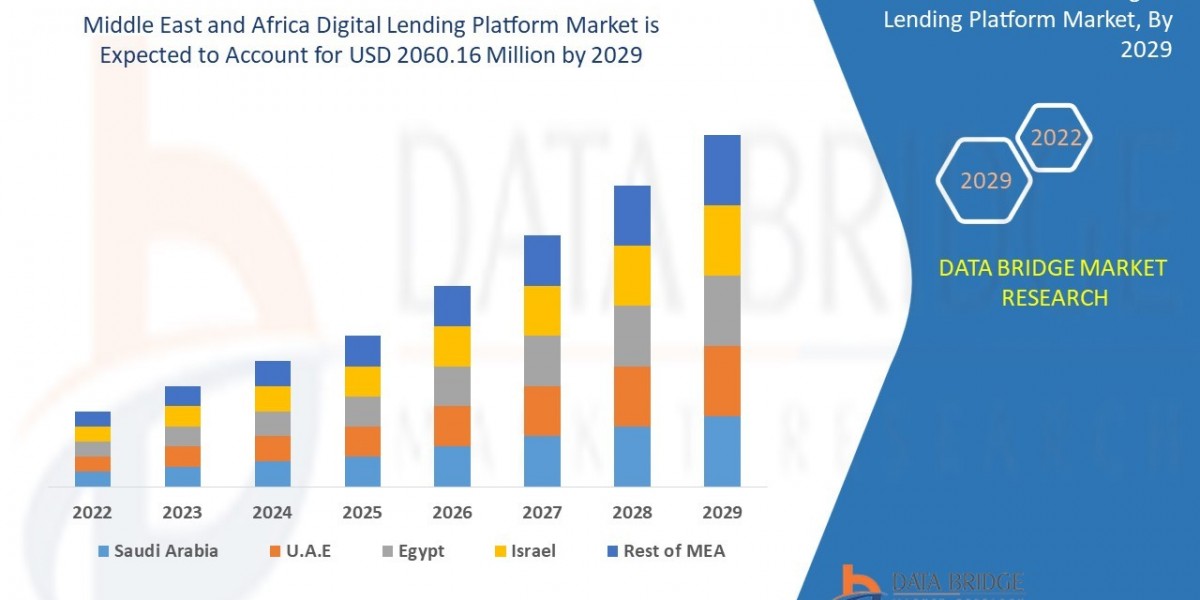

Middle East and Africa digital lending platform market was valued at USD 551.81 million in 2021 and is expected to reach USD 2060.16 million by 2029, registering a CAGR of 17.90% during the forecast period of 2022-2029.

The market study of Middle East and Africa Digital Lending Platform Market report helps minimize the risks of uncertainties and helps in taking sound decisions. This market report is also helpful in assessing the effectiveness of advertising programme and knows the causes of consumer resistance. It reveals the nature of demand for the firm’s product to know if the demand for the product is constant or seasonal. The report ascertains status of the firm and its products. The report aids to know how patents, licensing agreements and other legal restrictions affect the manufacture and sale of the firm’s products. The market analysis and competitor analysis helps the firm in determining the range in terms of sizes, colours, designs, and prices, etc within which its products are to be offered to the consumers.

This industry report is helpful in knowing the general conditions prevailing in the mark, the marketing and pricing strategy of competitors. Middle East and Africa Digital Lending Platform Market research report is a vital document in planning business objectives or goals. It is an organized method to bring together and document information about the industry, market, or potential customers. The info covered helps businesses know how patents, licensing agreements and other legal restrictions affect the manufacture and sale of the firm’s products. It is helpful in determining the discount rates, the actual prices and the price ranges, price elasticity for its products.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Middle East and Africa Digital Lending Platform Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/middle-east-and-africa-digital-lending-platform-market

Middle East and Africa Digital Lending Platform Market Overview

**Segments**

- **By Component**: The Middle East and Africa digital lending platform market can be segmented by component into solutions and services. The solutions segment is expected to dominate the market as it includes various software components and tools that facilitate digital lending processes efficiently. On the other hand, the services segment is projected to grow significantly due to the increasing demand for consulting, implementation, and support services to ensure seamless integration and operation of digital lending platforms.

- **By Deployment Mode**: Based on deployment mode, the market can be categorized into cloud and on-premises. The cloud deployment mode is anticipated to witness substantial growth during the forecast period as organizations in the region are increasingly adopting cloud-based solutions for cost-effectiveness, scalability, and flexibility. However, the on-premises deployment mode continues to hold a significant market share, particularly among traditional financial institutions that prioritize data security and compliance.

- **By End-User**: In terms of end-user, the Middle East and Africa digital lending platform market can be divided into banks, non-banking financial institutions (NBFIs), and credit unions. Banks are expected to lead the market owing to their extensive customer base, technological advancements, and focus on digitization to enhance operational efficiency. NBFIs and credit unions are also likely to adopt digital lending platforms to streamline lending processes, reduce manual errors, and improve customer experience.

**Market Players**

- **Kreditech**

- **LenddoEFL**

- **Tala**

- **OneFi**

- **Branch International**

- **Finnovation Africa**

- **Exuus**

- **UbaPesa**

- **TiME Pay**

- **M-Shwari**

These market players are actively involved in the Middle East and Africa digital lending platform market, offering innovative solutions and services to cater to the evolving needs of financial institutions and borrowers in the region. Their strategic initiatives such as partnerships, product launches, and acquisitions contribute to market growth and competitiveness.

The Middle East and Africa digital lending platform market is experiencing significant growth driven by factors such as increasing internet penetration, rising smartphone adoption, and a growing need for efficient lending solutions. One of the key trends shaping the market is the shift towards digital transformation in the financial sector, where traditional lenders are embracing digital lending platforms to streamline processes, reduce operational costs, and enhance customer experience. This trend is further accelerated by the changing preferences of consumers who are increasingly demanding quick and convenient access to financial services.

Moreover, the COVID-19 pandemic has acted as a catalyst for digital lending adoption in the region, as social distancing measures and lockdowns forced financial institutions to digitalize their lending operations rapidly. This sudden shift towards digital platforms highlighted the importance of online lending solutions in maintaining business continuity and serving customers remotely. As a result, both established financial institutions and emerging fintech companies are investing in advanced digital lending platforms to stay competitive and meet the evolving needs of borrowers.

The market players in the Middle East and Africa digital lending platform space are actively competing by offering a diverse range of solutions tailored to meet the specific requirements of different financial institutions and borrowers. These players are focusing on enhancing their product offerings through features such as AI-driven credit scoring, automated loan processing, and personalized customer experiences. Additionally, collaborations and partnerships with banks, fintech startups, and other stakeholders are becoming increasingly common to expand market presence and reach a wider customer base.

Furthermore, regulatory developments and initiatives aimed at promoting financial inclusion are also driving the adoption of digital lending platforms in the Middle East and Africa. Governments and regulatory bodies are recognizing the potential of fintech solutions to expand access to credit, particularly for underserved segments of the population. By creating a conducive regulatory environment and supporting innovation in the financial sector, policymakers are encouraging the growth of digital lending platforms as a means to boost economic development and financial inclusion in the region.

In conclusion, the Middle East and Africa digital lending platform market presents lucrative opportunities for players offering innovative solutions and services to address the evolving needs of financial institutions and borrowers. With the continued emphasis on digital transformation, technological advancements, and regulatory support, the market is expected to witness sustained growth and evolution in the coming years. Players that can adapt to changing market dynamics, leverage emerging technologies effectively, and forge strategic partnerships are likely to thrive in this competitive landscape.The Middle East and Africa digital lending platform market is poised for significant growth, driven by several key factors. The increasing internet penetration and smartphone adoption in the region are expanding the reach of digital financial services, creating a conducive environment for the adoption of digital lending platforms. Traditional financial institutions, such as banks, are increasingly recognizing the importance of digitization to enhance operational efficiency and meet the changing demands of customers. This trend is further fueled by the shift towards digital transformation in the financial sector, where digital lending platforms play a crucial role in streamlining lending processes and improving customer experience.

The COVID-19 pandemic has accelerated the adoption of digital lending platforms in the Middle East and Africa as financial institutions had to rapidly digitalize their operations to maintain business continuity amidst social distancing measures. This rapid shift towards online lending solutions emphasized the importance of digital platforms in enabling remote access to financial services, further driving the adoption of digital lending technologies across the region. As a result, both established financial institutions and emerging fintech companies are investing in advanced digital lending solutions to stay competitive in the market and cater to the evolving needs of borrowers.

Market players in the Middle East and Africa digital lending platform space are actively engaged in offering innovative solutions and services to meet the specific requirements of financial institutions and borrowers. These players are focusing on enhancing their product offerings with features like AI-driven credit scoring, automated loan processing, and personalized customer experiences to differentiate themselves in the competitive market landscape. Collaborations and partnerships with banks, fintech startups, and other industry stakeholders are becoming increasingly common as a strategy to expand market reach and cater to a wider customer base.

Regulatory developments and initiatives aimed at promoting financial inclusion are also playing a significant role in driving the adoption of digital lending platforms in the region. Governments and regulatory bodies are acknowledging the potential of fintech solutions to enhance access to credit, particularly for underserved segments of the population. By creating a supportive regulatory environment and fostering innovation in the financial sector, policymakers are encouraging the growth of digital lending platforms as a tool to drive economic development and financial inclusion in the Middle East and Africa.

In conclusion, the Middle East and Africa digital lending platform market presents promising opportunities for market players that can offer tailored solutions, leverage emerging technologies, and forge strategic partnerships to address the evolving needs of financial institutions and borrowers in the region. With the ongoing emphasis on digital transformation, technological advancements, and regulatory support, the market is expected to witness sustained growth and innovation in the foreseeable future. Adaptability to market dynamics, effective utilization of emerging technologies, and collaboration with key industry stakeholders will be key success factors for players operating in this competitive market landscape.

The Middle East and Africa Digital Lending Platform Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/middle-east-and-africa-digital-lending-platform-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the product portfolios of the top players in the Middle East and Africa Digital Lending Platform Market.

- Product Development/Innovation: Detailed insights on the upcoming technologies, R&D activities, and product launches in the market.

- Competitive Assessment:In-depth assessment of the market strategies, geographic and business segments of the leading players in the market.

- Market Development:Comprehensive information about emerging markets. This report analyzes the market for various segments across geographies.

- Market Diversification:Exhaustive information about new products, untapped geographies, recent developments, and investments in the Middle East and Africa Digital Lending Platform Market.

Browse More Reports:

Global Autoimmune Hemolytic Anemia Treatment Market

Asia-Pacific Trash Bags Market

Global Natural Food Colors and Flavors Market

Middle East and Africa Mild Cognitive Impairment (MCI) Treatment Market

Europe Core Materials Market

Global Vegan Waxes Market

Global Inductor Market

Global Sodium Citrate Market

Global GRP Pipes Market

Global Oral Care Products - Other Dental Consumables Market

Middle East and Africa Personal Watercraft Market

Global Micellar Casein Market

Global Orthopedic Implants (Including Dental Implants) Market

Global Curved Televisions Market

Middle East and Africa Digital Lending Platform Market

Global Digital Lending Platform Market

Global Camping Cooler Market

Europe Lung Transplant Therapeutics Market

Global Hexamethylenetetramine Market

Global Transcutaneous Monitors Market

Europe Omega-3 for Food Application Market

Global Grip Tape Market

Global Prion Disease Treatment Market

Global Glycidyl Methacrylate Market

Global Polyisoprene (PI) Surgical Gloves Market

North America Ink Resins Market

Global Avermactin Market

Global Silicon Alloys Market

Global Swabs Collection Kits Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com