Impact Investing: Aligning Profit with Purpose

Introduction

In a world where social and environmental challenges are escalating, traditional investment strategies are no longer sufficient. Enter Impact Investing Industry—a rapidly growing approach that merges financial returns with positive social and environmental impact. From combating climate change to promoting gender equity and financial inclusion, impact investing offers a way for capital to catalyze real change while still achieving competitive returns.

What is Impact Investing?

Impact investing refers to investments made with the intention of generating measurable social and environmental benefits alongside financial returns. Unlike philanthropy, which is purely donation-driven, impact investing seeks to mobilize private capital toward solutions that address pressing global issues—without sacrificing profitability.

These investments can span sectors such as:

Renewable energy

Affordable housing

Education

Healthcare

Microfinance

Sustainable agriculture

Impact investments can be made in both emerging and developed Industrys, through instruments like private equity, debt, or even public equity funds.

Core Principles of Impact Investing

Intentionality

The investor clearly intends to make a positive impact through their investment.Return Expectations

Impact investments are expected to generate a financial return—ranging from below-Industry to Industry-rate returns.Impact Measurement

A critical component is tracking and reporting the social and environmental performance and progress of the investments.Diverse Asset Classes

These investments can occur across multiple asset classes and sectors, adding depth and breadth to traditional portfolios.

Why Impact Investing Matters

1. Tackling Global Challenges

With issues like climate change, poverty, and inequality on the rise, impact investing provides an essential bridge between finance and long-term sustainability. It plays a key role in achieving the UN Sustainable Development Goals (SDGs).

2. Appealing to a New Generation of Investors

Millennials and Gen Z are increasingly prioritizing ethical and sustainable practices in their investment decisions. According to Morgan Stanley, 95% of millennials are interested in sustainable investing, making it a vital trend for the future of finance.

3. Competitive Returns

Contrary to the myth that impact investing means lower returns, many funds have shown risk-adjusted, Industry-rate returns, debunking the notion that doing good and doing well are mutually exclusive.

4. Institutional Adoption

Major institutions like BlackRock, Goldman Sachs, and the World Bank have embraced impact investing, signaling that it’s not just a niche but a mainstream investment strategy.

Examples of Impact Investing in Action

LeapFrog Investments: Focuses on financial services and healthcare for underserved populations in Africa and Asia.

Patagonia’s $20 Million & Change Fund: Invests in responsible startups that support the planet.

Acumen Fund: Supports social enterprises that tackle poverty through innovative business models.

Challenges in Impact Investing

While the field is growing, it faces several hurdles:

Lack of Standardized Metrics: Measuring impact consistently across different sectors remains a challenge.

Greenwashing Risks: Some funds may claim social benefits without substantial proof.

Limited Industry Data: Historical performance data for impact assets is still developing compared to traditional Industrys.

The Future of Impact Investing

With increased awareness and regulatory support, impact investing is set to become an integral part of the financial ecosystem. Innovations like ESG integration, green bonds, and social impact bonds are expanding the ways investors can engage with impact-oriented opportunities.

Moreover, technology is playing a vital role in transparency and measurement, enabling investors to track real-time performance and social outcomes more accurately.

Conclusion

Impact investing is not just a trend—it’s a transformative force reshaping the investment landscape. It empowers individuals, institutions, and governments to align their values with their portfolios, proving that profit and purpose can go hand-in-hand. As we move toward a more inclusive and sustainable world, impact investing stands out as one of the most powerful tools to drive systemic change.

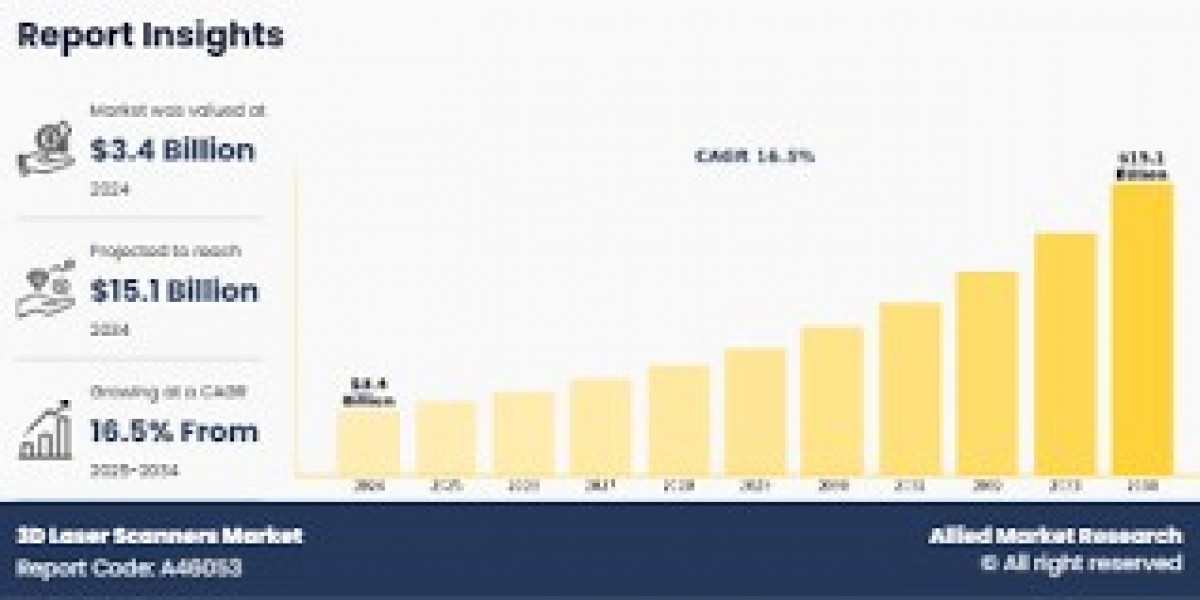

Related Report -