The Personal Loans Market has witnessed rapid growth in recent years, driven by rising consumer demand for quick access to funds and the increasing adoption of digital lending platforms. Personal loans are unsecured financial products that allow individuals to borrow money for diverse needs such as debt consolidation, medical emergencies, education, travel, or home renovation.

One of the biggest factors fueling this market is the digital transformation of financial services. Fintech companies and banks are leveraging AI, machine learning, and data analytics to provide instant loan approvals, personalized interest rates, and hassle-free repayment options. Mobile apps and online lending portals have reduced paperwork and improved accessibility, especially for younger demographics and underserved populations.

The growing trend of buy-now-pay-later (BNPL) and peer-to-peer lending is reshaping the market, offering consumers more flexible borrowing options. Additionally, low interest rate environments in some regions and rising disposable incomes have further boosted loan uptake.

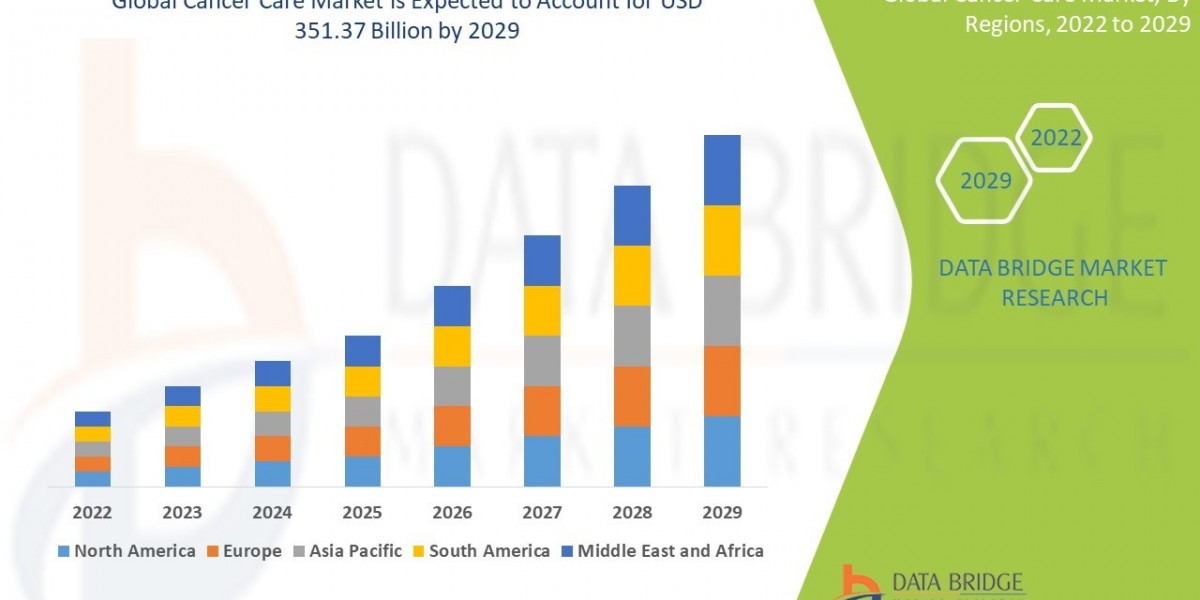

Regionally, North America and Europe dominate the personal loans market due to established credit systems, while Asia-Pacific is experiencing the fastest growth, driven by financial inclusion initiatives, rapid digitalization, and rising middle-class demand for consumer credit.

However, the sector faces challenges, including high default risks, regulatory scrutiny, and economic uncertainties that impact repayment behavior. Despite these hurdles, the personal loans market is expected to expand significantly as financial institutions continue innovating to meet evolving consumer needs.

Read More

| Air Quality Sensor Market |

| US Smart Grid Volt-Var Control Technologies Market |

| Smart Board Market |

| Building Management Systems Market |

| High Bandwidth Memory Market |