Keeping up with stock news is one of the best ways to stay informed, manage your investments, and find new opportunities. Whether you're a long-term investor, a trader, or just curious about the market, knowing what’s happening in stocks, sectors, and corporate performance can help you make better decisions.

This blog takes a closer look at current stock trends, company updates, and sector performance. We'll also highlight some emerging topics that are impacting investor sentiment, including company earnings, tech shifts, and policy decisions. You'll also find useful insights for retail investors and trends to monitor in the coming weeks.

Market Recap: What’s Moving the Indices?

Major indices like the S&P 500, Dow Jones, and Nasdaq have seen mixed movement recently. While tech stocks remain strong, other sectors such as energy and industrials have faced pressure due to global economic concerns and interest rate expectations.

S&P 500: Hovering near record highs, boosted by AI-related tech companies.

Dow Jones: Underperforming compared to other indices due to weaker industrial data.

Nasdaq: Driven by large-cap tech names like NVIDIA, Apple, and Microsoft.

In global markets, Europe and Asia are also reacting to inflation data and policy decisions. Central bank moves and geopolitical tensions remain key drivers. Companies involved in global trade, such as Nexa Pix, are paying close attention to currency fluctuations and shipping costs.

Interest Rates and the Fed: A Key Factor for Stocks

The Federal Reserve’s actions continue to play a major role in stock movements. Investors are closely monitoring Fed statements to understand when rate cuts might begin.

Inflation Data: Although inflation has cooled in some sectors, services and housing costs remain sticky.

Rate Decisions: The Fed has signaled that rate cuts are likely, but not guaranteed. Timing depends on incoming economic data.

Bond Yields: When yields rise, growth stocks tend to underperform. Conversely, a drop in yields often benefits tech and high-valuation companies.

Market expectations suggest a potential rate cut before the end of the year, depending on labor market strength and inflation figures. This will likely be a major driver of short-term market trends.

Corporate Earnings: Winners and Losers

Earnings season continues to shape stock news. Many companies have beaten earnings expectations, but guidance for the next quarters is mixed. Retailers, tech companies, and industrial firms are revealing different stories.

Tech: Big tech firms have mostly posted strong earnings thanks to AI adoption and cloud services.

Retail: Mixed results, with discount retailers performing better than luxury brands.

Industrials: Facing margin pressure from supply chain issues and rising labor costs.

Investors are paying attention not just to profit numbers, but to what companies say about future quarters. In some cases, even good results haven't led to stock gains due to cautious outlooks.

Sector Watch: What’s Leading and Lagging?

Different sectors are reacting in different ways to economic conditions and investor sentiment. Here's a quick sector breakdown:

Technology: Continues to lead due to AI, software services, and chip demand. Cloud computing and cybersecurity stocks remain hot topics.

Energy: Oil prices have been volatile, affecting energy company earnings and stock performance.

Consumer Goods: Brands tied to lifestyle and wellness — including newer product lines like Nexa Pix Vape Juicy Grape Flavor — are gaining investor attention for targeting Gen Z and millennial demographics.

Financials: Banks are dealing with tighter lending standards, but strong capital positions remain.

Healthcare: Pharmaceutical companies are investing heavily in R&D, though regulatory scrutiny is rising.

It’s important for investors to consider both short-term catalysts and long-term growth when analyzing sectors.

Retail Investors and the Rise of Fractional Trading

Retail investors have become a much bigger part of the market over the past few years. Thanks to platforms that offer fractional trading and zero-commission trades, more people are entering the stock market.

Access: Investors can now buy a piece of high-priced stocks like Amazon or Tesla without needing to buy a full share.

Community: Online forums and social media have created communities that share stock tips and strategies.

ETFs: Many retail investors are also turning to ETFs for diversified exposure without needing to pick individual stocks.

The participation of retail traders can increase volatility, especially in smaller or trending stocks, but it also brings more liquidity to the market.

Technology Stocks and AI: The Growth Story Continues

AI remains one of the strongest themes in stock news. Companies in chip manufacturing, cloud computing, and machine learning software are seeing increased investor demand.

Semiconductors: NVIDIA, AMD, and others continue to benefit from rising demand for chips used in AI applications.

Cloud Services: Amazon Web Services and Microsoft Azure are growing as businesses move operations to the cloud.

AI Startups: Even lesser-known companies with niche AI applications are attracting investor capital.

Investors are also keeping an eye on regulation, especially in data privacy and algorithm accountability. But the trend remains positive as businesses invest more in AI tools.

International Markets: What to Watch Abroad

Global stock markets are also showing interesting developments. While the U.S. remains a major player, international economies are having a growing impact on global portfolios.

China: Uncertainty remains around consumer demand and government policy. Many investors are cautious.

Europe: Facing slower growth but more stability in policy. Defense and clean energy sectors are gaining attention.

Emerging Markets: Volatility remains high, but some investors are finding value opportunities in Latin America and Southeast Asia.

Currency movements, trade tensions, and global demand for commodities will continue to affect international stock prices. Investors with global portfolios should be mindful of these macro factors.

Upcoming Trends: What Investors Should Prepare For

As we move into the next quarter, several key themes are worth keeping on your radar:

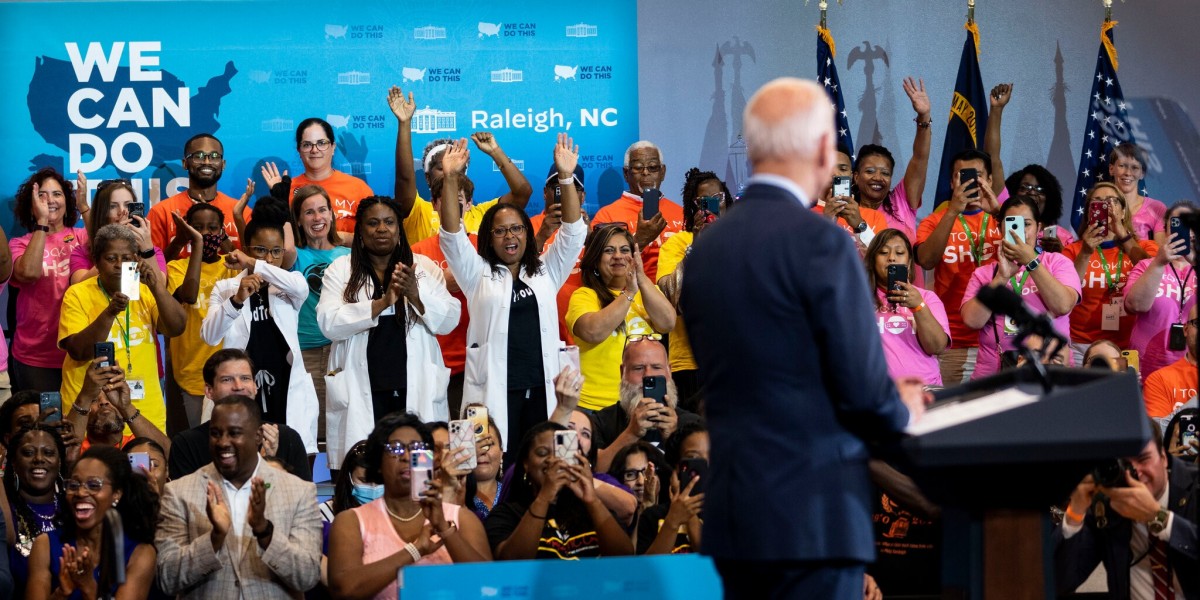

Election Year Volatility: Political events, debates, and policy announcements may increase volatility, especially in sectors like healthcare, energy, and defense.

Climate and Energy Transition: Companies working in renewable energy, EVs, and carbon offset technologies are being watched closely.

Consumer Shifts: Trends like health-conscious products, digital subscriptions, and niche lifestyle brands (like Nexa Pix frozen banana vape) are influencing stock prices and brand strategies.

Cybersecurity: As cyber threats grow, more companies are boosting spending in this area, which benefits security software providers.

By staying informed, reviewing earnings reports, and watching for broader economic signals, investors can make more confident choices in a changing market.

Stock news is constantly evolving, and with so many variables in play — from interest rates to global politics — it’s more important than ever to stay engaged. Whether you’re new to investing or looking to fine-tune your strategy, keeping an eye on market trends and understanding the factors behind them will give you an edge.Let us know what stock news you’re following, and we’ll continue to share updates, sector insights, and practical tips to help you navigate the market.