The Rise of Financial Apps: Revolutionizing Personal Finance Management

In the digital era, financial apps have emerged as powerful tools that are transforming the way individuals and businesses manage their money. These applications offer convenience, real-time insights, and financial control right from the palm of your hand. As the demand for digital finance grows, financial apps are playing a pivotal role in improving financial literacy, encouraging saving, enabling investments, and simplifying transactions.

What Are Financial Apps?

Financial App Market Share are mobile or desktop applications designed to help users manage various aspects of their personal or business finances. These apps range from budgeting tools and expense trackers to investment platforms, digital wallets, and banking services. Their core objective is to provide users with easier, faster, and more secure access to financial information and services.

Key Features of Financial Apps

- Budgeting and Expense Tracking

Apps like Mint or PocketGuard help users categorize expenses, set financial goals, and monitor spending patterns. - Banking and Payments

Apps from banks or fintechs (like Paytm, Google Pay, or Revolut) allow users to transfer money, pay bills, check balances, and manage accounts in real time. - Investment and Wealth Management

Platforms like Robinhood, Groww, and Zerodha make investing in stocks, mutual funds, or crypto accessible to a wider audience. - Loan and Credit Management

Apps offer insights into credit scores, loan eligibility, and EMI tracking. Some even offer instant personal loans with minimal paperwork. - Savings and Financial Planning

Digital savings platforms automate savings based on user goals and provide tools for retirement or tax planning.

Benefits of Financial Apps

- Convenience: 24/7 access to financial information and transactions.

- Automation: Saves time through automated bill payments, investments, and savings.

- Real-Time Updates: Keeps users informed with instant notifications and updates.

- Improved Financial Literacy: Offers insights, analytics, and tips to help users make informed financial decisions.

- Security: Most apps incorporate multi-factor authentication and encryption for safe transactions.

Trends Driving Financial App Growth

- Increased Smartphone Penetration: With more people owning smartphones, app usage is surging.

- Millennial and Gen Z Adoption: Younger generations prefer digital-first financial solutions.

- Open Banking: APIs and integration capabilities enable a seamless user experience across platforms.

- AI and Personalization: Apps use AI to offer tailored financial advice and alerts.

- Digital Payments Boom: A growing preference for cashless payments is fueling app adoption.

Challenges and Considerations

Despite their popularity, financial apps face challenges:

- Data Privacy and Security: Handling sensitive financial data requires robust security protocols.

- Digital Literacy: Not all users are equally tech-savvy, creating a digital divide.

- Regulatory Compliance: Apps must adhere to financial regulations and data protection laws across jurisdictions.

Future Outlook

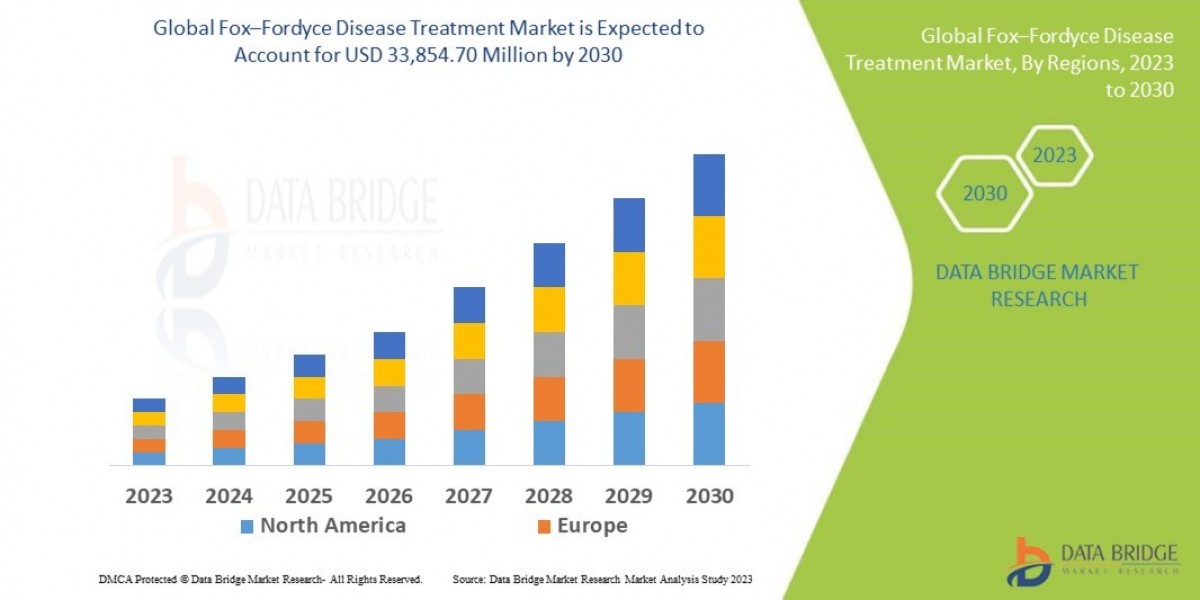

The financial app Market Share is expected to grow exponentially with the integration of emerging technologies like blockchain, artificial intelligence, and voice banking. As competition intensifies, user experience, trust, and innovation will become the key differentiators. Financial apps are not just convenience tools anymore—they are becoming indispensable partners in people’s financial journeys.

Related Report -

Core Banking Solution Market Share

Biometric Banking Market Share