Executive Summary Asia-Pacific Usage Based Insurance Market :

Executive Summary Asia-Pacific Usage Based Insurance Market :

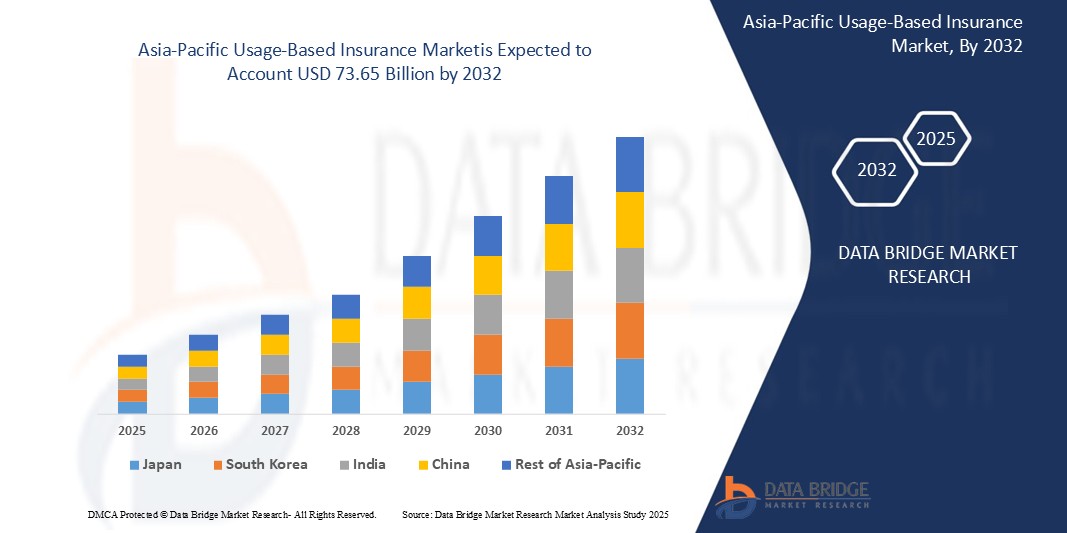

The Asia Pacific Usage-Based Insurance Market size was valued at USD 16.98 billion in 2024 and is expected to reach USD 73.65 billion by 2032, at a CAGR of 20.13% during the forecast period

Asia-Pacific Usage Based Insurance Market report is offered to the business with a complete overview of the market, covering various aspects such as product definition, market segmentation based on various parameters, and the customary vendor landscape. All statistical and numerical information given in the report is symbolized with the help of graphs and charts which facilitates the understanding of facts and figures. All the data and information collected for research and analysis is denoted in the form of graphs, charts or tables for the sensible understanding of users. The Asia-Pacific Usage Based Insurance Market report defines CAGR value fluctuation during the forecast period of 2019 - 2025 for the market.

This Asia-Pacific Usage Based Insurance Market report is composed of myriad of factors that have an influence on the market and include industry insight and critical success factors (CSFs), market segmentation and value chain analysis, industry dynamics, market drivers, market restraints, key opportunities, technology and application outlook, country-level and regional analysis, competitive landscape, company market share analysis and key company profiles. This global Asia-Pacific Usage Based Insurance Market business report is very reliable as all the data and the information regarding the industry is collected via genuine sources such as websites, journals, annual reports of the companies, and magazines.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Asia-Pacific Usage Based Insurance Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/asia-pacific-usage-based-insurance-market

Asia-Pacific Usage Based Insurance Market Overview

**Segments**

- **By Package Type**: Pay-as-you-drive (PAYD), Pay-how-you-drive (PHYD), Manage-how-you-drive (MHYD)

- **By Vehicle Type**: Passenger Vehicle, Commercial Vehicle

- **By Device Type**: OBD-II, Smartphone, Embedded System, Black Box

The Asia-Pacific usage-based insurance (UBI) market is segmented based on package type, vehicle type, and device type. The package type segment includes Pay-as-you-drive (PAYD), Pay-how-you-drive (PHYD), and Manage-how-you-drive (MHYD) insurance policies. Among these, PAYD is gaining popularity as it offers flexible premiums based on actual vehicle usage. Vehicle type segmentation comprises passenger vehicles and commercial vehicles, with passenger vehicles dominating the market due to the higher adoption rate among individual policyholders. In terms of device type, OBD-II, smartphone apps, embedded systems, and black box devices are used to track driving behavior and calculate insurance premiums accurately.

**Market Players**

- **Allianz**: Allianz is a key player in the Asia-Pacific UBI market, offering personalized insurance solutions and engaging policyholders through telematics technologies.

- **AXA**: AXA provides usage-based insurance products tailored to the evolving needs of customers, focusing on enhancing road safety and promoting better driving habits.

- **Progressive Corporation**: Progressive Corporation is known for its innovative Snapshot program, utilizing telematics devices to monitor driving habits and adjust insurance rates accordingly.

- **Generali Group**: Generali Group leverages UBI solutions to create customer-centric insurance offerings, enhancing customer satisfaction and loyalty.

- **Desjardins Group**: Desjardins Group is a prominent player in the UBI market, employing telematics technology to provide personalized insurance policies and promote safer driving behaviors.

These market players are actively contributing to the growth of the Asia-Pacific UBI market by introducing innovative products and services, fostering partnerships with technology providers, and driving awareness about the benefits of usage-based insurance. As the demand for personalized insurance solutions and risk mitigation strategies continues to rise, these players are well-positioned to capitalize on the evolving market trends and meet the changing needs of policyholders.

The Asia-Pacific usage-based insurance (UBI) market is witnessing significant growth and evolution propelled by key market players such as Allianz, AXA, Progressive Corporation, Generali Group, and Desjardins Group. These industry leaders are at the forefront of innovation, integrating telematics technologies to offer personalized insurance solutions that cater to the changing needs of customers. As the region experiences a surge in the adoption of UBI policies, driven by the demand for tailored insurance products and enhanced road safety measures, these players are strategically positioned to capitalize on the expanding market opportunities. By leveraging advanced data analytics and telematics devices, they are able to collect real-time driving data, assess risk profiles accurately, and incentivize safer driving behaviors among policyholders.

One of the emerging trends in the Asia-Pacific UBI market is the increasing use of smartphone apps as a device type for tracking driving behavior and determining insurance premiums. Smartphone-based UBI solutions offer convenience and accessibility to policyholders, allowing them to monitor their driving habits, receive feedback on their performance, and potentially qualify for lower premiums based on their driving data. This technology-driven approach not only enhances the customer experience but also encourages policyholders to actively engage in safer driving practices, leading to reduced accident rates and insurance claims.

Another area of growth in the Asia-Pacific UBI market is the rising demand for Manage-how-you-drive (MHYD) insurance policies. MHYD policies focus on providing policyholders with insights into their driving behavior and offering personalized recommendations to improve their driving skills. By promoting proactive risk management and offering tailored feedback to policyholders, MHYD policies contribute to the overall goal of enhancing road safety and reducing insurance risks. As more insurers introduce MHYD options in their product portfolios, the market is expected to witness increased adoption and customer interest in these innovative insurance offerings.

Furthermore, the Asia-Pacific UBI market is experiencing a shift towards collaborative partnerships between insurance companies and technology providers to enhance the capabilities of UBI solutions. By joining forces with telematics service providers, data analytics firms, and automotive manufacturers, insurers can access advanced technologies, improve data accuracy, and launch innovative UBI products that meet the evolving needs of customers. These strategic alliances not only drive competitiveness in the market but also facilitate the development of more sophisticated UBI offerings that deliver greater value to policyholders.

In conclusion, the Asia-Pacific UBI market is poised for robust growth driven by technological advancements, changing customer preferences, and a focus on road safety initiatives. With leading market players pioneering innovative solutions, expanding their product portfolios, and engaging in strategic collaborations, the UBI market in the region is set to witness continued evolution and transformation. As insurers continue to embrace data-driven decision-making and customer-centric approaches, the Asia-Pacific UBI market holds immense potential for sustainable growth and development in the coming years.The Asia-Pacific usage-based insurance (UBI) market is a dynamic and rapidly growing sector driven by key players such as Allianz, AXA, Progressive Corporation, Generali Group, and Desjardins Group. These market leaders are at the forefront of innovation, leveraging telematics technologies to offer personalized insurance solutions that cater to the evolving needs of customers in the region. The surge in demand for UBI policies is fueled by the increasing preference for tailored insurance products and the emphasis on road safety measures. By capitalizing on advanced data analytics and telematics devices, these players are able to collect real-time driving data, accurately assess risk profiles, and encourage safer driving behaviors among policyholders.

One significant trend shaping the Asia-Pacific UBI market is the adoption of smartphone apps as a device type for tracking driving behavior and determining insurance premiums. Smartphone-based UBI solutions provide convenience and accessibility to policyholders, enabling them to monitor their driving habits, receive personalized feedback, and potentially qualify for lower premiums based on their performance. This shift towards technology-driven solutions not only enhances the overall customer experience but also incentivizes policyholders to engage in safer driving practices, ultimately leading to a decrease in accident rates and insurance claims.

Moreover, the increasing demand for Manage-how-you-drive (MHYD) insurance policies is another notable development in the Asia-Pacific UBI market. MHYD policies focus on providing policyholders with insights into their driving behavior and offering customized recommendations to enhance their driving skills. By promoting proactive risk management and delivering tailored feedback, MHYD policies play a crucial role in improving road safety and reducing insurance risks. The introduction of MHYD options by insurers is expected to drive greater adoption and customer interest in these innovative insurance offerings, further propelling market growth.

Additionally, collaborative partnerships between insurance companies and technology providers are becoming increasingly prevalent in the Asia-Pacific UBI market. By teaming up with telematics service providers, data analytics firms, and automotive manufacturers, insurers are gaining access to cutting-edge technologies, enhancing data accuracy, and launching advanced UBI products that meet evolving customer needs. These strategic alliances not only boost competitiveness in the market but also facilitate the development of more sophisticated UBI offerings that deliver enhanced value to policyholders.

Overall, the Asia-Pacific UBI market's future looks promising, with technology advancements, changing consumer preferences, and a focus on road safety driving growth and innovation. With leading players driving forward with innovative solutions, expanding product portfolios, and engaging in strategic collaborations, the UBI market in the region is poised for continued evolution and transformation. By embracing data-driven strategies and customer-centric approaches, insurers are well-positioned to unlock the market's substantial potential for sustainable growth and development in the years ahead.

The Asia-Pacific Usage Based Insurance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/asia-pacific-usage-based-insurance-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key Pointers Covered in the Asia-Pacific Usage Based Insurance Market Industry Trends and Forecast

- Asia-Pacific Usage Based Insurance Market Size

- Asia-Pacific Usage Based Insurance Market New Sales Volumes

- Asia-Pacific Usage Based Insurance Market Replacement Sales Volumes

- Asia-Pacific Usage Based Insurance Market By Brands

- Asia-Pacific Usage Based Insurance Market Procedure Volumes

- Asia-Pacific Usage Based Insurance Market Product Price Analysis

- Asia-Pacific Usage Based Insurance Market Regulatory Framework and Changes

- Asia-Pacific Usage Based Insurance Market Shares in Different Regions

- Recent Developments for Market Competitors

- Asia-Pacific Usage Based Insurance Market Upcoming Applications

- Asia-Pacific Usage Based Insurance Market Innovators Study

Browse More Reports:

Middle East and Africa Orthopedic Surgical Robots Market

Global Cast Elastomers Market

North America Medical Device Testing Market

Global Pump Jack Market

Global Dunnage Packaging Market

Global Smart Lighting Market

Global Encryption Management Solutions Market

Global Calcium Ammonium Nitrate Market

Global Ilmenite Market

Global Sports Protective Equipment Market

India Robotic Arm Market

Global Food And Beverages Color Fixing Agents Market

Global Bio-Based Resins Market

Global Oophoritis Treatment Market

Global Cloud Workload Protection Market

Global Wind Turbine Tower Market

Global Anticoagulant Market

Asia-Pacific Laryngoscopes Market

Global Coffee Flavored Syrups Market

Middle East and Africa Health Screening Market

Global High Heat Foam Market

Global Micro-Invasive Glaucoma Implants Market

Global Optical Fiber Cable Market

Global Water Hardness Test Strip Market

North America Wireless Display Market

Global Ayurvedic Toothpaste Market

Global Commercial Seaweed Market

Asia-Pacific Semiconductor Manufacturing Equipment Market

Global Tardive Dyskinesia Treatment Market

Global Stress Testing Solutions Market

Global Contrast Media Injectors Market

Global Automotive Battery Sensor Market

Europe Orthopaedic Braces and Supports Market

North America Laboratory Information Systems (LIS) Market

Asia-Pacific Urinalysis Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com