The Telecom Equipment industry plays a foundational role in enabling global communication infrastructure, encompassing core components such as switches, routers, transmission systems, base stations, and fiber optic cables. As we head toward 2035, the sector is undergoing transformative shifts, driven by the explosive demand for high-speed data, 5G and 6G rollouts, satellite-based communication, and the rise of intelligent edge computing.

Key industry Drivers

5G/6G Expansion: Global investments in 5G are already redefining telecom infrastructure. By 2035, 6G deployment will further drive demand for high-capacity, low-latency equipment.

Edge and Cloud Computing: The decentralization of computing power to the network edge is increasing the need for edge-optimized telecom equipment.

Fiber Optic Networks: Massive upgrades in backhaul networks and the replacement of legacy copper with fiber are accelerating industry growth.

IoT and Connected Devices: Telecom equipment is evolving to support a skyrocketing number of connected devices in industrial, smart city, and home environments.

Rural Connectivity and Satellite Internet: Government-led rural broadband programs and LEO satellite services (like Starlink) are unlocking new growth regions.

Technology Trends

Open RAN (O-RAN): Increasing vendor interoperability and cost savings are pushing O-RAN adoption among network providers.

Software-Defined Networking (SDN) and NFV: Virtualization of network functions is reshaping how telecom hardware is designed and deployed.

AI in Network Management: Intelligent, self-healing networks using AI/ML are reducing outages and optimizing bandwidth.

Energy-Efficient Equipment: Growing environmental concerns are encouraging telecom operators to adopt greener, low-power hardware.

Challenges

Geopolitical Tensions: Trade restrictions, especially around 5G hardware, continue to shape industry dynamics between key economies.

High CapEx: Initial investments in advanced telecom infrastructure remain capital-intensive, especially for smaller players.

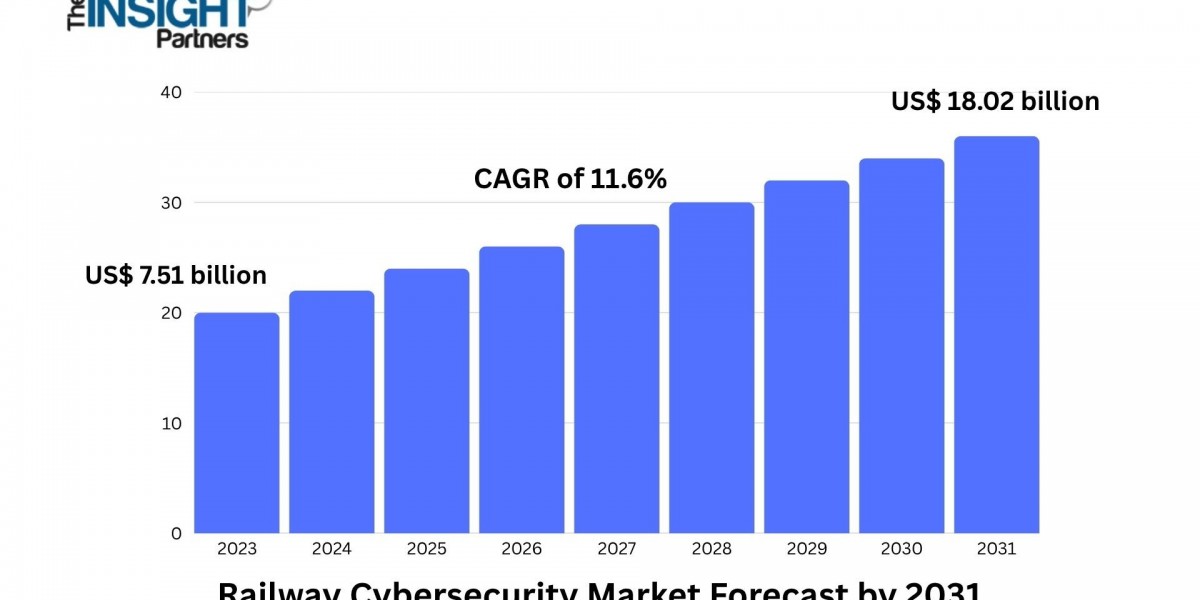

Cybersecurity Risks: Rising digital connectivity increases vulnerability, requiring telecom equipment to include built-in security features.

Regional Insights

Asia-Pacific is leading in 5G infrastructure development, especially China, South Korea, and Japan.

North America continues strong investments in private LTE/5G networks for enterprises and government.

Europe focuses on sustainable infrastructure and rural coverage.

Emerging industrys in Africa and Latin America offer untapped growth potential for affordable, scalable telecom solutions.

Future Outlook

By 2035, the Telecom Equipment industry will be deeply integrated with cloud-native software platforms, highly modular hardware systems, and AI-enabled automation. Vendors that align with sustainability goals, offer cybersecurity-ready products, and support interoperability will dominate the competitive landscape.

read more

| Spain Educational Robots industry |

| UK Educational Robots industry |

| Canada EMS ODM industry |

| Europe EMS ODM industry |

| Canada Fire Protection Systems industry |

| Europe Fire Protection Systems industry |