Cyber Insurance: Shielding the Digital World from Cyber Threats

Introduction

As the digital transformation of businesses accelerates, so does the risk of cyber threats. From ransomware attacks to data breaches, organizations face a growing array of cybersecurity risks that can disrupt operations and cause significant financial losses. Cyber insurance Market Size, also known as cyber liability insurance, has emerged as a critical component of modern risk management strategies, providing a financial safety net in the event of a cyber incident.

What is Cyber Insurance?

Cyber insurance is a specialized insurance product designed to protect businesses and individuals from internet-based risks. It covers costs associated with cyberattacks, such as data breaches, business interruption, legal fees, regulatory fines, and reputation management.

Key Coverage Areas Include:

Data Breach Costs: Notification, credit monitoring, and public relations.

Business Interruption: Loss of income during downtime caused by a cyber event.

Cyber Extortion: Ransom payments and negotiation costs in ransomware attacks.

Legal Expenses: Defense costs and settlements from lawsuits or regulatory penalties.

Network Security Liability: Damage to third parties due to security failures.

Why Cyber Insurance is Essential

Rising Cyber Threats

The frequency and sophistication of cyberattacks are increasing globally. Small businesses, often lacking robust cybersecurity, are particularly vulnerable.High Financial Impact

The average cost of a data breach in 2024 was estimated at over $4.5 million globally, making recovery without insurance extremely difficult for most organizations.Regulatory Compliance

Laws like GDPR, HIPAA, and India’s Digital Personal Data Protection Act mandate stringent data protection measures. Cyber insurance helps manage the risks of non-compliance.Reputation Management

In the event of a breach, cyber insurance often covers PR services to help restore brand reputation.

Who Needs Cyber Insurance?

While all organizations connected to the internet face cyber risks, the following sectors have the highest exposure:

Financial Services

Healthcare

Retail & E-commerce

Education

IT & SaaS Providers

Even small startups and individual professionals handling sensitive data (like consultants or legal advisors) can benefit from coverage.

How Cyber Insurance Works

Risk Assessment: Insurers evaluate your cybersecurity posture, existing controls, and risk exposure.

Policy Customization: Based on your needs, policies are tailored with specific coverage limits and inclusions.

Incident Response: Upon a cyber event, insurers provide access to expert response teams and financial compensation.

Claims Process: Businesses file a claim outlining damages, which is then assessed and settled per the policy terms.

Limitations and Exclusions

Cyber insurance is not a substitute for cybersecurity measures. Common exclusions include:

Acts of war or terrorism

Pre-existing vulnerabilities

Failure to maintain adequate security

Insider threats or employee negligence (in some cases)

Trends in the Cyber Insurance Market Size

Rising Premiums: Due to increased claims, premiums are rising, especially in high-risk industries.

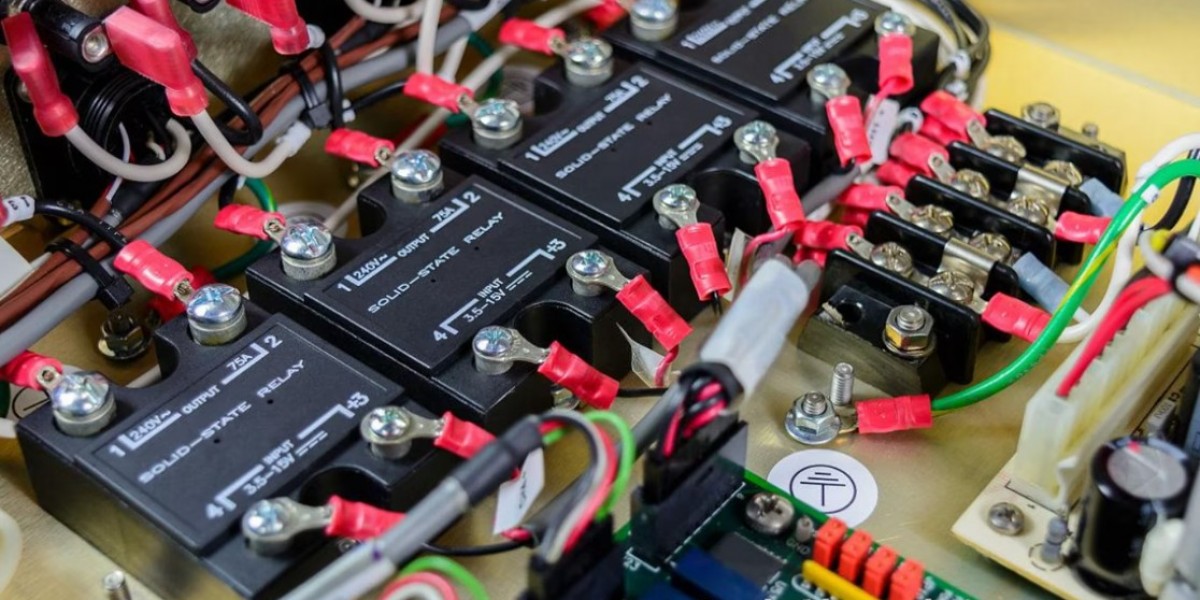

Demand for Risk Mitigation Tools: Insurers now expect policyholders to have robust cybersecurity frameworks (e.g., firewalls, MFA, encryption).

AI in Risk Assessment: Use of AI and analytics for underwriting and claims processing is on the rise.

Expansion to SMEs: Products tailored for small and medium businesses are becoming more accessible.

Conclusion

Cyber insurance is no longer a luxury—it's a necessity in today’s digital economy. As cyber threats grow more severe, having a reliable policy can mean the difference between recovery and ruin. However, it should complement, not replace, a strong cybersecurity strategy. Proactive prevention, paired with the right insurance coverage, is the best defense against the evolving landscape of cyber risks.

Related Report -

Oil And Gas Accounting Software Market Size

Online Financing Platform For Smbs Market Size

Online Payment Fraud Detection Market Size

Online Powersports Market Size

Real Estate Management Solution Market Size