Banking as a Service (BaaS): Revolutionizing the Financial Ecosystem

In the evolving landscape of financial services, Banking as a Service (BaaS) Market Size has emerged as a transformative model, enabling non-bank businesses to offer banking products and services through seamless integration with licensed financial institutions. This innovative approach is not only disrupting traditional banking but also empowering fintechs, e-commerce platforms, and even retailers to provide customized financial solutions to their customers.

What is Banking as a Service (BaaS)?

Banking as a Service is a model where banks or financial institutions provide their digital banking infrastructure and regulatory licenses to third-party companies through APIs (Application Programming Interfaces). These third parties can then embed financial services—such as payments, loans, deposits, or card issuance—into their own products or platforms.

For example, a ride-sharing app could offer a digital wallet or a branded debit card to its drivers without becoming a bank. The backend operations and regulatory compliance are handled by the BaaS provider.

How BaaS Works

The BaaS model typically involves three players:

Licensed Bank – Provides the core banking infrastructure and regulatory compliance.

BaaS Platform Provider – Acts as a middleware offering APIs and SDKs that connect the bank to the third party.

Third-Party Business – Offers the financial services to end users, using the bank's infrastructure via the BaaS platform.

Key Features of BaaS

API Integration: Allows quick and secure embedding of banking features.

White-Label Solutions: Businesses can brand financial services as their own.

Regulatory Compliance: Handled by the licensed bank or provider.

Customizable Offerings: Tailored financial services based on user behavior and data.

Benefits of Banking as a Service

For Businesses:

Faster Time-to-Market Size: Launch financial products without building infrastructure from scratch.

Enhanced Customer Engagement: Offering value-added financial services deepens user relationships.

New Revenue Streams: Monetize financial services like loans, insurance, or payments.

For Banks:

Expanded Market Size Reach: Collaborate with fintechs and digital platforms to access new customer segments.

Innovation without Complexity: Offer cutting-edge services without building them in-house.

For Consumers:

Improved Accessibility: Access financial services from familiar platforms or apps.

Convenience: Streamlined, user-friendly digital experiences.

Use Cases of BaaS

Fintech Apps: Digital banks, personal finance management tools, and investment platforms.

E-commerce Platforms: Embedded payment options, credit offerings, or digital wallets.

Gig Economy Platforms: Custom banking tools for freelancers and contractors.

Retail Chains: Branded debit cards or buy-now-pay-later (BNPL) services.

Challenges and Considerations

Regulatory Complexity: Varying global regulations require compliance vigilance.

Data Security: Protecting customer data across platforms is crucial.

Reliability: Dependency on third-party platforms requires robust SLAs and infrastructure.

Future Outlook

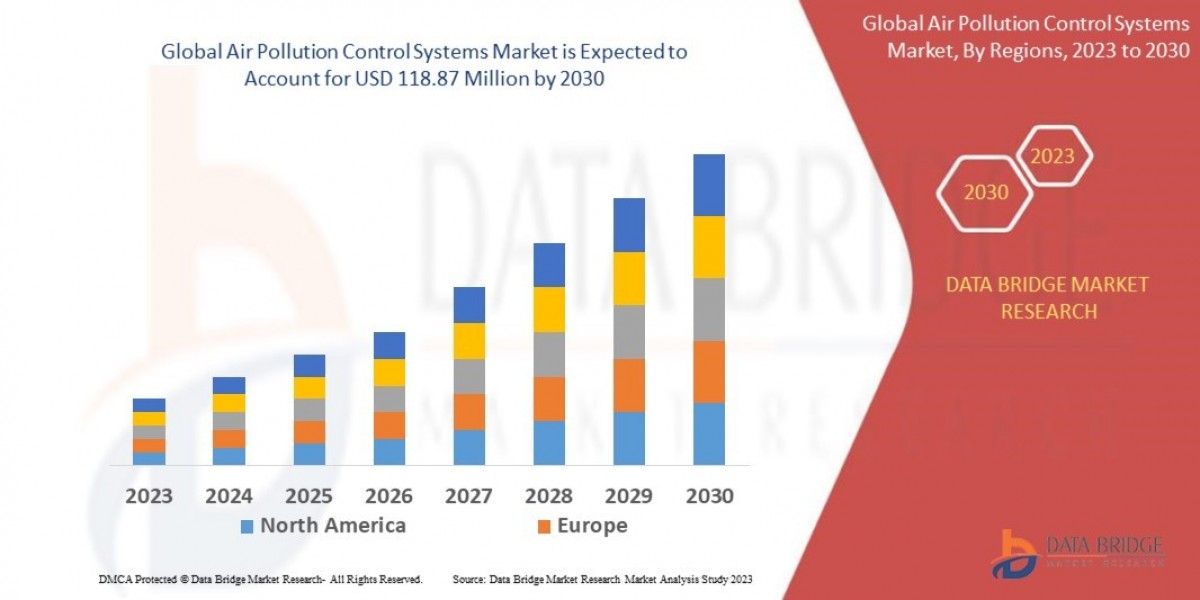

As digital transformation accelerates across industries, Banking as a Service is poised to become a core pillar of modern finance. With the rise of open banking, artificial intelligence, and real-time data analytics, BaaS will enable more personalized and intelligent financial solutions. Analysts predict that the global BaaS Market Size will grow exponentially over the next decade, driven by fintech innovation and consumer demand for seamless digital experiences.

Conclusion

Banking as a Service is not just a trend—it is a fundamental shift in how financial services are built, delivered, and consumed. By bridging the gap between traditional banking infrastructure and digital innovation, BaaS empowers companies to offer smarter, more accessible, and customer-centric financial solutions. As the ecosystem continues to evolve, BaaS will play a central role in shaping the future of financial inclusion and digital banking worldwide.

Related Report -

Business Travel Accident Insurance Market Size

Capital Restructuring Service Market Size

Cargo Transportation Insurance Market Size

Digital Asset Trading Platform Market Size