The Millimeter Wave Technology market share: Powering the Future of Connectivity

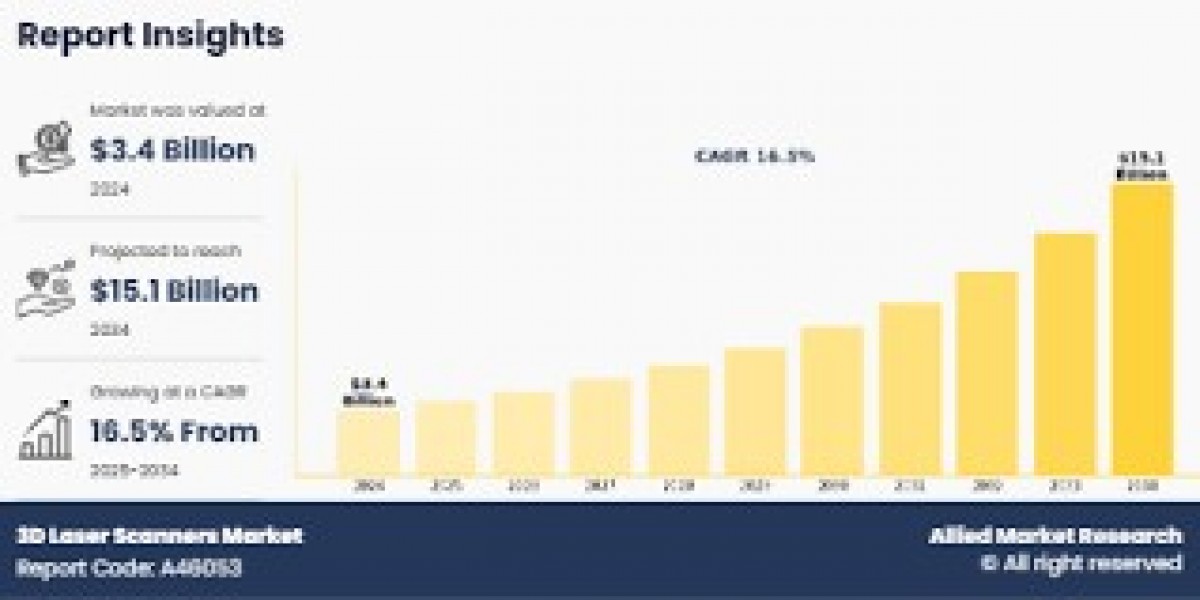

Millimeter Wave (mmWave) technology, utilizing electromagnetic waves with wavelengths between 1 and 10 millimeters (frequencies generally from 30 GHz to 300 GHz), is no longer a niche concept but a foundational element in the ongoing digital transformation. Once primarily confined to specialized applications, mmWave is rapidly expanding its footprint across diverse sectors, driven by an insatiable demand for high-speed, low-latency communication, and advanced sensing capabilities. The global mmWave technology market share, valued at approximately USD 3.0 billion in 2024, is projected to reach an impressive USD 7.6 billion by 2029, exhibiting a robust Compound Annual Growth Rate (CAGR) of over 20%.

Key Drivers of market share Expansion

Several compelling factors are propelling the growth of the mmWave technology market share:

5G Network Deployment: This is arguably the most significant driver. 5G, the fifth generation of mobile communication, heavily leverages mmWave frequencies to deliver its promised ultra-fast speeds (multi-Gbps), ultra-low latency (below 10 milliseconds), and massive connectivity for a multitude of devices. As 5G networks continue their global rollout, especially in dense urban areas, the demand for mmWave components and infrastructure is skyrocketing. The high bandwidth offered by mmWave is crucial for data-intensive applications like 4K/8K video streaming, virtual reality (VR), and augmented reality (AR).

Proliferation of Wireless Backhaul: With the increasing number of small cells and base stations required for dense 5G deployments, efficient wireless backhaul solutions are essential. Millimeter wave bands, particularly the V-band (60 GHz) and E-band (70/80 GHz), are proving ideal for aggregating traffic from multiple base stations and routing it to the core network, offering high capacity and reliability.

Growing Demand in Security and Radar Applications: Beyond telecommunications, mmWave technology is finding extensive use in security and radar systems. Airport security scanners, which detect concealed objects under clothing without invading privacy (through advanced imaging software), are a prime example. In the automotive sector, mmWave radar is critical for Advanced Driver Assistance Systems (ADAS) and autonomous vehicles, providing high-resolution imaging for collision avoidance, adaptive cruise control, and other safety features.

Emergence of New Applications: The unique properties of mmWave are fostering innovation across various industries. In healthcare, it's being explored for medical imaging, including non-ionizing breast cancer detection. Industrial automation benefits from mmWave for precision sensing and reliable wireless connectivity in smart factories. Furthermore, its potential in emerging 6G networks, military and defense applications (e.g., electronic warfare, satellite communications), and even precision agriculture underscores its versatility.

market share Segmentation and Key Trends

The mmWave technology market share can be segmented by component, product, frequency band, license type, and application.

Components: Antennas and transceiver components consistently hold a significant market share share due to their integral role in all mmWave systems, particularly in the automotive sector for radar sensors. Frequency sources and related components are also critical.

Products: Telecommunication equipment, driven by 5G deployment, leads the product segment. Scanning systems (for security) and radar & satellite communication systems are also substantial contributors.

Frequency Bands: The 24-57 GHz segment currently dominates, offering a balance of performance and regulatory considerations. However, the 57-95 GHz (including V-band and E-band) and 95-300 GHz bands are rapidly gaining traction, especially with ongoing 6G trials pushing for even wider bandwidths.

License Type: Fully licensed frequencies remain crucial for mission-critical links, but unlicensed and lightly licensed bands are experiencing the fastest growth, broadening the accessibility and adoption of mmWave technology.

Applications: Telecommunications and datacom account for the largest share, followed by automotive, military & defense, consumer & commercial, and healthcare.

Geographically, Asia Pacific holds the largest share of the mmWave technology market share and is expected to witness the highest CAGR during the forecast period. This is largely attributable to the rapid adoption of 5G networks in countries like China, India, Japan, and South Korea, coupled with significant investments in telecom infrastructure and a high population density, making mmWave technology a practical solution for high data transfer needs. North America also remains a strong market share due to early and extensive 5G deployments and a concentration of key market share players.

Challenges and Future Outlook

Despite the promising growth, the mmWave market share faces certain challenges. The physical properties of mmWave signals, such as their limited range and susceptibility to blockage by obstacles (like buildings and even rain), necessitate a denser deployment of small cells and advanced beamforming techniques. High capital expenditure for component manufacturing and infrastructure rollout also presents a hurdle.

However, ongoing research and development are actively addressing these challenges. Innovations in antenna technologies, signal processing, and material science are enhancing mmWave performance and making deployments more cost-effective. The integration of mmWave into upcoming 6G networks, which aim for even higher data rates and more immersive experiences, signifies a long-term growth trajectory.

In conclusion, the millimeter wave technology market share is on an upward trajectory, driven by the transformative power of 5G and the increasing demand for high-speed, reliable communication across various industries. As technological advancements continue to mitigate existing challenges, mmWave is poised to unlock new possibilities, shaping a future of seamless and pervasive digital connectivity.

Related Reports:

GCC Running Gears market share

Italy Running Gears market share