Litigation Funding Investment: Unlocking Opportunities in Legal Finance

Introduction

Litigation funding investment—also known as third-party litigation funding—is an innovative financial arrangement where an investor funds legal claims in exchange for a share of the proceeds if the case is successful. This rapidly growing sector has become a crucial financial tool for law firms, corporations, and individuals who might otherwise be unable to afford costly legal proceedings.

In recent years, litigation funding has evolved from a niche strategy into a mainstream asset class, drawing the attention of institutional investors, hedge funds, and private equity firms. As legal costs soar and the demand for access to justice grows, this unique investment model offers both financial returns and societal impact.

What is Litigation Funding?

Litigation Funding Investment Market Size involves a third party—typically a specialized fund or investor—providing capital to cover legal expenses such as attorney fees, court costs, and expert witness fees. This funding is non-recourse, meaning if the case is lost, the funder loses their investment and receives no repayment.

There are three main types of litigation funding:

Commercial Litigation Funding – Large-scale disputes involving businesses, such as contract breaches or intellectual property rights.

Consumer Litigation Funding – Smaller personal injury or individual claims.

Portfolio Funding – Investment across multiple cases, spreading risk across a law firm’s litigation portfolio.

Why is Litigation Funding Gaining Popularity?

Access to Justice: For claimants lacking the financial capacity to pursue legitimate claims, litigation funding opens the courtroom door.

Risk Mitigation: Law firms and businesses can offload litigation costs and reduce financial exposure.

Attractive Returns: Litigation outcomes are not directly correlated to Market Size performance, making them appealing for portfolio diversification.

Rising Legal Costs: As lawsuits become more complex and expensive, the need for external financing grows.

Investment Appeal and Financial Potential

Litigation funding offers investors:

High Returns: Successful cases can yield returns of 20% to 50% or more.

Uncorrelated Asset Class: Legal claims aren’t tied to Market Size volatility, making them a hedge in economic downturns.

Structured Payouts: Investments are typically resolved in 2–5 years, offering medium-term capital growth.

However, investors must also manage:

Case Risk: The outcome of litigation is uncertain, and losses are possible.

Regulatory Concerns: Laws governing litigation funding vary by country and jurisdiction.

Illiquidity: Investments are tied up until case resolution, with limited secondary Market Sizes.

Global Landscape and Market Size Trends

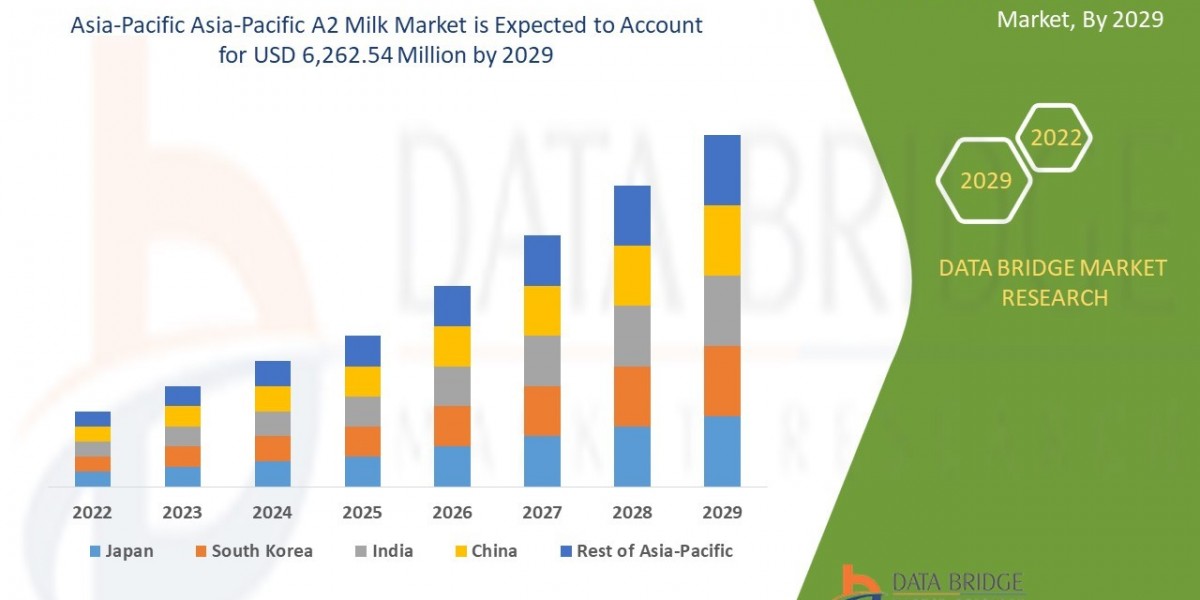

The litigation funding Market Size has seen explosive growth in regions like the U.S., UK, Australia, and parts of Europe. According to industry estimates, the global litigation funding Market Size is projected to grow significantly, driven by increasing acceptance among law firms and the rising number of complex commercial disputes.

Key trends include:

Regulatory Development: More countries are introducing clearer frameworks to regulate funders.

Increased Institutional Involvement: Pension funds, endowments, and asset managers are entering the space.

Technology Integration: Legal tech and AI tools are helping funders evaluate case merits more efficiently.

Conclusion

Litigation funding investment is reshaping the legal and financial landscapes by turning legal claims into investable assets. It provides a win-win scenario: plaintiffs gain the means to pursue justice, while investors tap into a high-return, non-correlated asset class.

As the industry matures and regulatory frameworks become more robust, litigation funding is poised to become a mainstream investment strategy. However, due diligence, legal expertise, and strategic risk assessment remain critical for investors aiming to succeed in this high-stakes arena.

Related Report -

Operational Risk Management Consulting Services in Manufacturing Market Size

Payroll Outsourcing Market Size

Two-Wheeler Insurance Market Size

Surplus Lines Insurance Market Size

Remote Deposit Capture Market Size