Investment Management Software: Features, Benefits, and Market Size Outlook

In today’s fast-paced financial landscape, investment firms, asset managers, and individual investors rely heavily on technology to streamline operations, optimize portfolios, and make data-driven decisions. One such technological tool that has transformed the investment industry is Investment Management Software (IMS) Market Size. This article explores what investment management software is, its core features, benefits, and how it is reshaping the financial sector.

What is Investment Management Software?

Investment Management Software is a digital solution designed to help investors, financial advisors, wealth managers, and institutions manage investment portfolios efficiently. It automates various processes such as portfolio management, risk analysis, compliance, client reporting, and performance tracking.

The software can be cloud-based or on-premise and is used by banks, hedge funds, family offices, mutual fund companies, and independent advisors.

Key Features of Investment Management Software

Portfolio Management:

Enables tracking and managing multiple portfolios across asset classes including equities, bonds, mutual funds, ETFs, and real estate.Automated Reporting:

Generates detailed reports on investment performance, risk exposure, and compliance metrics for clients and regulatory authorities.Risk & Compliance Management:

Includes tools to assess Market Size risk, credit risk, and ensures adherence to financial regulations and client mandates.Trade Order Management (OMS):

Facilitates order creation, execution, and settlement processes while reducing operational errors.Data Integration & Analytics:

Integrates with Market Size data providers and analytics platforms to offer real-time insights and investment research tools.Client Relationship Management (CRM):

Tracks client interactions, preferences, and financial goals to offer personalized investment advice.

Benefits of Using Investment Management Software

Efficiency and Automation:

Reduces manual work, allowing financial professionals to focus more on strategy and client service.Accuracy and Compliance:

Minimizes human error and ensures investments meet legal and regulatory requirements.Enhanced Decision Making:

Offers real-time data and predictive analytics to guide smarter investment strategies.Scalability:

Supports business growth by handling increasing volumes of portfolios and transactions.Improved Client Experience:

Clients gain access to intuitive dashboards, performance tracking tools, and transparent reporting.

Use Cases Across Financial Sectors

Wealth Management Firms use IMS for client profiling, asset allocation, and performance tracking.

Asset Management Companies benefit from trade automation, compliance tracking, and real-time analytics.

Banks and Financial Advisors use it for risk-adjusted returns and regulatory reporting.

Hedge Funds employ IMS for advanced trading strategies and risk mitigation.

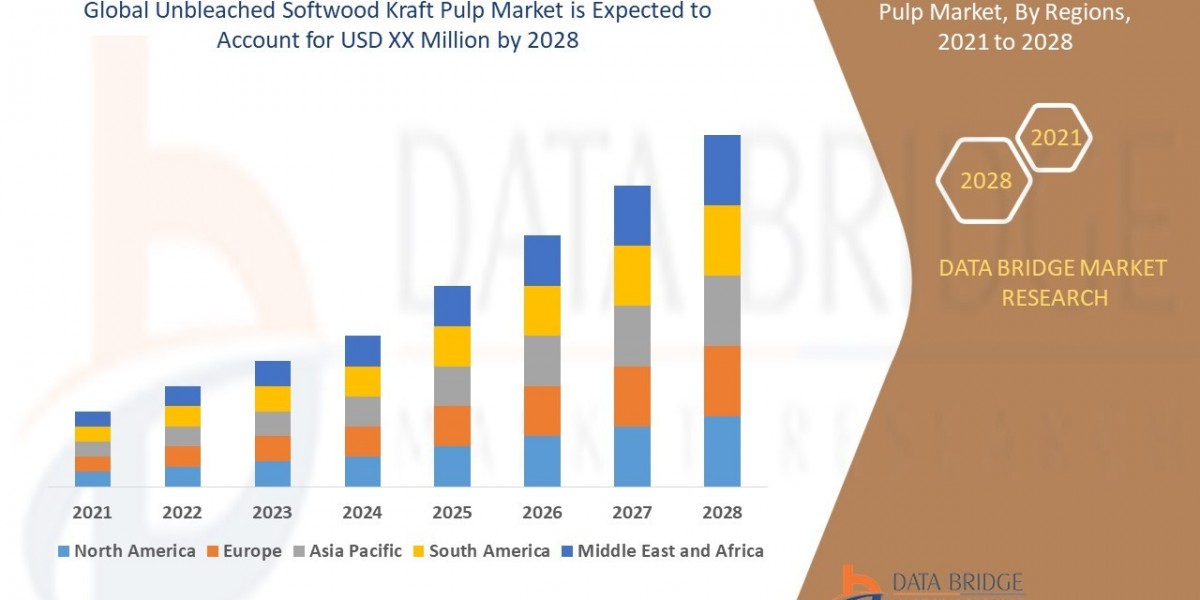

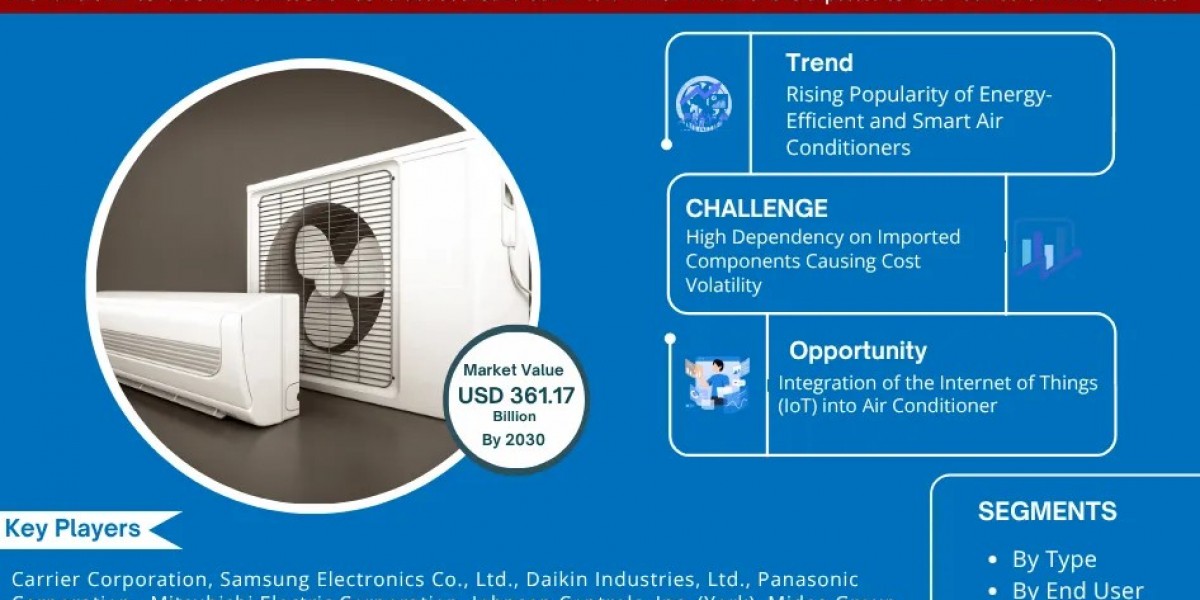

Market Size Outlook and Future Trends

The global investment management software Market Size is expected to grow significantly in the coming years, driven by digitization, the rise of fintech, and increasing demand for transparent and data-driven investment processes.

Emerging trends include:

Integration with AI and machine learning for predictive analysis.

Use of blockchain for secure transaction recording and verification.

Growth in robo-advisory platforms for low-cost, algorithm-driven investment management.

Conclusion

Investment Management Software has become indispensable in the modern financial ecosystem. By automating complex tasks, improving accuracy, and enabling data-driven decisions, it empowers investment professionals to deliver better outcomes for clients. As the industry continues to evolve with advancements in technology, IMS will play a critical role in shaping the future of investment management.

Related Report -

Employers Liability Insurance Market Size

Insurance Brokerage Market Size

Intellectual Property Fraud Market Size

Canada Digital Payment Market Size