The Mobile Robotics industry is rapidly transforming from a niche segment into a cornerstone of modern automation, driven by advances in AI, sensors, edge computing, and navigation technologies. From autonomous vehicles and drones to warehouse robots and field inspection units, mobile robots are becoming essential tools across a range of sectors including logistics, defense, agriculture, healthcare, and manufacturing.

As businesses seek increased flexibility, safety, and efficiency, mobile robotics offers scalable, intelligent, and contactless solutions that adapt to dynamic environments — a capability that traditional stationary systems lack.

industry Overview

The global mobile robotics industry was valued at approximately USD 25 billion in 2024 and is expected to reach USD 85 billion by 2035, growing at a CAGR of 11.7%. Fueled by Industry 4.0 adoption, smart city development, and the rise of autonomous delivery systems, this industry is poised for massive expansion over the next decade.

Key industry Drivers

Logistics & E-commerce Boom

Autonomous mobile robots (AMRs) and automated guided vehicles (AGVs) are revolutionizing warehouse automation, last-mile delivery, and inventory management in a world of rapid fulfillment.Advancements in AI & Navigation

Improvements in SLAM (Simultaneous Localization and Mapping), computer vision, and sensor fusion allow mobile robots to operate safely in unstructured environments with minimal human input.Labor Shortages and Cost Reduction

Robotics fill critical labor gaps in industries like manufacturing and agriculture while reducing long-term operational costs.Increased Demand for Contactless Solutions Post-COVID

Robots are being deployed in healthcare, hospitality, and public sanitation to reduce human exposure and maintain operational continuity.

industry Segmentation

By Type:

Automated Guided Vehicles (AGVs)

Autonomous Mobile Robots (AMRs)

Unmanned Ground Vehicles (UGVs)

Unmanned Aerial Vehicles (UAVs or Drones)

Unmanned Marine Vehicles (UMVs)

By Application:

Logistics & Warehousing

Military & Defense

Agriculture

Healthcare & Elder Care

Inspection & Maintenance

Mining & Construction

By Mobility:

Wheeled

Legged

Tracked

Aerial/Flight-Based

Hybrid/Multimodal

Emerging Trends

5G-Enabled Robotics for Real-Time Control

Ultra-low-latency communication enables real-time decision-making for mobile robots operating in fleets or swarms.AI at the Edge

On-device processing reduces response time and improves autonomy, especially in remote or infrastructure-poor environments.Swarm Robotics

Coordinated operations among groups of smaller robots are being explored for agriculture, search & rescue, and military use.Human-Robot Interaction (HRI)

Mobile robots in public and healthcare spaces are being enhanced with voice recognition, emotion detection, and behavior modeling for improved collaboration.

Regional Insights

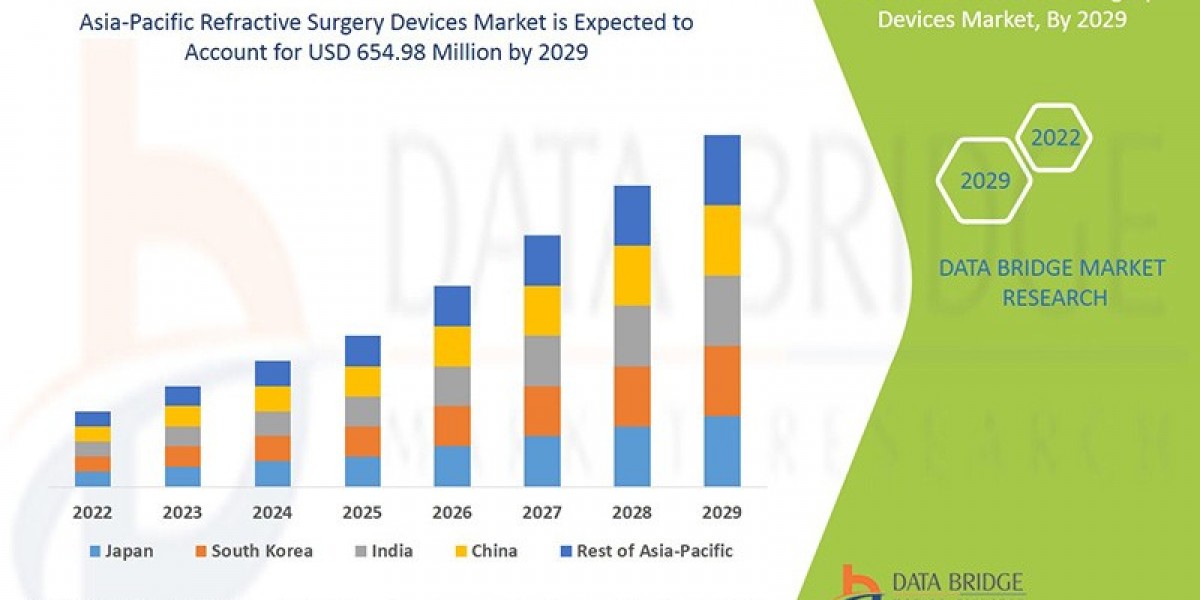

Asia-Pacific leads the industry, with China, Japan, and South Korea investing heavily in robotics across industries.

North America dominates in AI-powered robotic startups, defense robotics, and warehouse automation.

Europe shows strength in precision agriculture robotics and urban mobility solutions.

Key Players

Boston Dynamics

Clearpath Robotics

KUKA AG

ABB Ltd.

DJI

iRobot Corporation

Omron Corporation

MiR (Mobile Industrial Robots)

Locus Robotics

AGILOX

These leaders are driving innovation in intelligent navigation, cloud-robotic platforms, and high-performance autonomous systems.

Challenges

Regulatory and Safety Concerns

Deployment in public or shared spaces requires compliance with local and international safety standards.Infrastructure Compatibility

Not all environments are robot-friendly; adapting physical spaces can incur high retrofitting costs.Cybersecurity Risks

Networked mobile robots present potential vulnerabilities for data breaches and remote manipulation.

Future Outlook

By 2035, mobile robots will become ubiquitous across industries. They will form interconnected fleets that autonomously interact with each other and the environment to deliver results in real-time. Whether it’s a drone inspecting pipelines, a delivery robot navigating city streets, or a healthcare robot assisting patients, mobile robotics will play a central role in making operations smarter, safer, and more sustainable.

read more

| Capacitive Proximity Sensors industry |

| Industrial Logic Integrated Circuit industry |

| Wireless Connectivity Chipset industry |

| Optical Chemical Sensors industry |

| Silicon Capacitor industry |