Instant Payments – Revolutionizing the Way We Transact

Introduction

In today’s fast-paced digital economy, instant payment Market Size have become a game-changer, offering consumers and businesses the ability to transfer funds in real-time, 24/7/365. As global commerce becomes increasingly digitized, the demand for fast, secure, and always-available payment systems continues to grow. Instant payments are redefining the financial landscape by eliminating delays and enhancing user convenience.

What Are Instant Payments?

Instant payments, also known as real-time payments (RTP), are electronic fund transfers that are initiated, processed, and settled within seconds. Unlike traditional banking systems that may take hours or even days to process transactions, instant payments offer near-immediate confirmation and finality.

Key Features

Real-Time Processing: Funds are transferred and settled instantly, reducing wait times.

24/7 Availability: Transactions can be made any time, including weekends and holidays.

Certainty of Payment: Once processed, the payment is irrevocable.

Improved Transparency: Both sender and receiver receive instant confirmation.

Benefits of Instant Payments

For Consumers:

Convenience: Pay bills, split costs, or send money anytime.

Speed: Eliminates delays for urgent payments.

Better Cash Flow Management: Instant access to transferred funds.

For Businesses:

Faster Settlements: Improves working capital and liquidity.

Customer Satisfaction: Enhances the checkout experience and payment flexibility.

Operational Efficiency: Reduces reliance on manual processes.

Use Cases

Peer-to-peer (P2P) transfers via mobile apps like UPI in India or Zelle in the U.S.

Merchant payments at point-of-sale terminals.

E-commerce transactions for instant refunds or payments.

Government disbursements such as emergency aid or tax refunds.

Salary and vendor payments for just-in-time payouts.

Global Adoption

India: UPI (Unified Payments Interface) leads the world with its scale and adoption.

Europe: The SEPA Instant Credit Transfer (SCT Inst) enables pan-European real-time payments.

United States: The RTP network by The Clearing House and FedNow by the Federal Reserve are advancing adoption.

Brazil: PIX, launched by the Central Bank, has seen rapid uptake across users and merchants.

Challenges and Considerations

Cybersecurity Risks: Real-time systems can be targets for fraud if not secured.

Interoperability: Integration across multiple banks and platforms remains complex.

Cost Management: Infrastructure upgrades and compliance requirements can be expensive.

Customer Awareness: Users must be educated about the benefits and safe usage of instant payments.

The Future of Instant Payments

As central banks and fintechs continue to innovate, the future of instant payments will likely include:

Cross-border real-time payments

Integration with blockchain and digital currencies

AI-driven fraud detection and risk management

Universal mobile payment solutions

Conclusion

Instant payments are revolutionizing the financial ecosystem by enabling real-time money movement with greater transparency and convenience. As adoption grows globally, these systems are expected to become the new standard for personal and business transactions alike—ushering in an era of faster, smarter, and more inclusive finance.

Related Report -

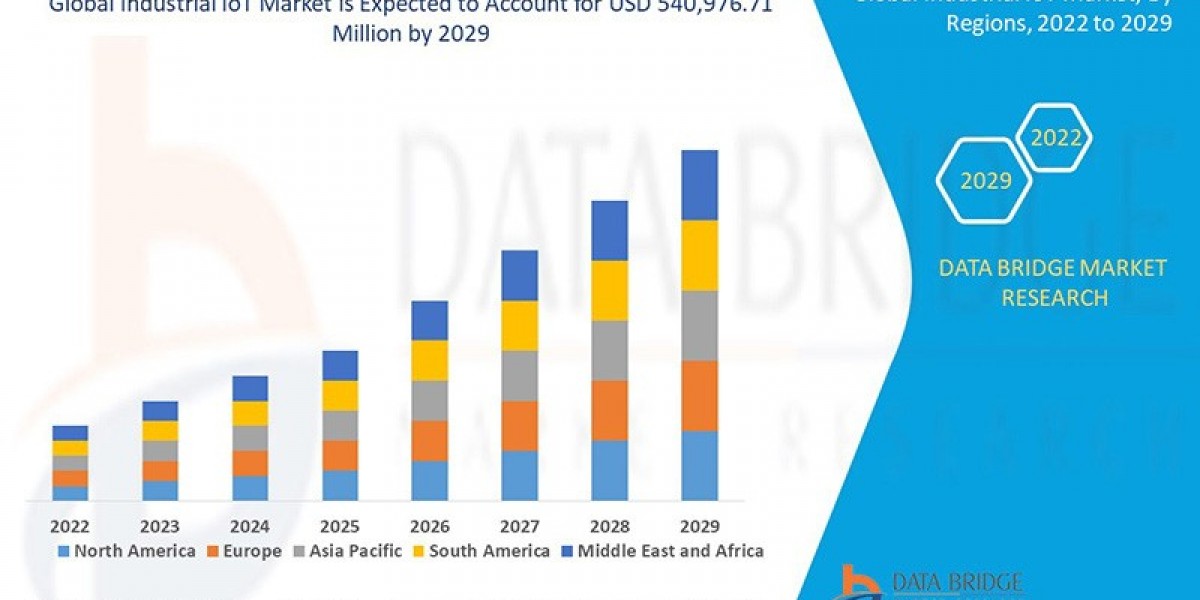

Internet of Things (IoT) Insurance Market Size

Insurance Protection Product Market Size

Debt Collection Software Market Size

Digital Transformation Consulting Market Size