Automotive Insurance: A Comprehensive Guide for 2025

Automotive insurance is a crucial aspect of vehicle ownership that provides financial protection against physical damage, theft, and liability resulting from accidents or other incidents involving your vehicle. As the global automotive landscape evolves with technological advancements and changing consumer behavior, the importance and structure of automotive insurance have also significantly transformed.

What is Automotive Insurance?

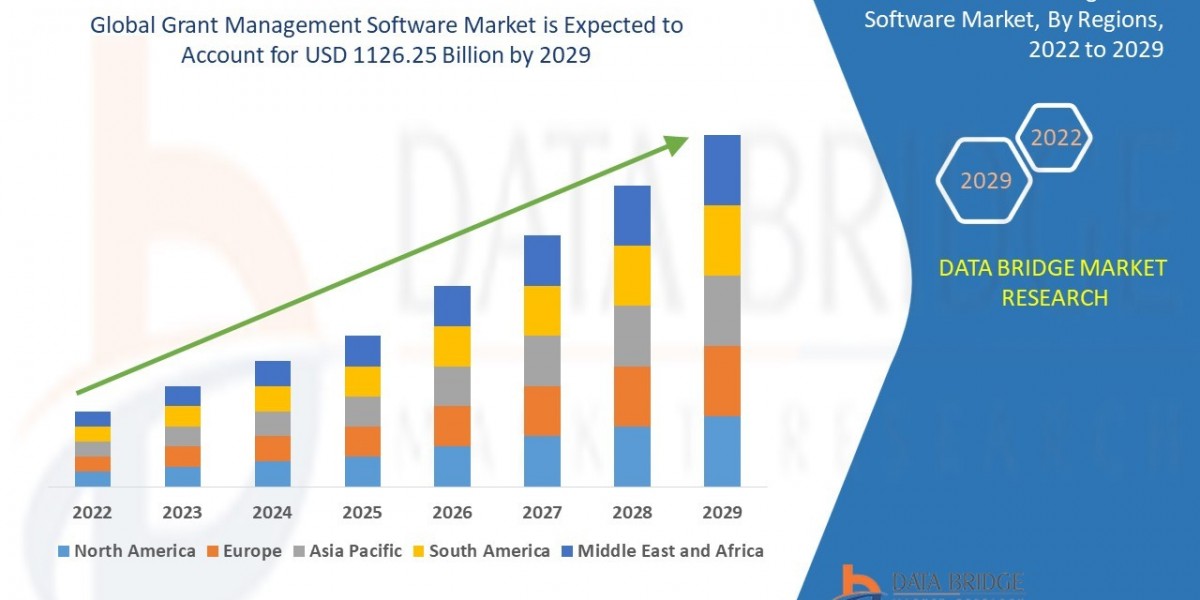

Automotive insurance Market Size is a contract between a vehicle owner and an insurance company that provides coverage for financial losses related to vehicle damage, theft, accidents, and third-party liabilities. In exchange for regular premium payments, insurers agree to cover certain costs as per the policy’s terms.

Types of Automotive Insurance Coverage

Liability Coverage

Bodily Injury Liability: Covers costs associated with injuries to others in an accident you caused.

Property Damage Liability: Covers damage to another person’s property (like their car or fence).

Collision Coverage

Pays for damages to your vehicle caused by a collision with another car or object.

Comprehensive Coverage

Covers non-collision events such as theft, vandalism, fire, natural disasters, and falling objects.

Personal Injury Protection (PIP)

Covers medical expenses for you and your passengers, regardless of who is at fault.

Uninsured/Underinsured Motorist Coverage

Provides protection if you’re hit by a driver without insurance or insufficient coverage.

Importance of Automotive Insurance

Legal Requirement: In most countries, at least third-party liability insurance is mandatory to operate a vehicle.

Financial Security: Helps cover expensive repair or medical bills resulting from accidents or damage.

Peace of Mind: Offers confidence while driving, knowing you are financially protected.

Vehicle Protection: Essential for protecting the investment you’ve made in your car.

Emerging Trends in Automotive Insurance (2025)

Usage-Based Insurance (UBI):

Premiums based on driving behavior using telematics devices or mobile apps.AI and Automation:

Insurers use artificial intelligence to streamline claims processing, fraud detection, and personalized pricing.Electric Vehicle (EV) Insurance:

Specialized insurance products are being developed to cover unique risks associated with EVs, like battery damage and charging equipment.Digital Claims Processing:

Policyholders can now file and track claims online with faster settlement times.Blockchain Integration:

Enhancing transparency, reducing fraud, and simplifying claim settlements with blockchain-based policy and claims management.

Factors Influencing Automotive Insurance Premiums

Age and gender of the driver

Driving history and record

Type and value of the vehicle

Geographic location

Coverage limits and deductibles

Vehicle usage (personal or commercial)

Tips for Choosing the Right Automotive Insurance

Compare Multiple Policies: Look for the best mix of coverage, premium, and benefits.

Understand Coverage Needs: Choose coverage based on your car’s value and your financial risk tolerance.

Check Insurer Reputation: Go with companies known for good customer service and prompt claim settlements.

Review Annually: Evaluate your policy every year to ensure it matches your current needs.

Conclusion

Automotive insurance is more than a legal obligation—it’s a smart financial decision that protects your vehicle, your finances, and others on the road. As technology continues to influence the automotive industry, insurance providers are adapting to offer more personalized, efficient, and digital-first solutions. Whether you're a new driver or a seasoned car owner, staying informed about your insurance options and rights is essential in today's fast-evolving environment.

Related Report -

Usage Based Car Insurance Market Size

Livestock Insurance Market Size

Mobile Phone Insurance Market Size

Travel Credit Insurance Market Size

E-Commerce Buy Now Pay Later Market Size