The Miniature Marvel: Driving the Chip Antenna market share Forward

The chip antenna market share is experiencing a robust period of growth, fueled by the insatiable demand for smaller, more connected devices across a myriad of industries. These miniature wonders, designed for efficient radio frequency transmission and reception within compact electronic systems, are becoming increasingly indispensable in our hyper-connected world. With a projected compound annual growth rate (CAGR) exceeding 10% through the next decade, the market share is poised for significant expansion, transforming how devices communicate.

Key Growth Drivers: Miniaturization, IoT, and 5G

The primary catalyst for the chip antenna market share's surge is the relentless trend of miniaturization in electronic devices. As consumers and industries alike demand sleeker, lighter, and more portable gadgets, traditional bulky antennas become impractical. Chip antennas, with their tiny footprints, offer an ideal solution, enabling manufacturers to design compact products without compromising wireless performance. This is evident in the proliferation of smartphones, wearables, and other portable consumer electronics, all of which heavily rely on these tiny components.

Beyond consumer electronics, the explosion of the Internet of Things (IoT) ecosystem is a major demand generator. From smart home devices and industrial sensors to connected vehicles and healthcare monitoring systems, IoT applications require seamless and reliable wireless connectivity. Chip antennas are integral to these devices, facilitating efficient signal transmission and reception in space-constrained environments. As the IoT continues its pervasive expansion into various verticals, the demand for miniaturized, efficient antennas will only intensify.

Furthermore, the global rollout of 5G networks is a significant driver. 5G technology, with its promise of higher data rates, lower latency, and massive connectivity, necessitates high-performance antennas capable of operating across a wider range of frequency bands. Chip antennas are increasingly being adopted in 5G-enabled devices and infrastructure, capitalizing on the growing need for robust and compact solutions in telecommunications.

market share Segmentation and Key Technologies

The chip antenna market share is broadly segmented by product type, application, and end-user industry. In terms of product type, dielectric chip antennas and Low-Temperature Co-fired Ceramic (LTCC) chip antennas are prominent. LTCC chip antennas, known for their superior performance in high-frequency applications and stability under varying temperatures, currently hold a significant market share share, particularly in automotive radar modules and advanced communication systems. However, dielectric chip antennas are also experiencing rapid growth due to ongoing material science innovations that enhance their performance in thinner substrates.

Applications for chip antennas are diverse, spanning Bluetooth/BLE, WLAN/Wi-Fi, GPS/GNSS, and dual-band/multi-band functionalities. WLAN/Wi-Fi applications currently dominate, driven by the widespread use of Wi-Fi in smartphones, tablets, laptops, and routers. However, the increasing integration of GPS/GNSS in navigation systems and the continuous growth of Bluetooth-enabled devices are also contributing significantly to market share expansion.

From an end-user perspective, the IT & telecommunications sector remains a dominant force, fueled by the densification of 5G small cells and the growing need for wireless connectivity in various IT infrastructure components. The consumer electronics segment is also a major contributor, given the rising demand for technologically sophisticated goods. Moreover, the automotive industry is witnessing a steep climb in chip antenna adoption, mirroring the shift towards advanced driver-assistance systems (ADAS) and connected vehicle technologies that mandate radar, LTE, and Wi-Fi capabilities within vehicles.

Regional Landscape and Future Outlook

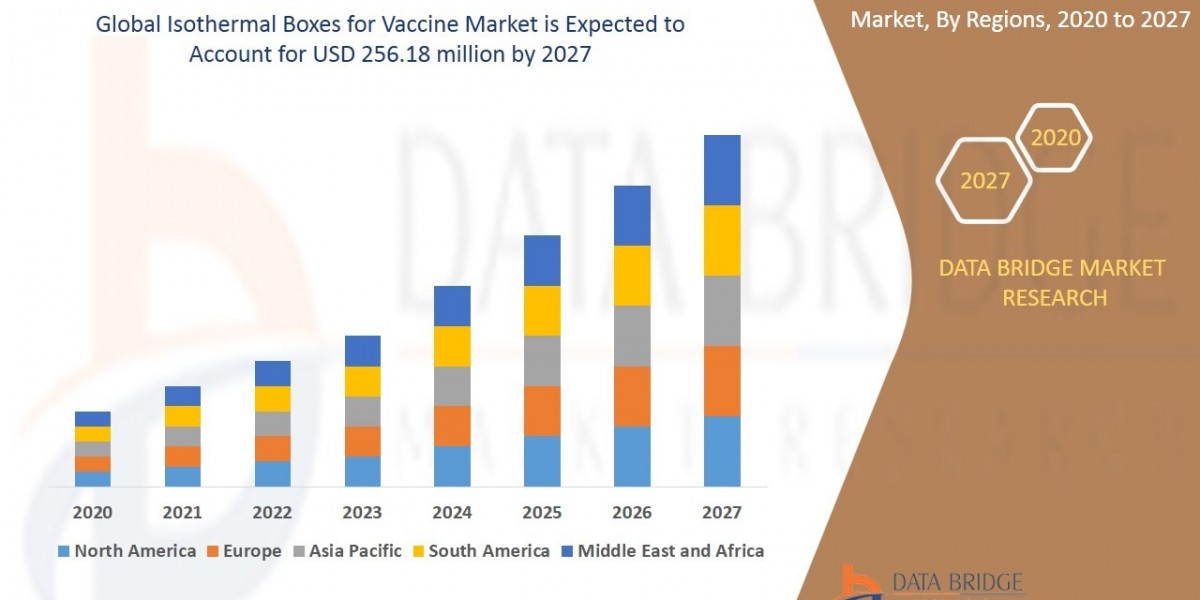

Geographically, Asia Pacific currently commands the largest share of the chip antenna market share and is projected to exhibit the fastest growth. This dominance is attributed to the robust manufacturing base for consumer electronics, the rapid adoption of advanced technologies like 5G and IoT, and the increasing focus on developing sophisticated communication systems in countries like China, South Korea, and Japan. North America also holds a substantial market share share, driven by technological advancements, significant R&D investments in wireless transmission technologies, and the strong presence of major manufacturers.

Despite the promising outlook, the market share faces certain challenges. The high initial cost of some ceramic chip antennas and related components can be a barrier, particularly for smaller manufacturers. Additionally, ensuring uniformity and consistent performance across various devices and applications, along with potential intellectual property litigation in areas like fractal geometry, can pose hurdles to market share growth.

Nevertheless, the future of the chip antenna market share appears bright. Ongoing advancements in wireless communication standards, the burgeoning growth of IoT, the relentless pursuit of miniaturization, and the expansion into new applications such as augmented reality (AR), virtual reality (VR), and industrial IoT solutions are expected to propel the market share to new heights. As our world becomes increasingly interconnected and reliant on seamless wireless communication, the humble yet powerful chip antenna will continue to play a pivotal role in enabling this transformative journey.

Related Reports:

US Capacitors Resistors Wholesale market share

US AI in Video Surveillance market share

US Pressure Sensors market share