Virtual Cards: Revolutionizing the Way We Pay

In the age of digital transformation, the way we handle money is undergoing a dramatic shift. Among the many innovations reshaping the financial ecosystem, virtual cards have emerged as a secure, convenient, and efficient tool for online and remote transactions. Whether for personal spending, business expenses, or subscription management, virtual cards offer a digital alternative to traditional plastic cards.

What is a Virtual Card?

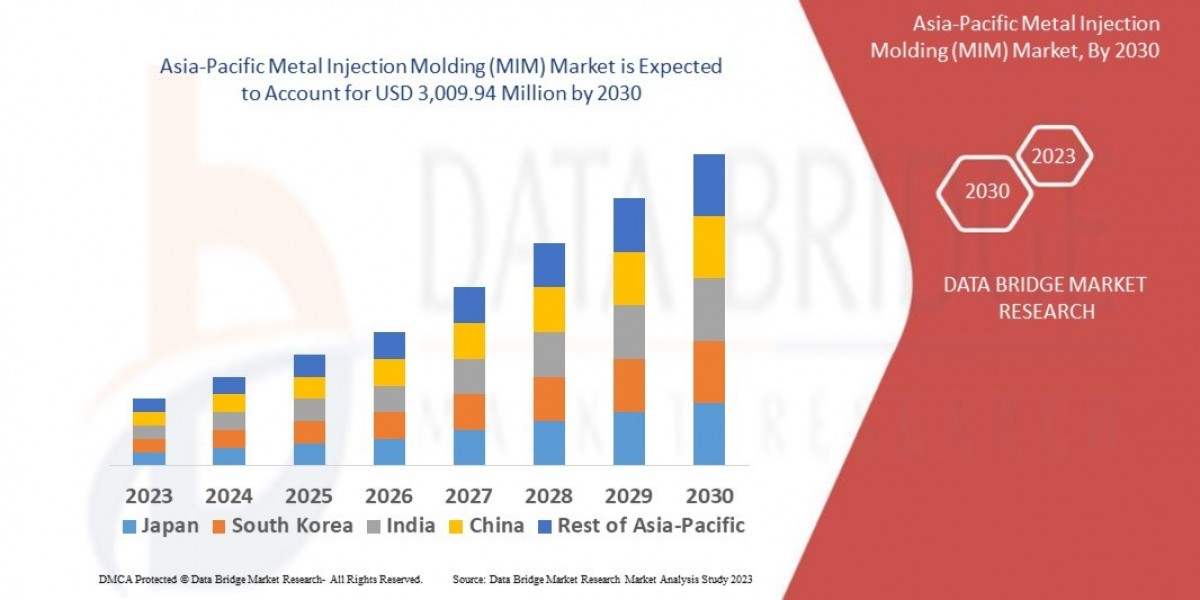

A virtual card Market Size is a digitally generated payment card that exists only in electronic form. It functions just like a physical debit or credit card and includes a card number, expiration date, and CVV. However, it is stored on your phone, laptop, or within an app, eliminating the need for a physical version.

Virtual cards can be either:

Single-use: Designed for one-time transactions to enhance security.

Multi-use: Reusable virtual cards with customizable spending limits and expiration dates.

How Virtual Cards Work

When a virtual card is issued (typically by a bank or fintech company), it is linked to your primary account or credit line. You can use it to make online purchases, pay for subscriptions, or manage corporate expenses. Once a transaction is completed, especially with a single-use card, the details become invalid, preventing any further use.

Key Benefits of Virtual Cards

Enhanced Security

Virtual cards reduce the risk of fraud by masking your real account details.

If compromised, they can be immediately locked or deleted without affecting your main account.

Control and Flexibility

Set spending limits, usage duration, and even restrict usage to specific merchants.

Ideal for budgeting and subscription management.

Ease of Use

Instantly generated via apps or online banking platforms.

No waiting time or physical delivery required.

Reduced Risk of Data Breach

With no physical presence, the chance of card skimming or theft is eliminated.

Efficient Expense Management for Businesses

Businesses can issue virtual cards to employees for travel, procurement, or vendor payments.

Each card can be tracked and monitored, simplifying accounting and reconciliation.

Popular Use Cases

Online Shopping: A secure way to make purchases without exposing actual card details.

Travel and Expense Management: Companies use virtual cards for bookings and expense control.

Subscription Services: Manage recurring charges with specific cards for each service.

Freelancers & Remote Teams: Distribute and track expenses easily without physical logistics.

Virtual Cards vs Physical Cards

| Feature | Virtual Cards | Physical Cards |

|---|---|---|

| Form | Digital only | Plastic (physical) |

| Security | High (temporary, masked details) | Moderate (can be lost/stolen) |

| Convenience | Instant issuance, app-based | Requires shipping, wallet access |

| Expense Control | High (custom rules & limits) | Limited customization |

| Environmental Impact | Low (no plastic waste) | High (plastic production involved) |

The Future of Virtual Cards

As contactless and online payments continue to dominate, virtual cards are expected to become a mainstream tool for both consumers and enterprises. With increased adoption of mobile wallets, digital banking, and AI-driven fintech services, virtual cards are evolving to offer smarter controls, real-time analytics, and integrations with accounting software.

Conclusion

Virtual cards represent the future of secure, seamless, and smart financial transactions. Whether you're an individual shopper, a startup owner, or a CFO of a global company, virtual cards offer unmatched control, security, and flexibility in the digital payment landscape. As financial services continue to digitize, virtual cards will play a pivotal role in how we spend and manage money.

Related Report -

Digital Transformation Consulting Market Size

Financial Risk Management Software Market Size

Convenience Stores Market Size

Blockchain Distributed Ledger Market Size