Cargo Insurance: Safeguarding Goods in Global Trade

In today’s interconnected world, the movement of goods across borders has become the backbone of international trade. With trillions of dollars' worth of cargo shipped globally each year, the risks involved in transportation—ranging from theft and loss to damage from weather or accidents—are significant. This is where cargo insurance comes into play, providing a safety net that protects businesses and individuals against financial loss during transit.

What is Cargo Insurance?

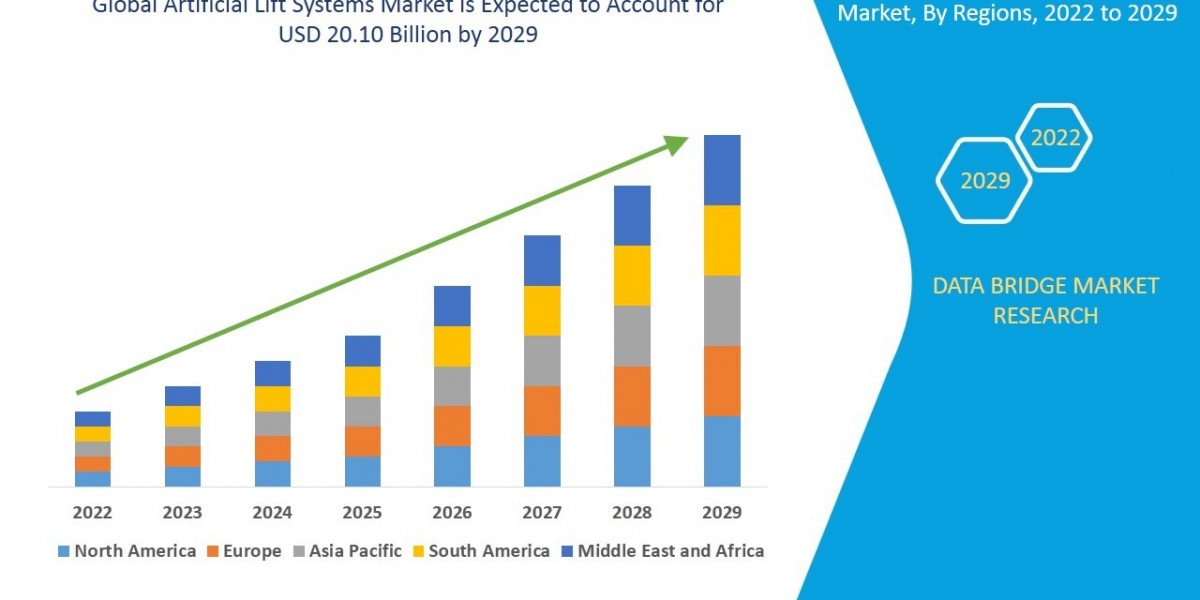

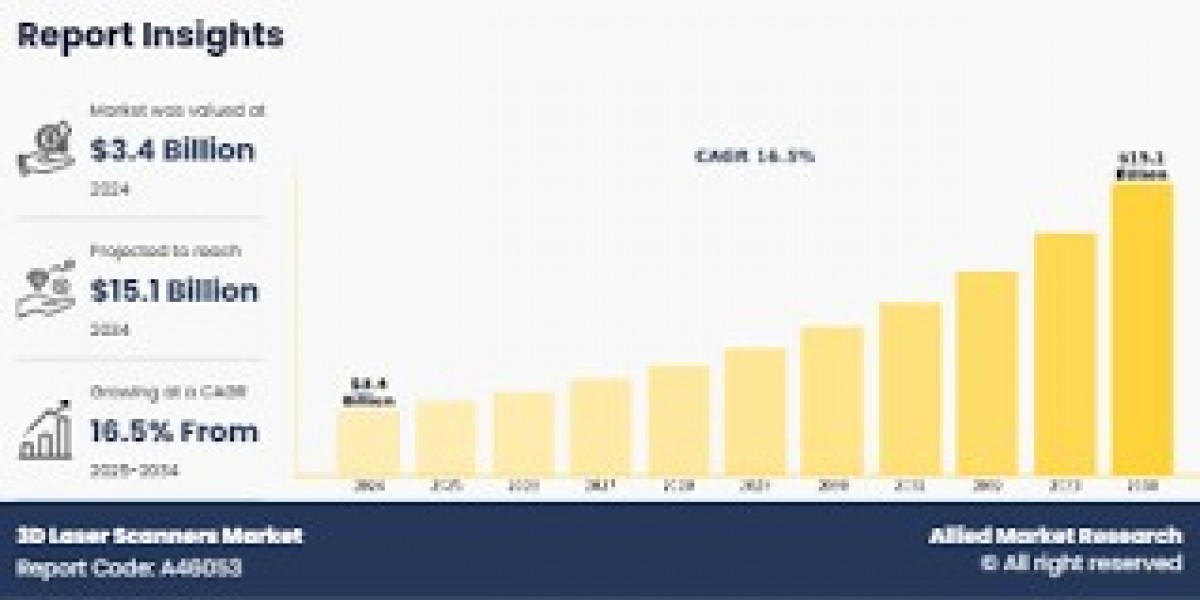

Cargo insurance Market Size is a type of coverage that protects goods being transported from one location to another, whether by sea, air, rail, or road. It compensates the insured for losses or damage to cargo due to unforeseen events during shipping. The policyholder can be a shipper, exporter, importer, freight forwarder, or logistics company.

Why is Cargo Insurance Important?

Despite advancements in logistics and technology, cargo is still vulnerable to a wide array of risks. Common threats include:

Natural disasters such as storms or earthquakes

Theft or piracy

Accidents including collisions or overturns

Improper handling and loading errors

Delays or rerouting that may spoil perishable goods

Cargo insurance ensures that in the event of such incidents, the business does not suffer significant financial setbacks, maintaining operational continuity.

Types of Cargo Insurance

Land Cargo Insurance

Covers goods transported by land, typically within a country. It is commonly used for trucks and trains.Marine Cargo Insurance

Offers coverage for goods transported over water or air. Despite the name, it also includes air cargo and is the most comprehensive form of coverage for international shipments.

Coverage Options

Cargo insurance policies can be tailored to specific needs. The most common coverage types include:

All-Risk Coverage: Broadest protection against all physical loss or damage from external causes.

Named Perils Coverage: Covers only risks specifically listed in the policy (e.g., fire, collision).

Free of Particular Average (FPA): Limited coverage that applies only in cases of significant damage or loss.

Key Benefits of Cargo Insurance

Financial Protection: Reimbursement for lost or damaged goods reduces the financial impact.

Peace of Mind: Businesses can operate confidently, knowing they’re protected.

Compliance & Trust: Some buyers and suppliers require proof of insurance before transacting.

Global Coverage: Ideal for exporters and importers operating across borders.

Choosing the Right Cargo Insurance

When selecting cargo insurance, businesses should consider:

Value of the shipment

Type of goods (fragile, perishable, high-value)

Shipping method and route

Carrier’s liability coverage (often limited)

Exclusions and deductibles

Working with an experienced insurance broker can help tailor a policy to fit the specific needs of your supply chain.

Conclusion

In the dynamic world of logistics and international trade, cargo insurance is not just an option—it’s a necessity. It plays a crucial role in risk management, ensuring businesses can continue to thrive even when unforeseen disruptions occur. As global trade continues to expand, cargo insurance remains a vital tool for protecting the flow of commerce and securing economic interests worldwide.

Related Report -

Decentralized Insurance Market Size

Disability Insurance Market Size

Electronic Gadget Insurance Market Size

Embedded Insurance Market Size