Agricultural Insurance: Safeguarding Farmers Against Uncertainty

Agriculture is the backbone of many economies around the world, yet it remains one of the most vulnerable sectors due to its heavy dependence on natural factors such as weather, pests, and diseases. To mitigate the financial risks associated with these uncertainties, agricultural insurance plays a crucial role in protecting farmers and ensuring food security.

What is Agricultural Insurance?

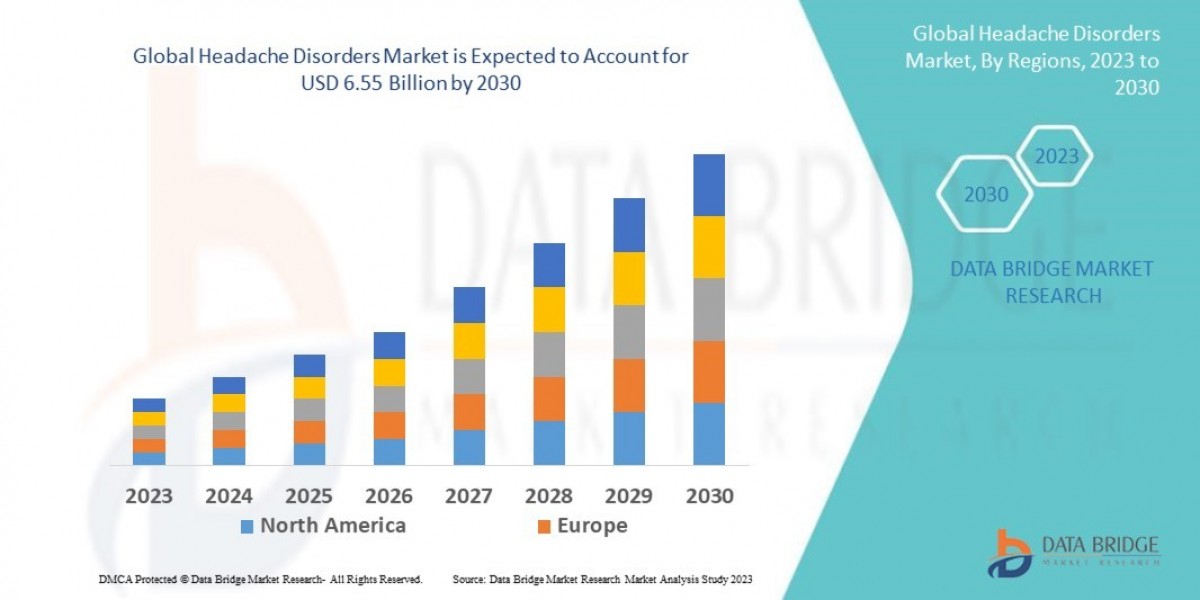

Agricultural insurance Market Size is a type of coverage specifically designed to protect farmers against losses caused by natural disasters, crop failure, livestock disease, or price fluctuations. It offers financial compensation that helps farmers recover and reinvest in their agricultural operations, ultimately stabilizing their income.

Types of Agricultural Insurance

Crop Insurance

This protects against the loss of or damage to crops due to natural calamities like droughts, floods, hailstorms, and pests. Crop insurance can be:Yield-based, which covers loss in yield below a guaranteed threshold.

Weather-based, which compensates based on weather deviations (rainfall, temperature).

Livestock Insurance

This covers loss due to death or disease of animals such as cattle, sheep, and poultry. It’s vital for farmers relying heavily on animal husbandry.Farm Property and Equipment Insurance

This protects against damage or theft of essential farming equipment, machinery, storage units, and other infrastructure.Revenue Insurance

This offers protection against the combined risk of yield loss and price decline, thus ensuring a guaranteed level of revenue.

Importance of Agricultural Insurance

Financial Stability: Helps farmers recover from losses and avoid falling into debt.

Risk Management Tool: Encourages investment in modern farming practices and technology.

Promotes Lending: Banks and financial institutions are more willing to offer loans to insured farmers.

Supports Food Security: Stabilizes agricultural production, ensuring a steady food supply.

Agricultural Insurance in India

In India, the government has introduced several schemes to support farmers, such as:

Pradhan Mantri Fasal Bima Yojana (PMFBY): A flagship crop insurance scheme offering low premium rates and coverage against yield losses due to natural disasters.

Weather-Based Crop Insurance Scheme (WBCIS): Provides coverage based on weather indices instead of actual yield.

Challenges in Agricultural Insurance

Low Penetration: Many small and marginal farmers remain uninsured due to lack of awareness.

Claim Settlement Delays: Slow assessment and disbursement processes affect farmer confidence.

Basis Risk: In weather-based insurance, actual loss might differ from what is estimated using weather data.

The Future of Agricultural Insurance

With the integration of technology, agricultural insurance is becoming more efficient and accessible. Innovations like satellite imagery, drones, and AI-powered analytics are being used to assess damage more accurately and process claims faster. Furthermore, parametric insurance models are gaining traction, offering quicker payouts based on predefined triggers.

Conclusion

Agricultural insurance is not just a financial product—it is a lifeline for millions of farmers who face unpredictable risks every day. By providing protection against natural and Market Size-related uncertainties, it strengthens rural economies, promotes sustainable agriculture, and ensures long-term food security.

As the world faces increasing climate challenges, strengthening agricultural insurance systems will be essential to safeguard the livelihoods of those who feed the planet.

Related Report -

Online Investment Platform Market Size

P&C Insurance Software Market Size

Pension Administration Software Market Size

Wealthtech Solutions Market Size

Telematics Based Auto Insurance Market Size