Takaful: An Islamic Alternative to Conventional Insurance

Introduction

Takaful Market, derived from the Arabic word “kafalah” meaning “guaranteeing each other,” is a cooperative system of Islamic insurance based on principles of mutual assistance, solidarity, and shared responsibility. Rooted in Shariah law, Takaful provides an ethical and interest-free alternative to conventional insurance, which is often viewed as incompatible with Islamic principles due to its reliance on elements like riba (interest), gharar (excessive uncertainty), and maysir (gambling).

In a Takaful arrangement, participants (policyholders) contribute a sum of money into a shared pool or fund, which is used to support one another in times of need, such as loss or damage. The fund is managed by a Takaful operator (company) who oversees the distribution of funds, invests in Shariah-compliant assets, and ensures compliance with Islamic ethics.

Key operational models include:

Mudharabah Model – A profit-sharing model where the operator and participants share the surplus and investment profits.

Wakalah Model – A fee-based model where the operator earns a predefined fee for managing the fund.

Hybrid Model – A combination of Mudharabah and Wakalah, commonly used in practice.

Mutual Guarantee – All participants agree to support each other and contribute to a common fund.

Tabarru (Donation) – Contributions are considered donations to the pool, not premiums with expectations of return.

Risk Sharing – Unlike conventional insurance where risk is transferred to the insurer, Takaful distributes risk among all participants.

Shariah Compliance – All operations, investments, and contracts must adhere to Islamic law.

Family Takaful – Similar to life insurance, it provides long-term savings and protection.

General Takaful – Covers non-life risks such as motor, property, health, and travel insurance.

Micro Takaful – Targeted at low-income populations to provide affordable protection.

Ethical and Transparent – Emphasizes fairness, transparency, and accountability.

Shariah-Compliant Investments – Avoids unethical businesses such as alcohol, gambling, and interest-bearing instruments.

Surplus Sharing – Policyholders may receive a share of the surplus if claims are low and the fund performs well.

Inclusive Growth – Encourages financial inclusion among Muslim communities.

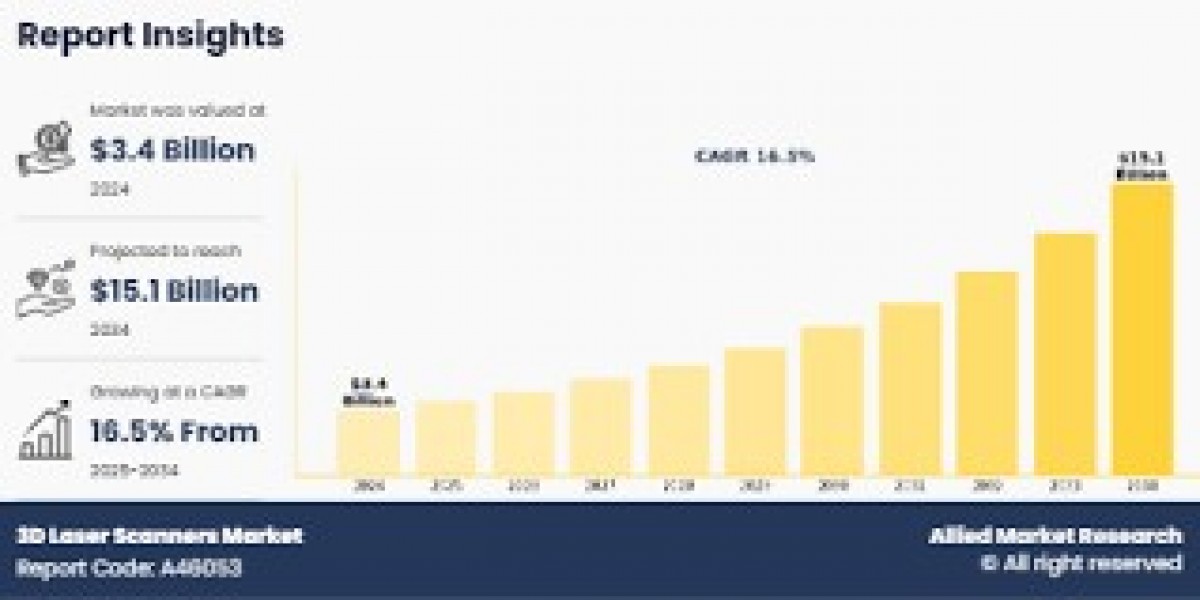

Takaful has seen rapid growth, particularly in Muslim-majority countries such as Malaysia, Saudi Arabia, the UAE, and Indonesia. It is also gaining traction in non-Muslim regions where ethical finance is appealing. The global Takaful market is expected to grow at a compound annual growth rate (CAGR) exceeding 10%, driven by increasing awareness, regulatory support, and demand for Shariah-compliant financial products.

Challenges in TakafulLack of Awareness – Many consumers are unaware of the benefits and operations of Takaful.

Regulatory Differences – Lack of uniform global standards can lead to inconsistencies across markets.

Limited Product Range – Compared to conventional insurers, Takaful providers often offer fewer products.

Operational Efficiency – Some models face challenges in profitability and sustainability.

Takaful presents a robust alternative to conventional insurance, offering risk protection based on the values of mutual help, ethical investment, and religious compliance. As the global financial ecosystem increasingly embraces ethical finance, Takaful stands poised for sustained growth. With further innovation, education, and regulatory support, it has the potential to become a mainstream insurance model, not only for Muslims but for ethically conscious consumers worldwide.