Insurance Third Party Administration: Role, Benefits, and Market Insights

In today’s dynamic and competitive insurance industry, operational efficiency and customer satisfaction are vital. Insurance Third Party Administration (TPA) plays a pivotal role in helping insurers streamline their processes, reduce costs, and enhance service delivery. This article delves into what TPAs are, how they function, their benefits, and current market trends.

What is Insurance Third Party Administration (TPA)?

A Third Party Administrator (TPA) Market in the insurance industry is an independent organization that handles various administrative functions on behalf of an insurance company. These functions typically include claims processing, customer service, premium collection, underwriting support, and sometimes risk management.

TPAs are commonly used in health insurance, but their services also extend to life insurance, general insurance, and employee benefit plans.

Key Functions of TPAs

Claims Processing:

TPAs manage the entire lifecycle of claims—from filing to settlement. They ensure accurate assessment, documentation, and timely processing.Customer Service:

Many TPAs operate 24/7 call centers and digital platforms to provide policyholders with assistance regarding coverage, claims status, and other queries.Network Management:

Especially in health insurance, TPAs maintain networks of hospitals, clinics, and healthcare providers, negotiating rates and facilitating cashless treatment.Data Management and Reporting:

TPAs collect, analyze, and report data related to claims, customer interactions, and operational metrics, enabling insurers to make data-driven decisions.Compliance and Regulatory Support:

TPAs help insurers comply with regulatory requirements, filing necessary reports and maintaining documentation as mandated by local insurance regulators.

Benefits of Using TPAs

Cost Efficiency:

Outsourcing administrative tasks helps insurers reduce overhead costs and focus on core business areas like product development and risk underwriting.Operational Expertise:

TPAs bring in specialized knowledge, technology, and infrastructure that improve service quality and turnaround times.Scalability:

TPAs offer flexible solutions that allow insurers to scale their operations without investing in large internal teams.Enhanced Customer Experience:

With dedicated customer service teams and faster claims processing, TPAs contribute to higher customer satisfaction.Risk Mitigation:

By managing complex claims and regulatory issues, TPAs help insurers minimize legal and financial risks.

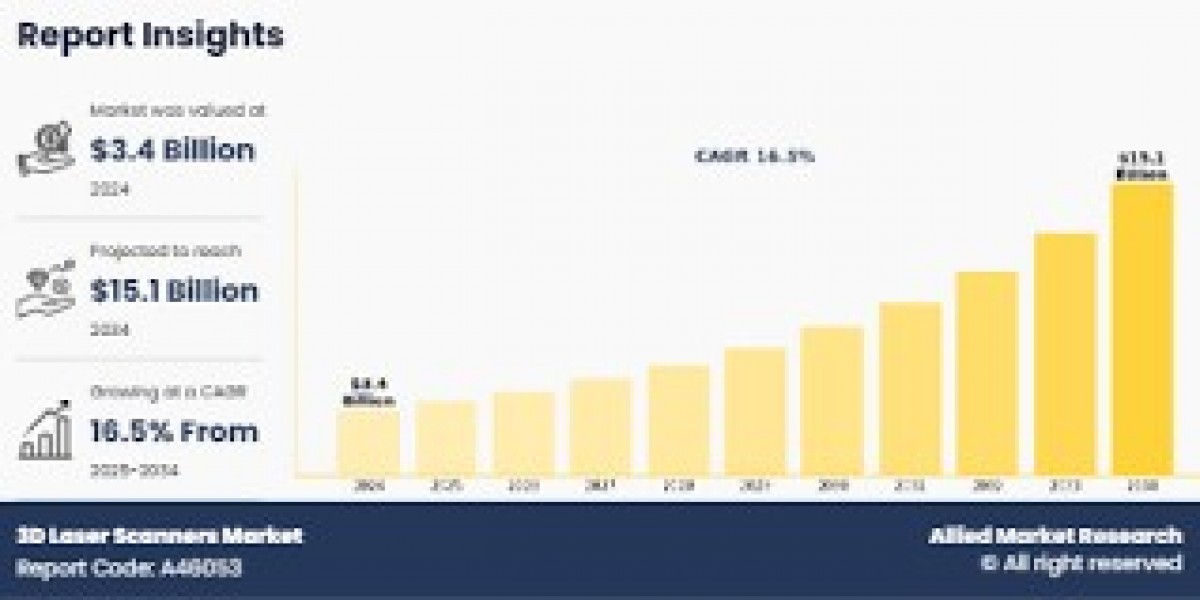

Market Trends and Future Outlook

The global market for Third Party Administrators is growing steadily, driven by the increasing complexity of insurance products and rising demand for cost-effective solutions.

Key trends include:

Digital Transformation:

TPAs are rapidly adopting technologies like AI, automation, and blockchain to enhance efficiency and transparency.Expansion into New Segments:

While TPAs have traditionally served health insurers, they are now offering services in property, casualty, and life insurance domains.Regulatory Focus:

Insurance regulators in many countries are setting clearer frameworks for TPA operations, improving accountability and service standards.Integrated Services:

TPAs are increasingly offering end-to-end solutions, combining claims management, customer support, data analytics, and fraud detection.

Conclusion

Insurance Third Party Administration is a vital component of the modern insurance ecosystem. As the industry evolves, TPAs will continue to play an integral role in enhancing operational efficiency, ensuring compliance, and delivering superior customer experiences. Insurers that leverage TPA services effectively are better positioned to adapt to market changes and meet the growing expectations of policyholders.

Wantstats is a premium platform that provides unparalleled data and statistics across 30000 markets and 100 countries in both B2B and B2C segments. Designed to fit the needs of industry stakeholders, associations, libraries, students and many more looking for statistics.

Cryptocurrency Exchange Platform Market