Alternative Lending: Revolutionizing Access to Credit

Introduction

Alternative lending Market, also known as non-traditional lending, refers to the broad range of loan options available outside conventional banks and financial institutions. With the rapid growth of financial technology (fintech), alternative lending has emerged as a transformative force in the financial services landscape, providing businesses and individuals with faster, more flexible, and often more accessible financing solutions.

Understanding Alternative Lending

Traditional lending typically involves a lengthy approval process, strict credit score requirements, and rigid loan terms. In contrast, alternative lending leverages technology to streamline the borrowing process and expand credit access to underserved segments.

Common forms of alternative lending include:

Peer-to-Peer (P2P) Lending: Individuals lend to other individuals or businesses via online platforms.

Marketplace Lending: Platforms connect borrowers with institutional or retail investors.

Invoice Financing: Businesses borrow against unpaid invoices.

Merchant Cash Advances (MCA): Businesses receive funds in exchange for a portion of future sales.

Crowdfunding: Raising small amounts of money from a large number of people, often through online platforms.

Microloans: Small, short-term loans often used by startups or small enterprises.

Buy Now, Pay Later (BNPL): Allows consumers to split purchases into installments.

Key Drivers of Growth

Several factors have contributed to the rise of alternative lending:

Technological Advancements: AI, big data, and machine learning enable better risk assessment and automated underwriting.

Digitalization: Mobile apps and online platforms provide seamless user experiences.

Changing Consumer Behavior: Younger generations prefer fast, digital-first solutions.

Financial Inclusion: Provides credit access to underserved or credit-invisible populations.

Regulatory Flexibility: Fintechs often operate under lighter regulations than traditional banks.

Benefits of Alternative Lending

Speed: Loans are approved and disbursed much faster than through banks.

Accessibility: Lower barriers for borrowers with poor or limited credit history.

Flexibility: Tailored repayment structures and loan terms.

Innovation: Uses alternative data (e.g., social media, transaction history) to assess creditworthiness.

Challenges and Risks

Regulatory Oversight: Lack of uniform regulation can lead to consumer protection issues.

Higher Interest Rates: Some lenders charge premium rates to offset risk.

Default Risk: Without strong underwriting, default rates can be high.

Data Privacy: Concerns over how customer data is collected and used.

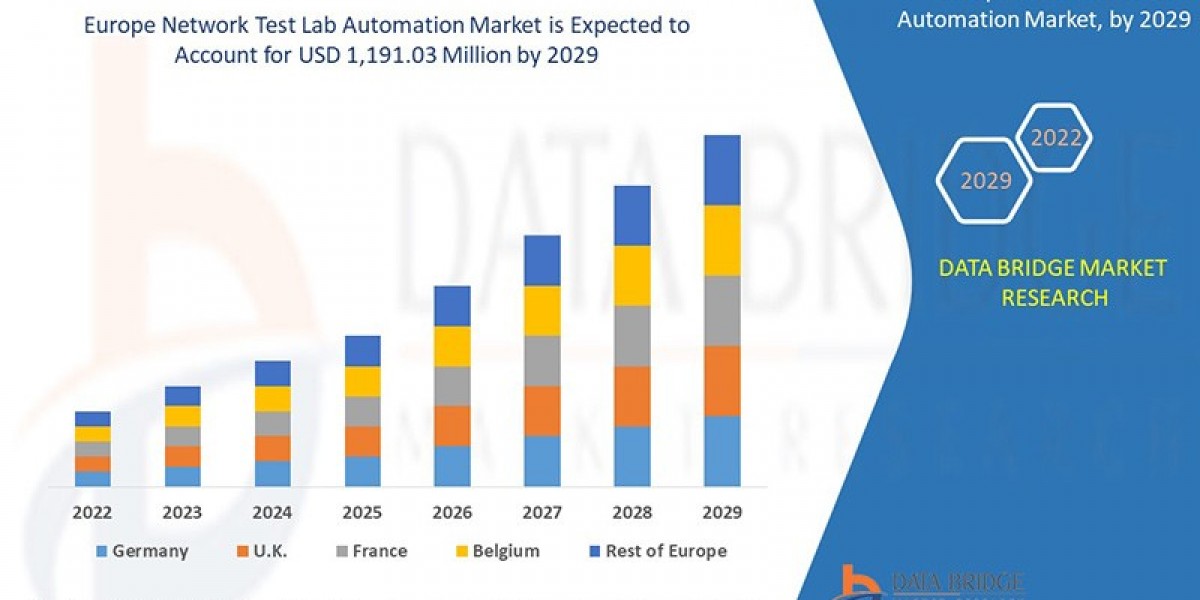

Market Outlook

The global alternative lending market is expected to grow significantly in the coming years, driven by increasing demand for digital financial solutions and the rise of embedded finance. Collaborations between fintech firms and traditional banks are also expected to increase, blending innovation with financial stability.

Conclusion

Alternative lending is reshaping the financial ecosystem by democratizing access to credit and fostering financial innovation. While challenges remain, particularly in terms of regulation and risk management, the continued evolution of technology and consumer expectations positions alternative lending as a vital component of the future of finance.

Wantstats is a premium platform that provides unparalleled data and statistics across 30000 markets and 100 countries in both B2B and B2C segments. Designed to fit the needs of industry stakeholders, associations, libraries, students and many more looking for statistics.

Related Report -

Portfolio Management Software Market

Payment Processing Solutions Market