Aviation Leasing: An In-Depth Overview

Introduction

Aviation leasing has become a vital component of the global aviation industry, enabling airlines to expand and modernize their fleets without bearing the massive upfront costs of purchasing aircraft. With the aviation sector recovering post-pandemic and adapting to evolving travel demands, leasing is playing an increasingly strategic role. This article explores the concept of aviation leasing, its types, benefits, market dynamics, and future outlook.

What is Aviation Leasing?

Aviation leasing Market refers to the practice of renting aircraft from leasing companies rather than purchasing them outright. Airlines lease aircraft for short- or long-term periods to maintain operational flexibility and manage capital more efficiently. The lessee (typically an airline) pays a monthly rental fee to the lessor (leasing company) in exchange for the use of the aircraft.

Types of Aviation Leasing

Operating Lease

Involves renting an aircraft for a short to medium term, typically less than the asset's useful life.

The lessor retains ownership and the aircraft is returned at the end of the lease term.

Popular for fleet flexibility and minimizing balance sheet obligations.

Finance Lease (or Capital Lease)

A long-term lease, often lasting the aircraft’s entire useful life.

The lessee assumes most of the ownership risks and benefits, and may purchase the aircraft at the end of the lease.

Recorded as an asset and liability on the lessee's balance sheet.

Wet Lease

The lessor provides the aircraft, crew, maintenance, and insurance (ACMI).

Used by airlines for short-term capacity needs or to test new routes.

Dry Lease

Only the aircraft is provided; the lessee handles crew, maintenance, and insurance.

More common for established airlines with operational infrastructure.

Benefits of Aviation Leasing

Cost Efficiency: Reduces the need for large upfront capital investments.

Fleet Flexibility: Allows airlines to scale operations quickly based on demand.

Risk Mitigation: Avoids long-term commitment in a volatile industry.

Tax and Accounting Advantages: Operating leases can provide off-balance-sheet financing benefits.

Access to Modern Aircraft: Facilitates fleet modernization without long procurement processes.

Market Trends and Dynamics

Dominance of Lessors: Over 50% of the world’s commercial aircraft are now owned by lessors.

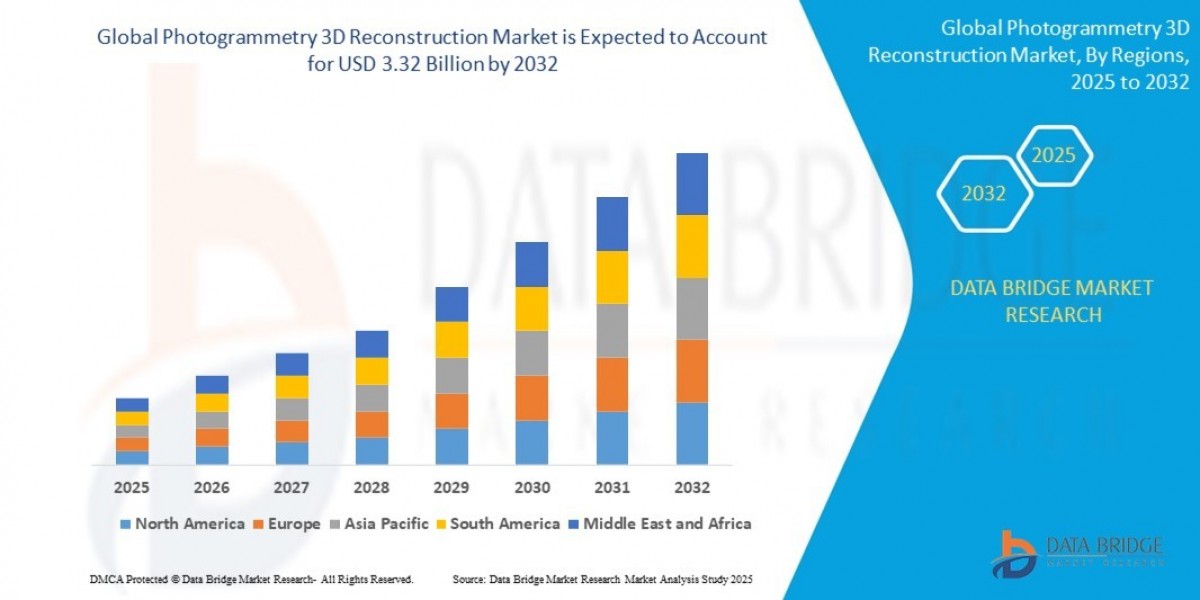

Growth of Emerging Markets: Asia-Pacific and Middle East are major growth hubs for aviation leasing due to increasing passenger traffic.

Sustainability Focus: Lessors are investing in fuel-efficient, environmentally friendly aircraft to meet evolving regulations and demand.

Consolidation and Competition: The sector is witnessing mergers and increased competition among major players like AerCap, Avolon, and SMBC Aviation Capital.

Digitalization: Leasing companies are leveraging AI and data analytics for asset management, maintenance forecasting, and valuation.

Challenges in Aviation Leasing

Economic Volatility: Geopolitical events, pandemics, and fuel price fluctuations can affect demand and lease rates.

Aircraft Depreciation: Managing residual value risk is crucial for lessors.

Regulatory Compliance: Varying aviation and tax regulations across jurisdictions add complexity.

Lessee Credit Risk: Financial instability of airlines can lead to defaults and repossession issues.

Future Outlook

The aviation leasing market is poised for robust growth, driven by the need for operational agility, growing air travel demand, and the transition to next-generation aircraft. ESG (Environmental, Social, Governance) criteria will also shape future leasing decisions, with increased investments in green technologies and sustainable practices.

Conclusion

Aviation leasing offers a practical and strategic solution for airlines navigating a capital-intensive and dynamic environment. As the industry evolves, leasing will continue to provide the financial flexibility and technological agility necessary for airlines to thrive in a competitive global market. Whether through traditional operating leases or innovative financing structures, aviation leasing remains a cornerstone of modern air travel operations.

Wantstats is a premium platform that provides unparalleled data and statistics across 30000 markets and 100 countries in both B2B and B2C segments. Designed to fit the needs of industry stakeholders, associations, libraries, students and many more looking for statistics.

Related Report -

E-Commerce Buy Now Pay Later Market

Equity Management Software Market

Factory and Warehouse Insurance Market