Corporate Lending: An Overview of Financing for Businesses

Corporate lending Market refers to the provision of loans and credit facilities by financial institutions to companies and corporations. Unlike retail lending, which caters to individual consumers, corporate lending deals with larger loan amounts, complex structures, and tailored financial solutions to meet the diverse needs of businesses across various industries. It plays a crucial role in supporting corporate growth, funding expansion plans, managing working capital, and facilitating mergers and acquisitions.

Key Components of Corporate Lending

Types of Corporate Loans:

Term Loans: These are traditional loans with fixed tenures and repayment schedules. They are used for purchasing assets, machinery, or for long-term capital investment.

Working Capital Loans: Offered to finance daily operational needs like inventory, payroll, and accounts payable.

Revolving Credit Facilities: Allow businesses to borrow, repay, and re-borrow up to a certain limit, providing flexibility in cash flow management.

Bridge Loans: Short-term loans used to cover temporary funding gaps until permanent financing is arranged.

Syndicated Loans: Large-scale loans provided by a group of lenders to spread the risk, typically used for big infrastructure or M&A projects.

Lending Institutions:

Commercial banks

Non-banking financial companies (NBFCs)

Development banks

Private equity and venture debt firms

Process of Corporate Lending

The corporate lending process involves several critical steps:

Loan Application and Documentation: Includes detailed financial statements, business plans, and credit history.

Credit Appraisal: Lenders evaluate the borrower’s financial health, cash flow, business model, and repayment capacity.

Loan Structuring and Pricing: Determining loan tenure, interest rate (fixed or floating), collateral requirements, and covenants.

Disbursement and Monitoring: Funds are disbursed based on agreed terms, and lenders continuously monitor performance and compliance.

Risk Management in Corporate Lending

Corporate lending carries inherent risks, which banks mitigate through:

Credit Rating and Scoring

Collateral and Guarantees

Loan Covenants (restrictive clauses)

Regular Monitoring and Auditing

Lenders also consider external factors such as economic cycles, industry trends, and regulatory environment.

Benefits of Corporate Lending

Growth Enablement: Provides the capital needed for expansion, new ventures, or acquisitions.

Liquidity Management: Helps in managing cash flow gaps and ensuring business continuity.

Tax Benefits: Interest on loans is often tax-deductible, lowering the overall cost of borrowing.

Customized Financial Solutions: Tailored to the company’s size, industry, and strategic objectives.

Challenges in Corporate Lending

Credit Risk and Defaults: Especially during economic downturns or industry-specific slowdowns.

Regulatory Compliance: Lenders must adhere to strict banking and financial regulations.

Market Volatility: Fluctuating interest rates, currency exchange rates, and commodity prices can affect repayment.

Documentation and Due Diligence: The process can be time-consuming and requires in-depth analysis.

Future Outlook

With increasing globalization, digitization, and evolving business models, corporate lending is also undergoing transformation. Innovations like fintech lending platforms, blockchain-based loan processing, and AI-driven credit scoring are making the lending process faster, more accurate, and customer-centric.

Furthermore, ESG (Environmental, Social, and Governance) factors are becoming critical in credit evaluation as companies and lenders aim for sustainable and responsible growth.

Conclusion

Corporate lending remains a fundamental component of the financial ecosystem, enabling businesses to thrive and economies to grow. While it involves a complex interplay of risks and regulations, the strategic deployment of capital through corporate lending continues to drive innovation, competitiveness, and economic development. As technology and market dynamics evolve, corporate lending is poised to become more agile, inclusive, and efficient.

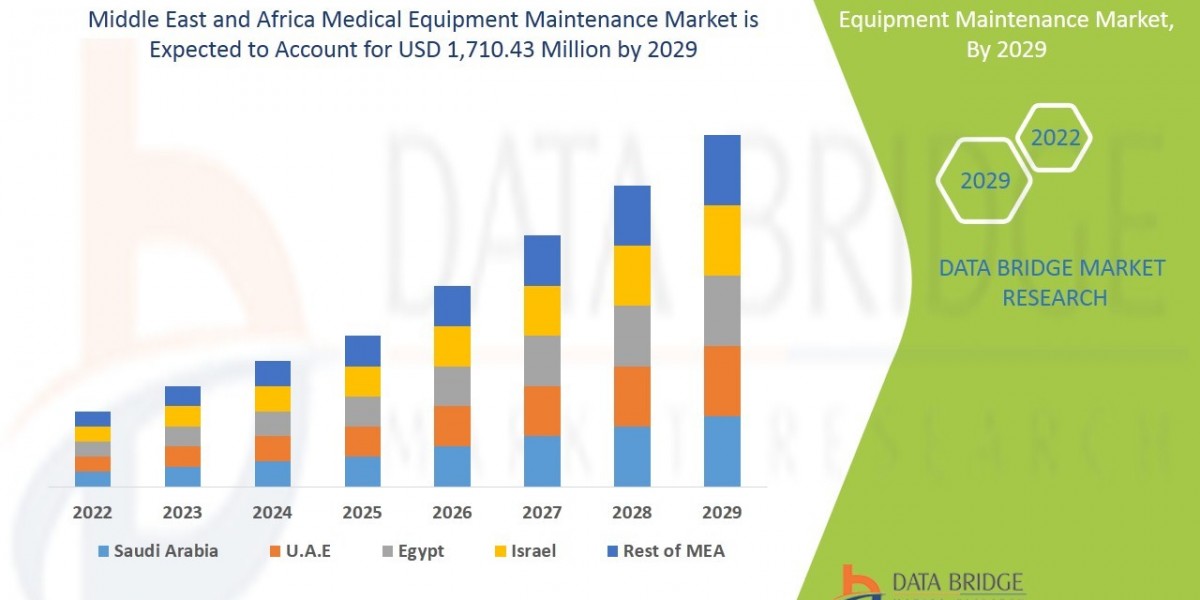

Wantstats is a premium platform that provides unparalleled data and statistics across 30000 markets and 100 countries in both B2B and B2C segments. Designed to fit the needs of industry stakeholders, associations, libraries, students and many more looking for statistics.

Related Report -