Telematics-Based Auto Insurance: Revolutionizing the Future of Car Coverage

In an age of digital transformation, traditional auto insurance is undergoing a dramatic shift. One of the most significant innovations in this domain is telematics-based auto insurance, which leverages real-time driving data to determine premiums. This model not only personalizes insurance pricing but also encourages safer driving habits and increases transparency between insurers and policyholders.

What is Telematics-Based Auto Insurance?

Telematics-based auto insurance Market, often referred to as usage-based insurance (UBI), involves the use of technology to monitor driving behavior. This is typically done through a device installed in the vehicle or via a mobile app. These systems collect various data points, such as:

Speed and acceleration

Braking patterns

Cornering behavior

Mileage

Time of day the car is driven

GPS location data

Insurers analyze this data to assess risk more accurately and calculate personalized premiums based on actual driving habits rather than generalized demographic statistics.

Types of Telematics Insurance Models

Telematics-based insurance comes in several models, each suited to different driver behaviors and needs:

Pay-As-You-Drive (PAYD)

This model charges drivers based on the number of miles driven. The less you drive, the lower your premium.Pay-How-You-Drive (PHYD)

This model factors in how well you drive. Safe driving habits like smooth acceleration and braking, obeying speed limits, and avoiding late-night driving can lead to premium discounts.Manage-How-You-Drive (MHYD)

A more interactive model where insurers provide feedback, tips, or scorecards to help drivers improve behavior in real time.

Benefits of Telematics Insurance

Personalized Premiums

Drivers are no longer penalized based on age or gender; instead, premiums reflect real-world behavior.Encouragement of Safe Driving

The awareness of being monitored often leads drivers to adopt safer habits, which can reduce accident rates.Increased Transparency

Telematics builds trust by offering a clear explanation for premium adjustments.Faster Claims Processing

In the event of an accident, telematics data can help reconstruct the incident, potentially speeding up claims investigations.Theft Recovery

GPS-enabled devices can assist in tracking and recovering stolen vehicles.

Challenges and Concerns

While telematics-based auto insurance offers numerous advantages, it also raises certain concerns:

Privacy Issues

Constant tracking of location and driving habits may feel intrusive to some users. Ensuring data protection and transparency in usage is critical.Device Costs and Compatibility

The cost of installing a telematics device or relying on smartphone sensors can be a barrier for some consumers.Bias in Algorithms

If not properly designed, algorithms may still introduce biases or penalize drivers unfairly based on contextual driving conditions.

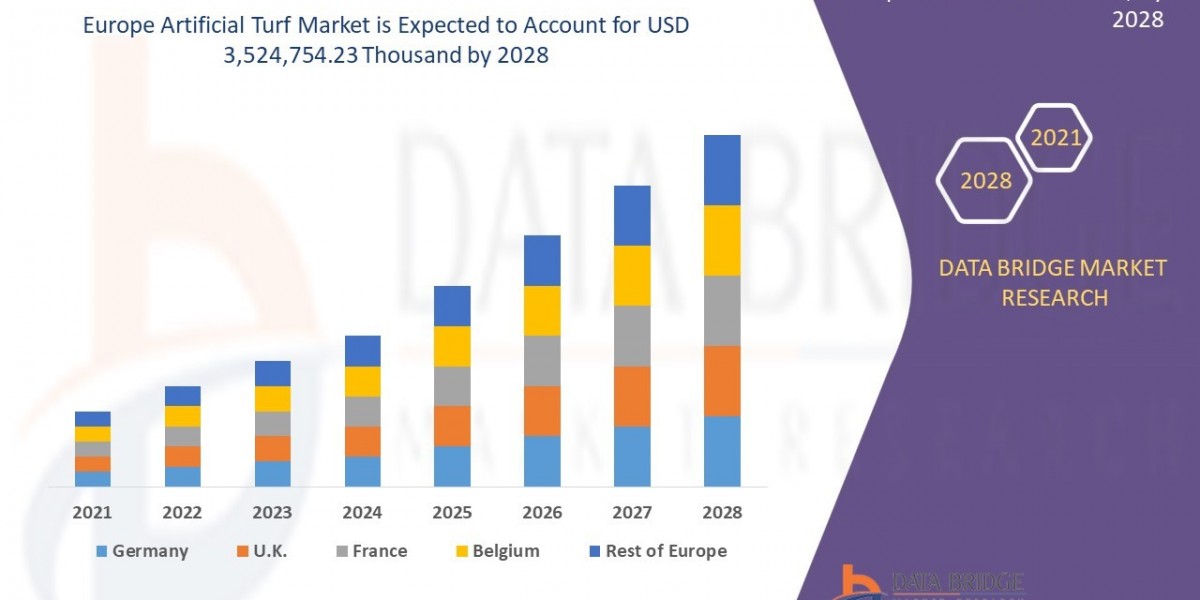

Global Adoption and Market Outlook

The global telematics insurance market is expanding rapidly. According to industry reports, it is projected to exceed $200 billion by 2032, driven by:

Increased smartphone and IoT adoption

Government regulations encouraging safe driving

Rising interest from younger, tech-savvy drivers

Insurance companies’ focus on profitability and customer retention

Regions like North America and Europe have led adoption, but Asia-Pacific is witnessing the fastest growth due to rising vehicle ownership and digital infrastructure improvements.

Future of Telematics in Auto Insurance

As connected car technology evolves and 5G becomes more widespread, telematics will become even more sophisticated. Future advancements could include:

Integration with autonomous vehicles

Real-time driver coaching

Dynamic pricing models based on traffic and weather

Vehicle-to-vehicle (V2V) communication data integration

Conclusion

Telematics-based auto insurance is more than a passing trend—it's a fundamental shift in how auto insurance is priced, managed, and experienced. By aligning insurance premiums with actual driving behavior, this model promotes fairness, safety, and efficiency. As technology advances, we can expect telematics to become the standard, offering smarter, safer, and more cost-effective insurance solutions for all.

Related Report -