Executive Summary Liquidity Asset Liability Management Solutions Market

The global liquidity asset liability management solutions market size was valued at USD 629.13 billion in 2024 and is expected to reach USD 869.65 billion by 2032, at a CAGR of 4.13% during the forecast period

The Liquidity Asset Liability Management Solutions Market report has been designed in such a way that it proves to be the most appropriate to the business needs. Moreover, this market report gives idea to clients about the market drivers and restraints with the help of SWOT analysis and also provides all the CAGR projections for the historic year, base year and forecast period. This Liquidity Asset Liability Management Solutions Market study also evaluates the market status, market share, growth rate, future trends, market drivers, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The Liquidity Asset Liability Management Solutions Market business report endows with an exhaustive overview of product specification, technology, product type and production analysis considering major factors such as revenue, costing, and gross margin. This market report also provides the list of leading competitors along with the strategic insights and analysis of the key factors influencing the industry. Liquidity Asset Liability Management Solutions Market research study lends a hand to the purchaser in comprehending the various drivers and restraints with their effects on the market during the forecast period. The Liquidity Asset Liability Management Solutions Market industry report comprises of primary, secondary and advanced information about the global market with respect to status, trends, size, share, growth, and segments in the forecasted

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Liquidity Asset Liability Management Solutions Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-liquidity-asset-liability-management-solutions-market

Liquidity Asset Liability Management Solutions Market Overview

**Segments**

- **By Component**: The market can be segmented by component into software and services. The software segment is expected to dominate the market due to the increasing demand for advanced technological solutions that can efficiently manage liquidity, assets, and liabilities within organizations. On the other hand, the services segment is also anticipated to grow as more organizations seek professional assistance in implementing and managing liquidity asset liability management solutions.

- **By Deployment Mode**: The market is categorized based on deployment mode into on-premises and cloud. The cloud deployment mode is expected to witness significant growth as organizations increasingly opt for flexible and cost-effective cloud-based solutions. However, on-premises deployment continues to be relevant for organizations that prioritize data security and have specific regulatory requirements.

- **By Organization Size**: This segment includes small and medium-sized enterprises (SMEs) and large enterprises. Large enterprises are expected to hold a larger market share as they have the resources to invest in comprehensive liquidity asset liability management solutions. However, SMEs are increasingly recognizing the importance of such solutions to manage their financial risks and optimize liquidity.

**Market Players**

- **IBM Corporation**: IBM offers a range of liquidity asset liability management solutions that leverage cutting-edge technologies such as artificial intelligence and machine learning to provide real-time insights and forecasting capabilities.

- **Oracle Corporation**: Oracle is a key player in the market, providing integrated asset liability management solutions that help organizations optimize their balance sheets and manage liquidity effectively.

- **Sungard Availability Services**: Sungard offers robust liquidity asset liability management solutions tailored to meet the specific needs of financial institutions and corporate treasuries, focusing on risk management and compliance.

- **Finastra**: Finastra provides comprehensive asset liability management solutions that enable organizations to manage their liquidity effectively, enhance decision-making processes, and adapt to changing market conditions.

In conclusion, the global liquidity asset liability management solutions market is witnessing significant growth driven by the increasing focus on liquidity risk management, regulatory compliance, and financial optimization. Organizations are increasingly adopting advanced technological solutions to manage their liquidity, assets, and liabilities efficiently. Key market players are innovating their offerings to meet the evolving needs of organizations across various industries, providing a competitive landscape in the market.

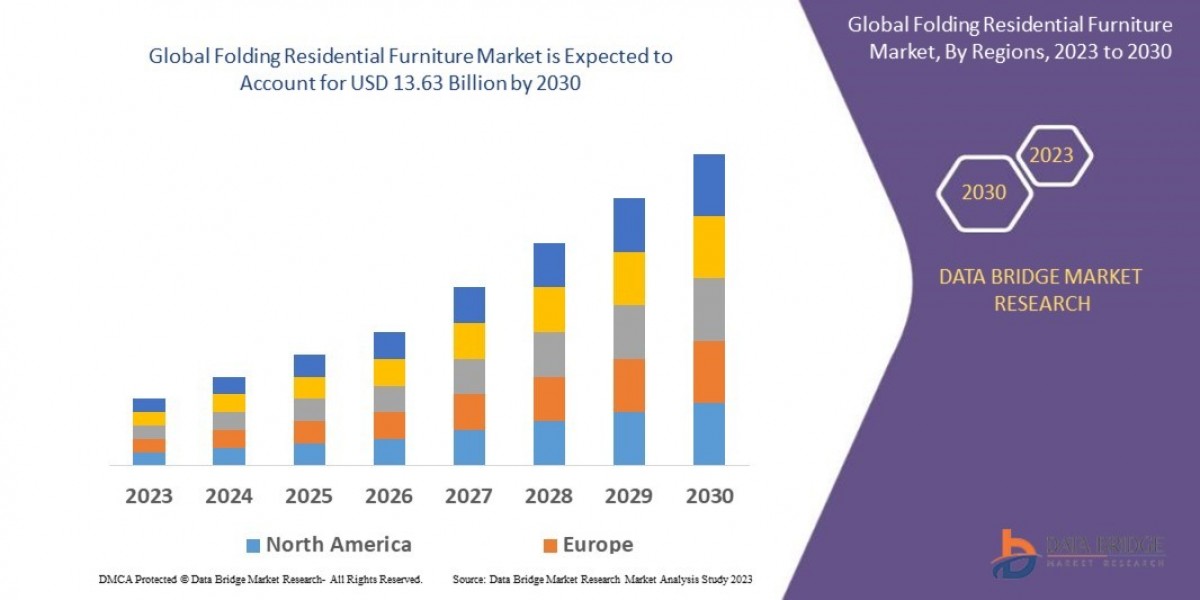

In addition to the segments mentioned earlier, another crucial aspect to consider in the liquidity asset liability management solutions market is the geographical segmentation. The market can be analyzed based on regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Each region has its unique characteristics and drivers that impact the adoption of liquidity asset liability management solutions.

North America, particularly the United States, is a significant contributor to the market growth due to the presence of established financial institutions and regulatory frameworks that emphasize risk management practices. The region's adoption of advanced technologies and the demand for real-time analytics further drive the need for robust liquidity asset liability management solutions.

In Europe, stringent regulatory requirements, especially in the banking sector, are propelling the adoption of liquidity asset liability management solutions. Countries like the United Kingdom, Germany, and France are focusing on enhancing financial stability through effective liquidity risk management, creating opportunities for market players offering comprehensive solutions.

The Asia Pacific region, led by countries such as China, Japan, and India, is experiencing rapid economic growth and digital transformation, leading to an increased demand for liquidity asset liability management solutions. The region's expanding financial services sector, coupled with a growing emphasis on risk management practices, is driving the adoption of advanced solutions to manage liquidity effectively.

Latin America and the Middle East & Africa regions are also witnessing growth in the adoption of liquidity asset liability management solutions as organizations aim to optimize their financial resources, comply with regulatory requirements, and mitigate potential risks.

Furthermore, the market dynamics are influenced by factors such as market trends, competitive landscape, technological advancements, and regulatory environment. Emerging trends such as the integration of artificial intelligence, blockchain, and predictive analytics in liquidity asset liability management solutions are reshaping the market landscape. Market players are focusing on strategic partnerships, mergers, and acquisitions to enhance their product offerings and expand their market presence.

Overall, the liquidity asset liability management solutions market is poised for continued growth as organizations across various industries recognize the importance of effective liquidity risk management and financial optimization. The market players mentioned earlier, along with other key stakeholders, are expected to drive innovation and cater to the evolving needs of organizations in a dynamic business environment.The global liquidity asset liability management solutions market is undergoing significant transformation driven by the increasing complexity of financial operations, stringent regulatory requirements, and the growing need for real-time insights and analytics to manage liquidity risks effectively. The shift towards advanced technological solutions such as artificial intelligence, machine learning, and cloud-based deployments is reshaping the market landscape and offering new opportunities for market players to innovate and cater to the evolving needs of organizations.

One key trend influencing the market is the integration of advanced technologies such as artificial intelligence and blockchain in liquidity asset liability management solutions. These technologies enable organizations to enhance their forecasting capabilities, automate manual processes, and improve decision-making processes by providing real-time insights into liquidity positions and potential risks. Market players are investing in research and development to leverage these technologies and offer more sophisticated solutions that address the complex requirements of organizations across industries.

Another significant trend is the increasing focus on regulatory compliance and risk management practices, especially in regions like North America and Europe where stringent regulations govern financial institutions and corporate treasuries. Organizations are looking for comprehensive solutions that not only help them comply with regulatory requirements but also optimize their balance sheets, manage liquidity efficiently, and mitigate potential risks arising from market fluctuations or operational disruptions.

Furthermore, the competitive landscape in the liquidity asset liability management solutions market is characterized by strategic partnerships, mergers, and acquisitions aimed at expanding market presence, enhancing product offerings, and gaining a competitive edge. Market players such as IBM, Oracle, Sungard Availability Services, and Finastra are continuously innovating their solutions to meet the diverse needs of organizations and stay ahead of industry trends.

As organizations across industries continue to recognize the importance of effective liquidity risk management and financial optimization, the demand for advanced liquidity asset liability management solutions is expected to grow. Market players will need to adapt to changing market dynamics, technological advancements, and regulatory requirements to stay relevant and capitalize on the opportunities presented by the evolving market landscape. Overall, the liquidity asset liability management solutions market is poised for sustained growth as organizations prioritize financial stability, regulatory compliance, and strategic decision-making processes in an increasingly complex business environment.

The Liquidity Asset Liability Management Solutions Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-liquidity-asset-liability-management-solutions-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key Influence of this Liquidity Asset Liability Management Solutions Market:

- Comprehensive assessment of all opportunities and risk in this Liquidity Asset Liability Management Solutions Market

- This Liquidity Asset Liability Management Solutions Marketrecent innovations and major events

- Detailed study of business strategies for growth of the this Liquidity Asset Liability Management Solutions Market leading players

- Conclusive study about the growth plot of the Market for forthcoming years

- In-depth understanding of this Liquidity Asset Liability Management Solutions Market particular drivers, constraints and major micro markets

- Favorable impression inside vital technological and market latest trends striking this Liquidity Asset Liability Management Solutions Market

- To provide historical and forecast revenue of the Liquidity Asset Liability Management Solutions Marketsegments and sub-segments with respect to four main geographies and their countries- North America, Europe, Asia, and Rest of the World (ROW)

- To provide country level analysis of the Liquidity Asset Liability Management Solutions Market t with respect to the current market size and future prospective

Browse More Reports:

Global Gaucher Disease Market

Global Herbal Supplements Market

Global Moisture Wicking Socks Market

Global Pre-Workout Beverages Market

Global Electric Orthopedic Screwdriver Market

Global API Intermediates Market

Global Phthalic Anhydride Market

Global Wearable Sensors Market

Global Quantum Computing Market

North America Pulse Protein Market

Global App Analytics Market

Global Wafer Solar Cell Market

Global Microporous Insulation Market

Global Diqat Dibromide Market

Global Smart Exoskeleton Market

Global Munition Market

Global Chickpea Protein Market

Global 2K Protective Coatings Market

Global Supply Chain Analytics Market

Global Fluoroscopy - C Arms Market

Global Elastomeric Foam Insulation Market

North America Canned Meat Market

South Africa and Europe Point-of-Care-Testing (POCT) Market

Global Tooth Mounted Sensor Market

North America Cyclodextrins in Pharma Market

Asia-Pacific Anthrax Treatment Market

Asia-Pacific Biostimulants Market

Global Portable E Tanks Market

South America Biostimulants Market

Europe Magnesium Alloys Market

Asia-Pacific Parental Control Software Market

Global Anti-Infective Drugs Market

Global Remote Patient Care Market

Global Marine Fuel Injection Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com"

Liquidity Asset Liability Management Solutions Market, Liquidity Asset Liability Management Solutions Market Trends, Liquidity Asset Liability Management Solutions Market Growth, Liquidity Asset Liability Management Solutions Market Demand, Liquidity Asset Liability Management Solutions Market Size, Liquidity Asset Liability Management Solutions Market Scope, Liquidity Asset Liability Management Solutions Market Insights, Liquidity Asset Liability Management Solutions Market Analysis