Dielectric Resonator Antenna (DRA): Powering the Future of High-Frequency Wireless Communication

As wireless systems evolve toward higher frequencies and broader bandwidths—especially in the era of 5G, 6G, and IoT—antenna technologies must keep pace. Among the promising solutions rising to meet these challenges is the Dielectric Resonator Antenna (DRA). Leveraging low-loss dielectric materials and compact geometries, DRAs are redefining how engineers design high-performance, miniaturized antennas for emerging communication systems.

What Is a Dielectric Resonator Antenna?

A Dielectric Resonator Antenna (DRA) is a type of antenna that uses a ceramic dielectric resonator instead of metallic elements to radiate electromagnetic waves. First introduced in the early 1980s, DRAs have become increasingly popular in recent decades due to their ability to operate efficiently at microwave and millimeter-wave frequencies.

Key Features:

Low conduction losses (as they do not rely on metallic currents)

High radiation efficiency at high frequencies

Compact size, making them ideal for space-constrained applications

Wide bandwidth potential depending on the resonator geometry

Market Overview

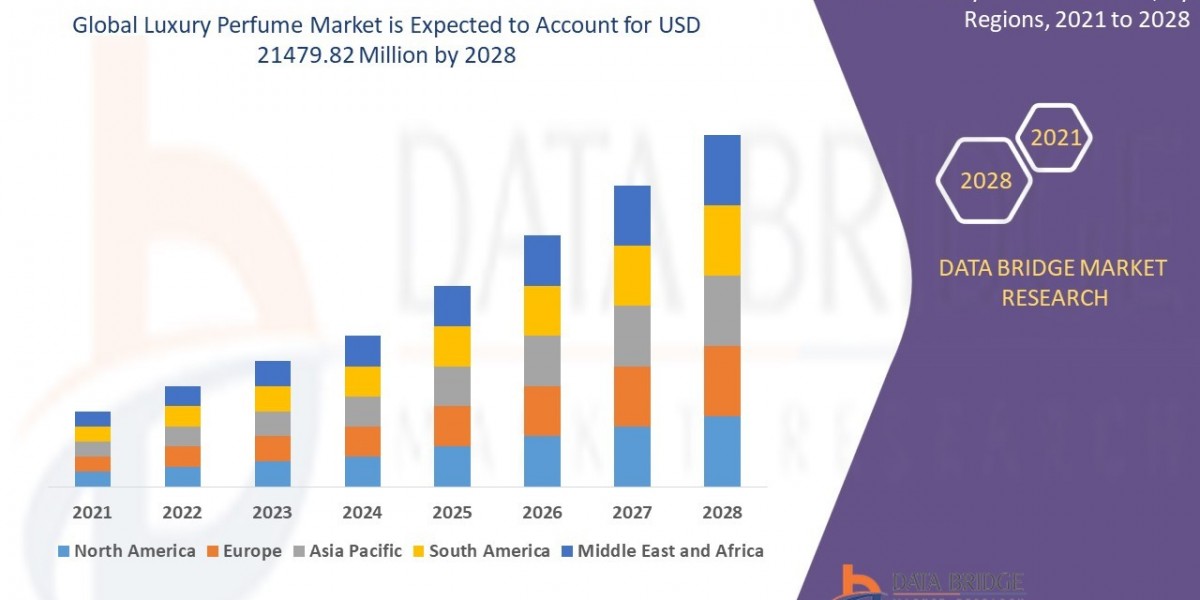

The global Dielectric Resonator Antenna (DRA) market is gaining traction due to the growing demand for high-frequency and high-efficiency antenna systems across industries. The market was valued at approximately USD 240 million in 2023 and is projected to reach USD 580 million by 2032, growing at a CAGR of around 10.2% during the forecast period (2024–2032).

Key Market Drivers

1. Proliferation of 5G and Upcoming 6G Networks

DRA technology supports mmWave bands (e.g., 24 GHz, 28 GHz, 39 GHz) used in 5G infrastructure. Its high radiation efficiency and compact design are ideal for base stations, beamforming arrays, and user terminals.

2. Miniaturization and Integration

DRA structures can be embedded into circuit boards and packaged alongside other components, enabling System-in-Package (SiP) designs and conformal antennas in devices such as wearables, drones, and satellites.

3. Military and Aerospace Applications

DRAs are widely used in radars, missile guidance systems, and airborne communication systems due to their robustness in harsh environments and minimal metal dependency (reducing electromagnetic interference).

4. Growing IoT and Automotive Radar Adoption

The expansion of connected vehicles, smart homes, and industrial IoT demands antennas that are not only compact but also highly reliable at GHz-range frequencies—an ideal use case for DRAs.

Key Applications

5G/6G Base Stations and Antenna Arrays

Millimeter-Wave Wireless Backhaul

Automotive Radar (24/60/77 GHz)

Military Radar and Satellite Communication

Medical Imaging (Microwave Tomography)

Point-to-Point Communication Links

Wearable and Biomedical Devices

Advantages of DRAs Over Traditional Antennas

| Feature | Dielectric Resonator Antenna | Traditional Metallic Antenna |

|---|---|---|

| Efficiency at mmWave | High | Moderate to low |

| Size | Compact | Bulky at low frequencies |

| Bandwidth | Moderate to Wide | Typically Narrow |

| Fabrication Complexity | Moderate | Low to Moderate |

| Conformal Design | Feasible | Difficult |

Design Trends and Innovations

Multi-band and Dual-Polarized DRAs: Supporting MIMO systems for high data throughput.

Hybrid DRAs: Combining dielectric and metallic elements for performance tuning.

3D-Printed DRAs: Offering cost-effective prototyping and customizable shapes.

Substrate-Integrated DRAs: Enabling seamless integration into multilayer PCBs.

Challenges in Adoption

Manufacturing Complexity: High-frequency DRAs require precision ceramic fabrication.

Cost of Dielectric Materials: High-permittivity ceramics can be expensive.

Design Complexity: Tuning dielectric geometries for optimal bandwidth and gain can be difficult.

Limited Commercial Off-the-Shelf Options: Most DRA designs are custom-made for specific applications.

Regional Market Insights

Asia-Pacific is leading the market with rapid 5G rollout in countries like China, South Korea, and Japan, and significant investment in mmWave technologies.

North America and Europe are investing in military radar, advanced communication systems, and 6G R&D, making them strong contributors to DRA adoption.

Emerging markets in the Middle East and Southeast Asia are deploying DRAs in telecom infrastructure and public safety systems.

Key Players

CST Global

Johanson Technology

Murata Manufacturing

Anaren (TTM Technologies)

Knowles Precision Devices

Kyocera AVX

Fractus Antennas

Yageo Corporation

Antenova Ltd.

These companies are actively working on DRA-based modules, especially for 5G infrastructure, satellite terminals, and advanced automotive radar systems.

Future Outlook

The future of DRAs lies in mass-market integration, multi-functional array systems, and conformal/3D antennas. With 6G targeting terahertz (THz) frequencies, the dielectric antenna domain is poised for explosive growth as traditional metallic antennas struggle to deliver performance at such scales.

Emerging developments include:

AI-optimized antenna geometry design

Integration with MEMS and photonics

Low-cost ceramic material innovations

Conclusion

Dielectric Resonator Antennas are unlocking new frontiers in antenna engineering, especially where performance, size, and efficiency at high frequencies matter. From powering the next generation of wireless networks to enabling smarter defense systems, DRAs are shaping the future of wireless connectivity.

As industries push the limits of data speed, latency, and device miniaturization, DRAs will become a foundational technology across telecom, defense, automotive, and beyond.

Read More

| US IPS Display Market |

| US IR Spectroscopy Market |

| US Vector Network Analyzer Market |

| US VRF System Market |

| US Smart Thermostat Market |

| US Current Sensor Market |