Business Income Insurance: Protecting Your Profits When Operations Stop

In the dynamic world of business, uncertainty is a constant. From natural disasters to equipment failures or unforeseen disruptions like fire or theft, businesses face a multitude of risks that can halt operations. While property insurance may cover the physical damage, what about the income lost during the downtime? That’s where Business Income Insurance steps in.

What is Business Income Insurance?

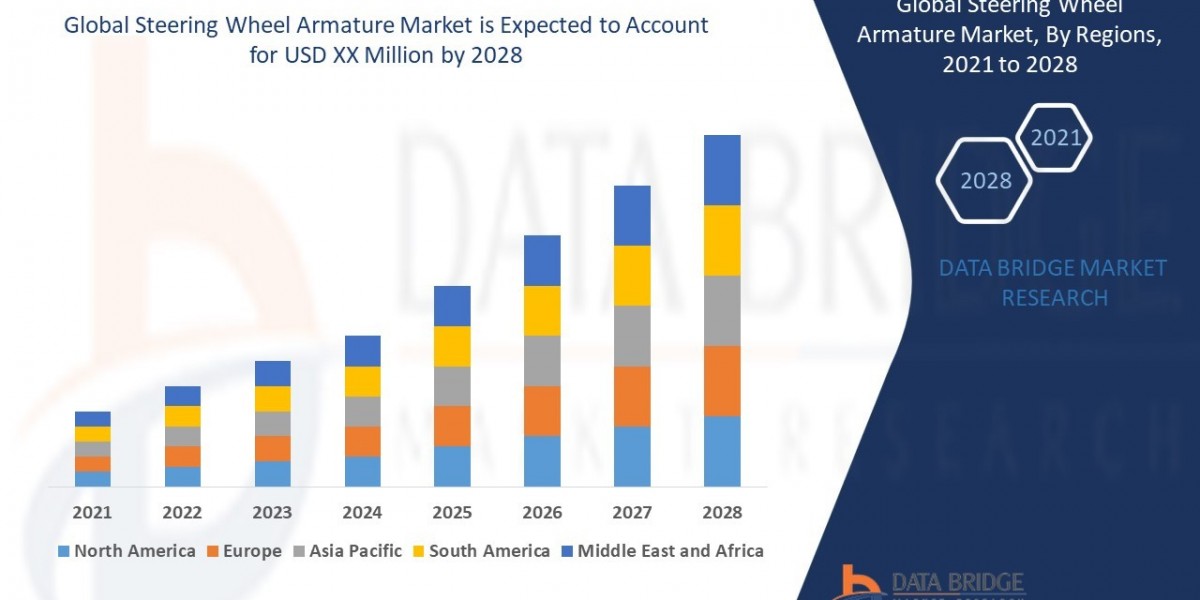

Business Income Insurance, also known as Business Interruption Insurance Market, is a type of commercial insurance that helps businesses recover lost income when operations are suspended due to a covered peril. It ensures that the company can continue to meet financial obligations such as payroll, rent, and utility bills—even when the business isn’t generating revenue.

Why Business Income Insurance Matters

Imagine a scenario: A fire damages your retail store, forcing you to close for repairs. Even though your property insurance covers the cost of rebuilding, you still lose weeks or even months of income. Business income insurance helps replace that lost revenue, allowing you to keep your business afloat.

Without this protection, many small and medium-sized businesses (SMBs) struggle to recover from extended downtime. According to FEMA, nearly 40% of small businesses never reopen after a disaster—a figure that highlights the importance of income protection.

What Does Business Income Insurance Cover?

Business income insurance typically covers:

Lost Net Income: Based on historical financial records.

Fixed Operating Expenses: Such as rent, utilities, and loan payments.

Payroll: To retain employees during the interruption.

Temporary Relocation Costs: If you move to a new location temporarily.

Extra Expenses: That help minimize the business interruption.

Coverage is generally triggered by physical damage to property caused by covered perils, such as:

Fire

Vandalism

Windstorms

Lightning

Theft

Note: Business income insurance does not cover damage itself—that’s the role of property insurance. It also doesn’t cover pandemics, earthquakes, floods (unless added), or undocumented income.

Types of Business Income Coverage

Standard Business Income Coverage: Replaces lost income for the duration of the restoration period.

Business Income with Extra Expense: Includes additional costs incurred to speed up recovery (e.g., renting temporary space or equipment).

Contingent Business Interruption: Covers income loss due to supply chain disruptions (e.g., supplier’s factory burns down).

Extended Business Income Coverage: Continues to pay lost income even after operations resume, until the business regains previous income levels (up to a limit).

How Much Coverage Do You Need?

Calculating the right amount of coverage involves analyzing:

Historical income statements and balance sheets

Forecasted revenues

Fixed and variable operating expenses

Potential recovery period

An insurance advisor can help assess your business risks and determine an appropriate coverage limit and indemnity period (typically 30–360 days).

Who Needs Business Income Insurance?

This type of insurance is valuable for:

Retailers and Restaurants: High reliance on daily customer traffic.

Manufacturers: Dependent on equipment and supply chains.

Professional Services Firms: With leased offices and ongoing payroll commitments.

Any business with a physical location or revenue-generating assets.

If your operations would take a financial hit from a shutdown—even a short one—business income insurance is not just useful, it’s essential.

Final Thoughts

In today’s unpredictable environment, having business income insurance is not a luxury—it’s a necessity. It provides a financial lifeline during periods of disruption, allowing businesses to recover without risking bankruptcy or closure. While it won’t prevent disasters, it ensures you're not financially devastated by them.

Before choosing a policy, work closely with an insurance broker or risk advisor to tailor coverage to your specific business model, risks, and needs.

Get Related Report -

Digital Identity in BFSI Market

Web3 in Financial Services Market