Executive Summary Blockchain Insuretech Market

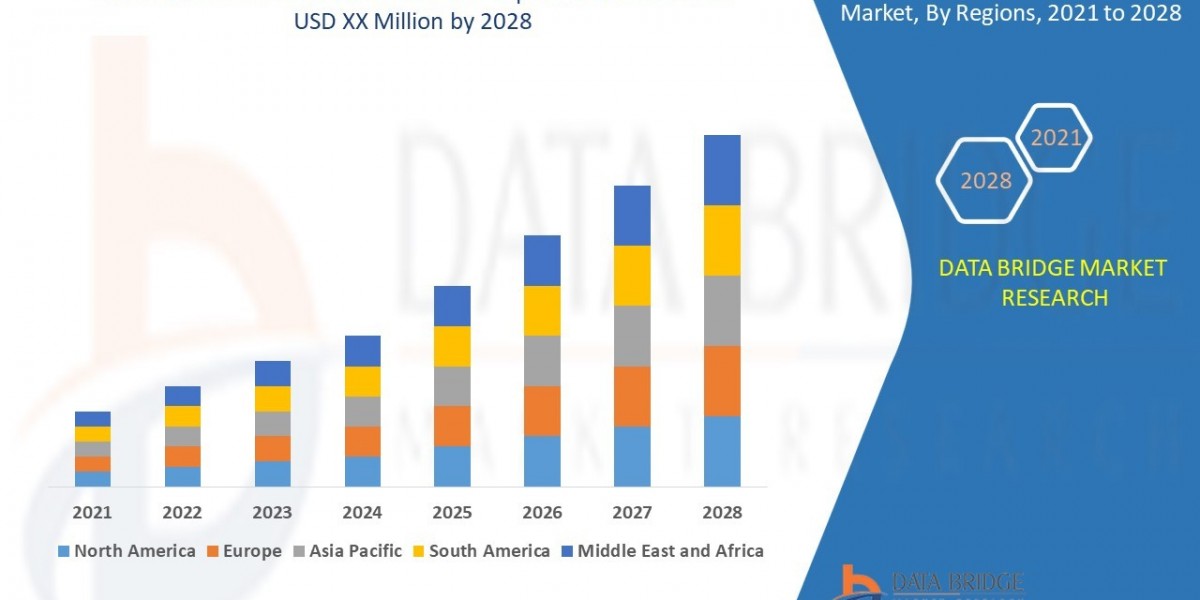

Blockchain insuretech market will reach at an estimated value of 2970.28 million and grow at a CAGR of 10.40% in the forecast period of 2021 to 2028. Growing number of fraudulent insurance claims is an essential factor driving the blockchain insuretech market.

The Blockchain Insuretech Market research report delivers comprehensive analysis of the market structure along with forecast of the diverse segments and sub-segments of the market. The report considers an in depth description, competitive scenario, wide product portfolio of key vendors and business strategy adopted by competitors along with their SWOT analysis and porter's five force analysis. Blockchain Insuretech Market report examines market by regions, especially North America, China, Europe, Southeast Asia, Japan, and India, focusing top manufacturers in global market, with respect to production, price, revenue, and market share for each manufacturer. The Blockchain Insuretech Market report provides an in-depth overview of product specification, technology, product type and production analysis considering major factors such as revenue, cost, gross and gross margin.

The market transformations are highlighted in the Blockchain Insuretech Market document which occurs because of the moves of key players and brands like developments, product launches, joint ventures, merges and accusations that in turn changes the view of the global face of industry. The market report evaluates CAGR value fluctuation during the forecast period. for the market. which will tell you how the Blockchain Insuretech Market is going to perform in the forecast years by informing you what the market definition, classifications, applications, and engagements are. This Blockchain Insuretech Market study also analyzes the market status, market share, growth rate, future trends, market drivers, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Blockchain Insuretech Market report. Download Full Report:

https://www.databridgemarketresearch.com/reports/global-blockchain-insuretech-market

Blockchain Insuretech Market Overview

Segments

By Component: Based on components, the global blockchain insuretech market can be segmented into platforms and services. The platforms segment is expected to witness significant growth due to the rising adoption of blockchain technology by insurance companies to improve transparency, security, and efficiency in their operations.

By Application: In terms of application, the market is segmented into property and casualty insurance, health insurance, reinsurance, title insurance, and others. The property and casualty insurance segment is projected to hold a substantial market share as blockchain technology helps in streamlining claims processing, underwriting, and fraud detection in this sector.

By End-User: The end-user segment includes insurance companies, third-party administrators, and insurance brokers. Insurance companies are likely to dominate the market share as they are actively investing in blockchain technology to enhance customer experience, reduce costs, and mitigate risks.

Browse More Reports:

Global Towel Warmers Market

Global Alcohol-Dependency Treatment Market

Global Outboard Engines Market

Global Automotive Interconnecting Shaft Market

Global Tumor Transcriptomics Market

Global Porcine Plasma Feed Market

Global Mezcal Market

Market Players

- **IBM Corporation:** IBM offers blockchain solutions for the insurance industry, enabling companies to improve transparency, automate processes, and enhance security.

- **Microsoft Corporation:** Microsoft provides blockchain-based platforms and tools for insurance companies to develop innovative products and services, creating new revenue streams.

- **Accenture:** Accenture offers consulting services to help insurance firms implement blockchain technology for operational efficiency and risk management.

- **B3i Services AG:** B3i is a consortium of insurance companies developing blockchain solutions to transform the industry's processes and drive collaboration.

- **R3:** R3 provides a blockchain platform for insurance companies to streamline transactions, enhance data security, and improve regulatory compliance.

The global blockchain insuretech market is witnessing significant growth, driven by the increasing adoption of blockchain technology in the insurance sector. Insurance companies are leveraging blockchain to enhance transparency, streamline operations, and reduce fraudulent activities. The market is also benefiting from the growing demand for innovative insurance products and services that offer improved security and efficiency. Moreover, government initiatives to promote blockchain technology and the rising awareness among insurers about the benefits of blockchain are further fueling market expansion. Overall, the global blockchain insuretech market is poised for substantial growth in the coming years, with key players focusing on product innovation and strategic partnerships to gain a competitive edge.

The global blockchain insuretech market is experiencing a paradigm shift in the insurance industry landscape, driven by the transformative potential of blockchain technology. The integration of blockchain in insurance operations has revolutionized traditional processes, offering a secure and transparent environment for transactions and data management. One of the key emerging trends in the market is the focus on interoperability and standardization across different blockchain platforms to ensure seamless communication and data sharing among insurance stakeholders. This emphasis on interoperability is crucial for driving collaboration and efficiency in the insurance value chain, ultimately leading to improved customer experiences and operational performance.

Another notable trend shaping the blockchain insuretech market is the increasing emphasis on data privacy and security. With the rising concerns over data breaches and cyber threats, insurance companies are turning to blockchain solutions to enhance the security of sensitive information and mitigate risks associated with unauthorized access. Blockchain's immutable and decentralized nature provides a robust framework for safeguarding critical data, thereby instilling trust among insurers, policyholders, and other stakeholders in the ecosystem.

Moreover, the evolving regulatory landscape is playing a significant role in driving the adoption of blockchain technology in the insurance sector. Regulatory bodies are recognizing the potential of blockchain to enhance compliance, transparency, and accountability in insurance operations. As a result, insurance companies are proactively embracing blockchain solutions to align with regulatory requirements and ensure adherence to industry standards.

Additionally, the market is witnessing a surge in strategic partnerships and collaborations among key players to accelerate innovation and expand market reach. Collaborative efforts between insurance companies, technology providers, and blockchain developers are fostering the development of tailored solutions that address specific industry challenges and capitalize on emerging opportunities. These partnerships are instrumental in driving product differentiation, enhancing customer value propositions, and driving sustainable growth in the blockchain insuretech market.

Overall, the global blockchain insuretech market is poised for continued growth and evolution, with a focus on driving operational efficiency, enhancing data security, and delivering value-added services to customers. As blockchain technology continues to mature and gain widespread adoption in the insurance sector, we can expect to see further advancements in product offerings, regulatory frameworks, and industry collaborations that will shape the future of insuretech ecosystem. The key to success in this dynamic market lies in innovation, agility, and strategic vision to capitalize on the immense potential of blockchain technology in transforming the insurance industry landscape.The global blockchain insuretech market is poised for continued growth and innovation, driven by the transformative potential of blockchain technology in the insurance industry. One key trend that is shaping the market is the increasing focus on interoperability and standardization across different blockchain platforms. This emphasis on compatibility ensures seamless communication and data sharing among insurance stakeholders, ultimately improving collaboration and operational efficiency within the insurance value chain. By promoting interoperability, insurers can enhance customer experiences, streamline processes, and drive overall industry growth.

Another significant trend influencing the blockchain insuretech market is the heightened emphasis on data privacy and security. With the persistent threat of data breaches and cyberattacks, insurance companies are turning to blockchain solutions to bolster the security of sensitive information and mitigate risks associated with unauthorized access. The immutable and decentralized nature of blockchain technology provides a robust framework for safeguarding critical data, fostering trust among insurers, policyholders, and other ecosystem participants. As data security remains a top priority for the insurance sector, the adoption of blockchain solutions is expected to rise to address these concerns effectively.

Furthermore, the evolving regulatory landscape is playing a crucial role in accelerating the adoption of blockchain technology in the insurance sector. Regulatory bodies are increasingly recognizing the potential of blockchain to enhance compliance, transparency, and accountability within insurance operations. In response, insurance companies are proactively embracing blockchain solutions to align with regulatory requirements and industry standards. By leveraging blockchain technology to ensure adherence to regulations, insurers can enhance the integrity of their operations, build trust with stakeholders, and meet compliance obligations effectively.

Moreover, the market is witnessing a surge in strategic partnerships and collaborations among key players to drive innovation and expand market reach. Collaborative efforts between insurance companies, technology providers, and blockchain developers are fueling the development of tailored solutions that address specific industry challenges and capitalize on emerging opportunities. These partnerships are instrumental in driving product differentiation, enhancing customer value propositions, and fostering sustainable growth within the blockchain insuretech market.

In conclusion, the global blockchain insuretech market continues to evolve rapidly, with a strong focus on enhancing operational efficiency, improving data security, and delivering value-added services to customers. As blockchain technology matures and gains wider acceptance in the insurance sector, we can anticipate further advancements in product offerings, regulatory frameworks, and industry collaborations that will shape the future of the insuretech ecosystem. Success in this dynamic market landscape will require continuous innovation, agility, and strategic foresight to leverage the full potential of blockchain technology in revolutionizing the insurance industry.

The Blockchain Insuretech Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-blockchain-insuretech-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key Benefits of the Report:

- This study presents the analytical depiction of the global Blockchain Insuretech Market Industry along with the current trends and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and opportunities along with detailed analysis of the global Blockchain Insuretech Market

- The current market is quantitatively analyzed to highlight the Blockchain Insuretech Market growth scenario.

- Porter's five forces analysis illustrates the potency of buyers & suppliers in the market.

- The report provides a detailed global Blockchain Insuretech Market analysis based on competitive intensity and how the competition will take shape in coming years.

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

Blockchain Insuretech Market, Blockchain Insuretech Market Trends, Blockchain Insuretech Market Growth, Blockchain Insuretech Market Demand, Blockchain Insuretech Market Size, Blockchain Insuretech Market Scope, Blockchain Insuretech Market Insights, Blockchain Insuretech Market Analysis