Facial Recognition Payment: Transforming the Future of Transactions

Facial recognition payment is an innovative and rapidly evolving technology that is reshaping the digital payments landscape. By enabling users to authorize transactions using their facial features, this method offers a seamless, secure, and contactless payment experience. As consumers increasingly demand convenience and speed, facial recognition payment systems are gaining traction across retail, banking, transportation, and hospitality sectors worldwide.

What is Facial Recognition Payment?

Facial Recognition Payment Market uses biometric authentication to identify and verify individuals based on their facial features. Leveraging advanced artificial intelligence (AI) and machine learning algorithms, this technology captures and matches a person’s face with pre-registered data in real-time to approve a financial transaction. It eliminates the need for physical cards, PINs, or smartphones at the point of sale.

How It Works

Enrollment: Users register their facial data through a secure application or platform linked to their bank or digital wallet.

Authentication: During a transaction, the system scans the customer’s face using a camera.

Verification: The scanned image is compared to the stored biometric data.

Authorization: Once verified, the payment is processed instantly.

Key Advantages

Contactless Convenience: Perfect for post-pandemic hygiene concerns, facial recognition payment is entirely touch-free.

Faster Checkout: Transactions are completed in seconds, reducing queues and wait times.

Enhanced Security: Facial data is unique to each person, reducing the risk of fraud or unauthorized access.

User-Friendly: No need to remember passwords, carry cards, or rely on mobile devices.

Applications Across Industries

Retail: Major stores and supermarkets in Asia and Europe are deploying facial payment kiosks to enhance customer experience.

Banking: Banks use facial recognition for ATM access and customer verification.

Transportation: Some metro and bus systems integrate facial payments for fare collection.

Hospitality: Hotels adopt facial authentication for check-in, room access, and payment.

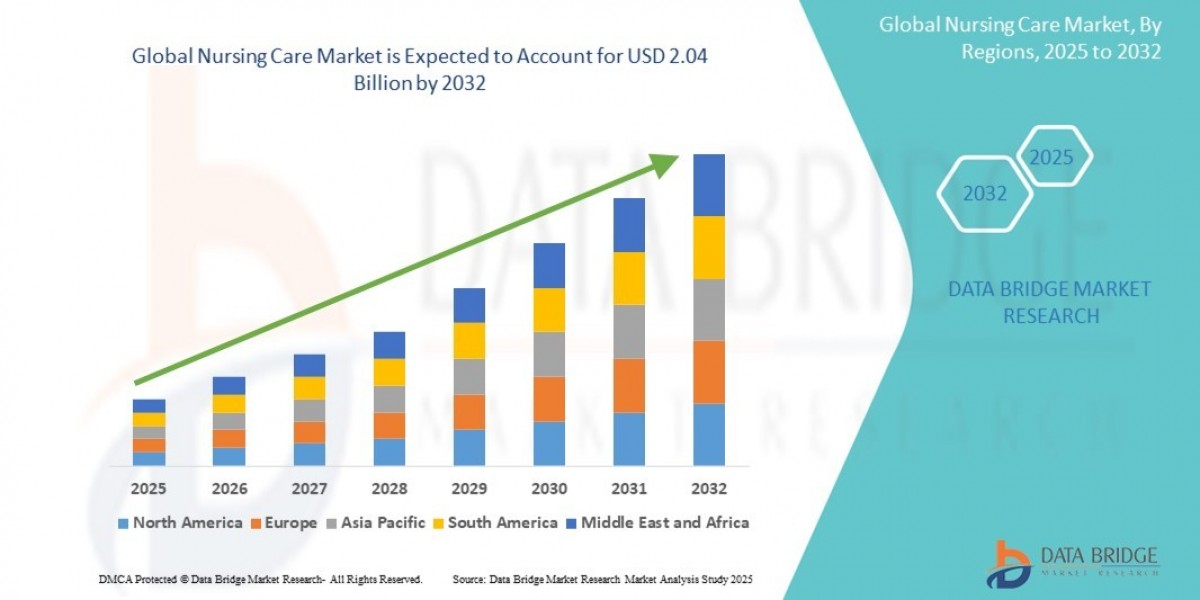

Global Adoption and Trends

China leads in facial recognition payments, with platforms like Alipay and WeChat Pay pioneering the technology. Other countries including South Korea, Russia, and Japan are also investing in biometric payments. In the West, adoption is slower due to regulatory challenges and privacy concerns, but momentum is building.

Challenges and Concerns

Privacy Issues: The collection and storage of biometric data raise significant privacy and ethical questions.

Regulatory Compliance: Varying laws across countries make implementation complex.

Data Security: Despite encryption, facial data could be vulnerable to cyberattacks if not properly protected.

Bias and Accuracy: Facial recognition systems may have lower accuracy across different demographics, which could lead to discrimination or errors.

Future Outlook

Facial recognition payment is poised to become a key pillar of the digital payment ecosystem. With advancements in AI, improved data security protocols, and growing consumer comfort with biometrics, its adoption will likely expand rapidly. Businesses aiming to stay competitive will increasingly look to incorporate facial payment options as part of their omnichannel strategies.

Conclusion

Facial recognition payment is more than just a futuristic concept—it's a practical, efficient, and secure way to pay that aligns with modern consumer expectations. While it presents challenges that need careful handling, particularly around privacy and ethics, its potential to revolutionize how we conduct everyday transactions is undeniable.

Related Report -

Guaranteed Auto Protection Insurance Market

Hong Kong Mobile Phone Insurance Market

Identity Theft Insurance Market

Intelligent Virtual Assistant-Based Banking Market