The rise of electric vehicles (EVs) is transforming the global automotive and insurance landscape. As the shift toward cleaner transportation accelerates, the Electric Vehicle Insurance Market is gaining prominence, driven by the unique characteristics and risks associated with EVs. In 2025, the market is valued at approximately USD 30 billion, and it is projected to exceed USD 120 billion by 2035, growing at a CAGR of 14.8%.

Market Overview

Electric vehicle insurance refers to specialized coverage policies tailored for battery-powered vehicles. These policies consider the cost of high-value EV components (like batteries), advanced driver-assistance systems (ADAS), software updates, and emerging technologies. As EV adoption increases, insurers are innovating in pricing, underwriting, and claims processes.

Key Market Drivers

1. Surging EV Adoption

Governments are offering incentives for EV adoption through tax credits, subsidies, and zero-emission mandates, leading to higher insurance demand.

2. Regulatory Push

Countries are mandating motor insurance for EVs, similar to traditional vehicles, but with growing attention to unique EV components and risks.

3. Costly Repairs and Parts

EVs often require specialized maintenance, with batteries and sensors being expensive to replace, leading to tailored premium models.

4. Connected and Autonomous Features

Telematics, ADAS, and over-the-air updates are influencing usage-based insurance and risk assessment models.

5. Climate Goals and ESG Investing

Sustainability efforts are fueling EV market growth, creating a parallel demand for responsible and eco-aligned insurance products.

Market Segmentation

By Coverage Type

Third-Party Liability

Comprehensive Coverage

Collision Insurance

Battery and Component Insurance

By Vehicle Type

Passenger EVs

Commercial EVs

Two-Wheelers and E-Bikes

By Distribution Channel

Online Platforms

Brokers and Agents

OEM & Dealership Tied Services

By End User

Private Owners

Fleet Operators

Subscription-Based EV Services

Regional Insights

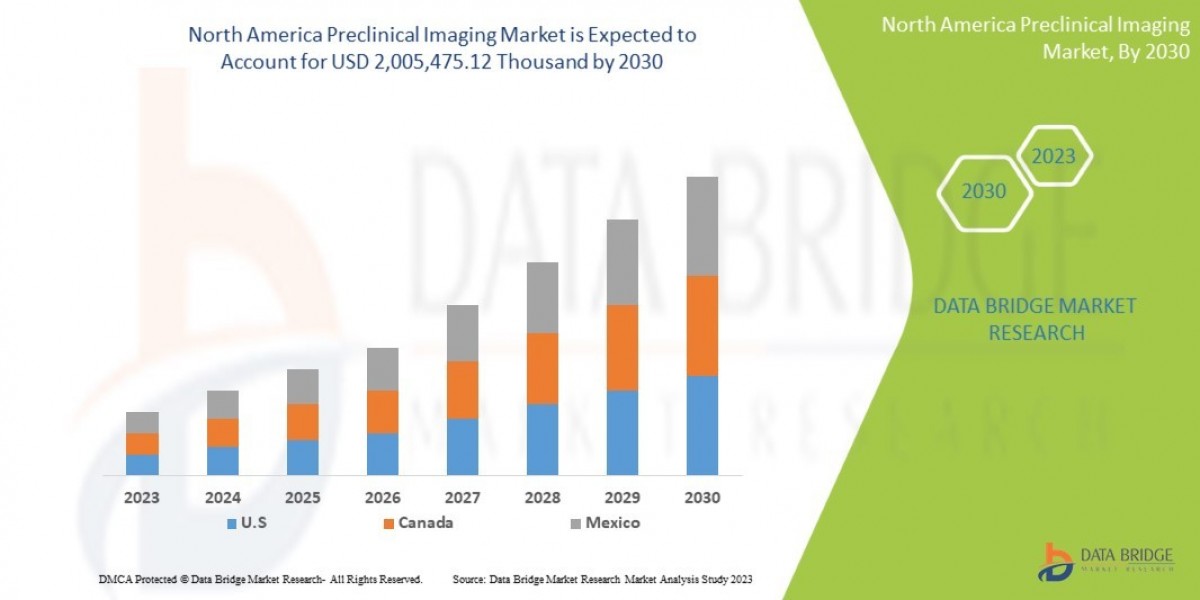

North America

High EV adoption in the U.S. and Canada is driving demand for innovative EV-specific policies, especially for Tesla, Rivian, and GM EVs.

Europe

Governments across the EU are actively promoting EV adoption. Markets like Norway, Germany, and the Netherlands lead in per capita EV sales.

Asia-Pacific

China dominates global EV sales, while India, Japan, and Southeast Asia show strong growth potential, spurred by micro-mobility and electric two-wheelers.

Latin America and MEA

Gradual adoption of EVs and supporting infrastructure is increasing the need for scalable, modular insurance solutions in urban centers.

Key Players

Progressive Corporation

Allianz SE

State Farm Mutual Insurance

GEICO (Berkshire Hathaway)

AXA S.A.

Tesla Insurance

Zurich Insurance Group

Liberty Mutual

HDFC ERGO General Insurance

Policybazaar (Digital Aggregators)

Emerging Market Trends

Usage-Based Insurance (UBI): Telematics and driving behavior determine premiums.

Battery-Specific Policies: Cover battery degradation, fire risk, and replacement costs.

AI in Claims Processing: Accelerated claim settlements via automated image and data analysis.

Bundled EV Services: Insurance included in vehicle financing or lease plans.

Cyber Risk Coverage: Addressing risks related to EV software, hacking, and autonomous functions.

Challenges

Lack of Historical Data: Limited claims data for newer EV models hampers risk pricing.

High Cost of Claims: EV repairs and parts are more expensive than ICE vehicles.

Battery Fire Risks: Lithium-ion battery fires, though rare, result in significant damage.

Unclear Residual Values: Depreciation and resale uncertainties complicate policy valuation.

Future Outlook (2025–2035)

Insurance-as-a-Service (IaaS) will become more common in EV ownership models.

Dynamic pricing based on real-time driving data and vehicle condition.

Blockchain for smart contracts and faster claim settlements.

Sustainable insurance models aligning with ESG principles and carbon tracking.

Conclusion

The Electric Vehicle Insurance Market is evolving alongside the global EV revolution. As automakers, consumers, and governments continue to embrace clean mobility, insurers are recalibrating their offerings to address new types of risk and opportunity. Future success will depend on real-time analytics, digital infrastructure, and the ability to tailor coverage to an increasingly complex and connected vehicle ecosystem.

read more

| US Wireless Sensor Network Market |

| US Smart Home Projector Market |

| US Semiconductor Memory IP Market |

| US EMS ODM Market |