Tax Compliance Software

Introduction

In an increasingly complex global tax environment, businesses and individuals alike are turning to technology to manage tax obligations efficiently. Tax Compliance Software Market has emerged as a vital tool, enabling users to stay updated with ever-changing tax laws, file accurate returns, and avoid penalties. As digital transformation accelerates across finance and accounting sectors, tax compliance software plays a crucial role in ensuring regulatory adherence while improving operational efficiency.

What is Tax Compliance Software?

Tax compliance software is a digital solution designed to help individuals, businesses, and tax professionals manage, calculate, and file tax returns in accordance with local, national, and international tax regulations. These platforms automate the process of tax data collection, computation, reporting, and filing, often integrating with accounting or ERP systems.

Key Features of Tax Compliance Software

Automated Tax Calculations: Automatically applies current tax rates and rules to transactions.

E-filing Capabilities: Facilitates electronic submission of tax returns to government portals.

Regulatory Updates: Continuously updates based on changes in tax laws and compliance requirements.

Multi-jurisdictional Support: Handles tax rules across multiple states or countries, especially important for global enterprises.

Integration: Connects with accounting, ERP, and invoicing software to streamline data flow.

Audit Trail: Maintains a detailed log of tax-related activities for transparency and audit readiness.

Analytics and Reporting: Generates tax reports, summaries, and dashboards to aid in decision-making.

Types of Tax Compliance Software

Sales Tax Software: Ensures accurate calculation and remittance of sales tax.

Income Tax Software: Helps individuals and corporations file annual income tax returns.

Indirect Tax Software: Supports VAT, GST, and excise tax compliance.

International Tax Software: Assists multinational companies with cross-border tax rules and transfer pricing.

Payroll Tax Software: Automates deduction and filing of employment-related taxes.

Benefits of Tax Compliance Software

Increased Accuracy: Reduces manual errors in tax calculations and filings.

Time Savings: Automates repetitive tasks, allowing teams to focus on strategic activities.

Cost Efficiency: Minimizes penalties and compliance costs through timely and accurate filings.

Scalability: Grows with the business and supports increasingly complex tax scenarios.

Enhanced Security: Protects sensitive tax and financial data with robust encryption and access controls.

Challenges and Considerations

Implementation Costs: Initial setup and integration can be expensive for some businesses.

Customization Needs: May require tailoring for specific industries or jurisdictions.

Regulatory Changes: Requires continuous updates to stay compliant with new laws.

User Training: Staff may need training to fully leverage software capabilities.

Top Players in the Tax Compliance Software Market

Thomson Reuters ONESOURCE

Wolters Kluwer CCH

Avalara

Sovos Compliance

Vertex Inc.

Intuit TurboTax (for individuals and SMBs)

SAP Tax Compliance

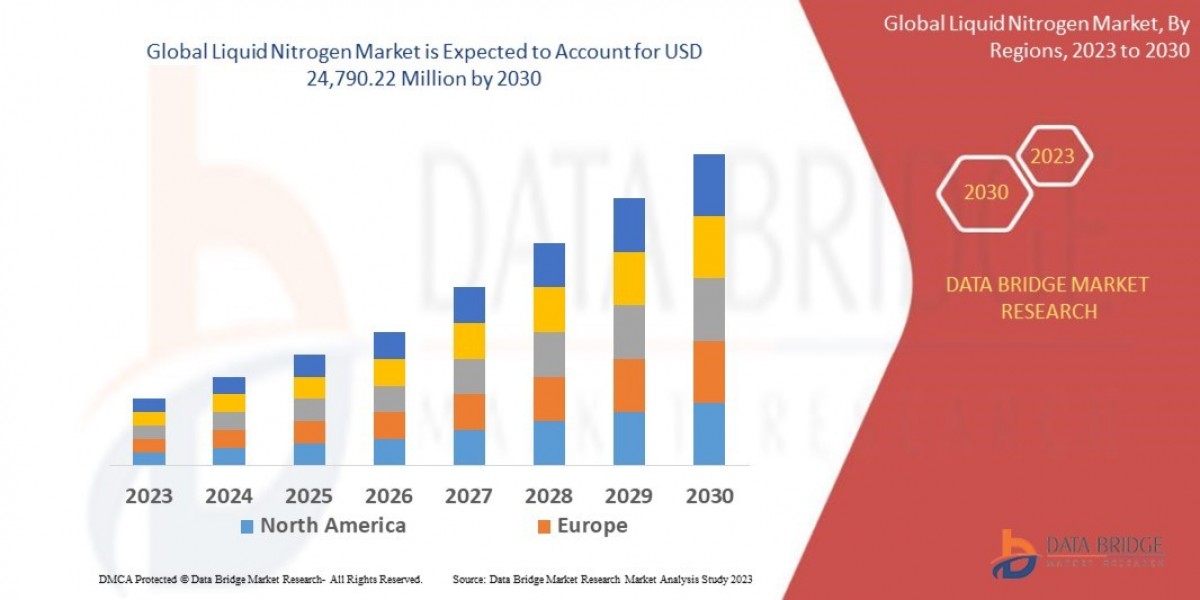

Market Outlook and Trends

The global tax compliance software market is expected to witness strong growth, driven by increasing digitization, complex tax regulations, and the growing adoption of cloud-based solutions. Governments are also pushing for digital tax systems—such as India's GST, the UK’s Making Tax Digital (MTD), and the EU’s e-invoicing mandates—fueling demand for automated compliance tools.

Emerging trends include:

AI-powered tax insights

Blockchain-based tax reporting

Cloud-native tax platforms

Real-time compliance dashboards

Conclusion

Tax compliance software has become indispensable in today’s regulatory and digital era. By automating and simplifying the tax process, these tools not only help organizations remain compliant but also enhance financial transparency and operational efficiency. As tax regulations continue to evolve globally, investing in robust and scalable tax compliance software is not just a convenience—it's a strategic necessity.

Related Report -