Blockchain in Fintech: Revolutionizing Financial Services

Blockchain technology has rapidly evolved from its initial use case in cryptocurrencies to becoming a transformative force across multiple industries. One of the most significant areas impacted by blockchain is financial technology (fintech). By offering decentralized, secure, transparent, and efficient systems, blockchain is reshaping the way financial services operate.

What is Blockchain?

At its core, Blockchain in Fintech Industry is a distributed digital ledger that records transactions across a network of computers. Each transaction is stored in a block, which is then linked to previous blocks—creating an immutable chain. This structure ensures data integrity, security, and transparency, making blockchain particularly appealing for the finance sector.

Key Benefits of Blockchain in Fintech

Enhanced Security

Blockchain uses cryptographic algorithms to protect data. Its decentralized structure reduces the risk of single points of failure, making it less vulnerable to cyberattacks and fraud.Transparency and Trust

Every transaction is recorded on a public ledger, which can be audited and verified. This builds trust among users and regulatory bodies.Lower Costs

By eliminating intermediaries and automating processes through smart contracts, blockchain reduces operational costs and increases efficiency.Faster Transactions

Traditional banking systems can take days to settle payments, especially across borders. Blockchain enables near-instantaneous transactions with global reach.Improved Access and Inclusion

Decentralized financial (DeFi) applications powered by blockchain can offer banking services to the unbanked population without needing traditional financial institutions.

Major Applications in Fintech

Cross-Border Payments

Blockchain streamlines international transactions by reducing costs, settlement time, and reliance on intermediaries like SWIFT.Smart Contracts

These self-executing contracts with built-in conditions automate complex financial agreements such as loans, insurance claims, and trade settlements.Digital Identity Verification

Blockchain allows for secure and tamper-proof digital identities, making KYC (Know Your Customer) processes faster and more reliable.Decentralized Finance (DeFi)

DeFi platforms built on blockchain enable lending, borrowing, trading, and earning interest without traditional banks.Tokenization of Assets

Real-world assets like real estate, stocks, or art can be tokenized on blockchain, improving liquidity and accessibility.

Challenges and Considerations

While blockchain offers numerous benefits, its adoption in fintech is not without challenges:

Scalability issues in handling large transaction volumes

Regulatory uncertainty in various jurisdictions

Energy consumption, especially in proof-of-work systems

Integration with legacy financial infrastructure

Future Outlook

The integration of blockchain into fintech is still evolving. As regulatory frameworks mature and technology advances (such as the shift to energy-efficient consensus mechanisms), blockchain is poised to become a core infrastructure for modern financial services.

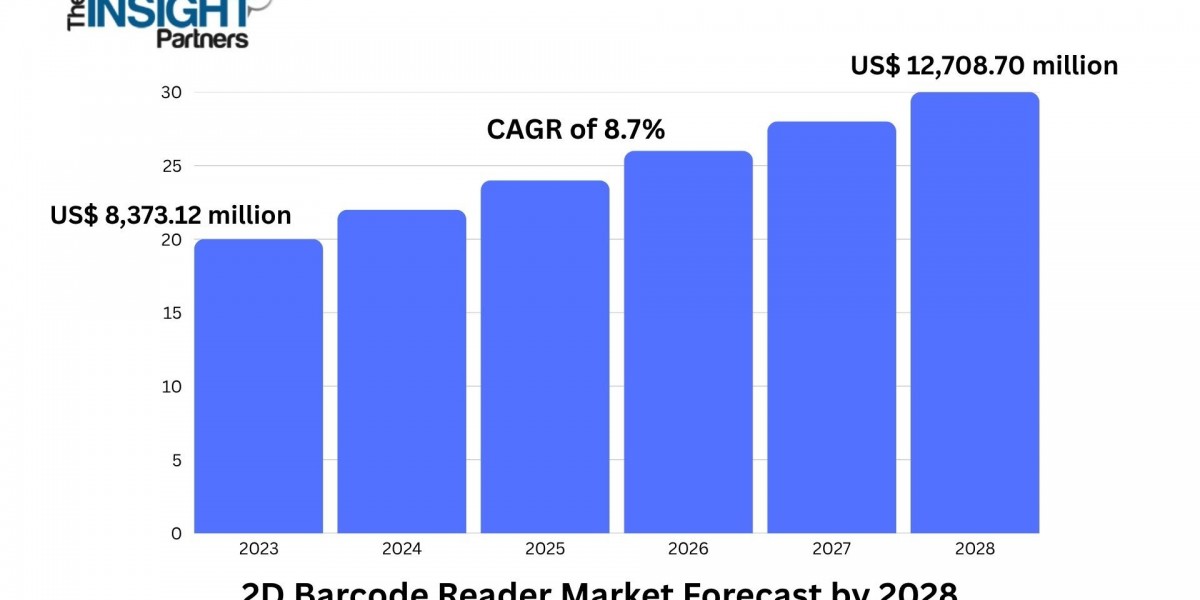

According to industry analysts, the global blockchain in fintech Industry is expected to witness exponential growth in the coming years, driven by demand for faster, secure, and transparent financial solutions.

Conclusion

Blockchain is not just a technological innovation—it is a paradigm shift in the way financial systems operate. From simplifying cross-border payments to powering decentralized finance, it holds the potential to make financial services more accessible, efficient, and secure. As fintech companies continue to embrace blockchain, we can expect a more inclusive and transparent financial ecosystem for the future.

Related Report -

Capital Exchange Ecosystem Market